India: The World’s Growth Champion Even as Growth Slows

For the past few years, India ($IN) has been hailed as the darling of global investors. Once considered a safe and obvious bet, Indian stock markets experienced meteoric rises, driven by impressive economic growth and a wave of international capital. Yet, recent developments have introduced uncertainty. Stock indices in the country have retreated, leading many to question India’s prospects. This paradox captures the complexity of a nation touted as the “Next China.”

The Next China: India’s Emergence as a Growth Engine

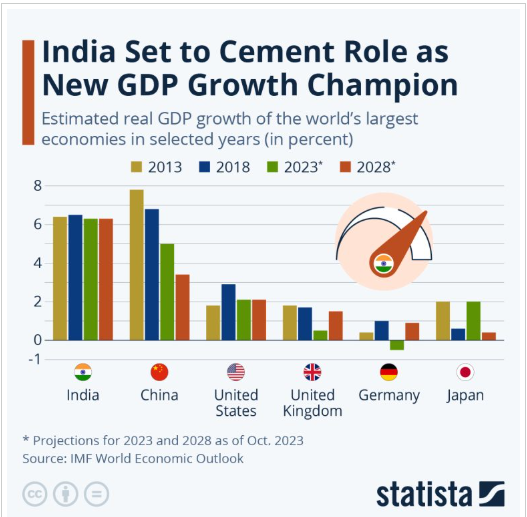

India ($IN) has often been referred to as the “Next China,” a moniker that underscores its potential to drive global growth at a time when China’s economic engine is losing steam. With annual GDP growth rates exceeding 7% in recent years, the Indian economy seemed poised to assume the mantle of the world’s primary growth driver. This optimism was mirrored in Indian stock markets, which posted spectacular gains over the past two years. For investors, India appeared to be a sure and obvious choice, offering opportunities in burgeoning industries, a growing consumer base, and an economy ripe for development.

However, as 2024 drew to a close, cracks began to form in this rosy narrative.

Below is a comparison between the FTSE India Index and the DJI China Index, highlighting the striking difference in performance since 2012.

A Market Slip: India’s Stock Indices Tumble

In a surprising turn of events, Indian stock markets have shed 11% of their value from historic highs, and this decline occurred within just a few weeks. Such a rapid retreat has sparked doubt among global investors. The final quarter of 2024 witnessed a significant exodus of foreign capital from India—a trend that rattled markets and undermined confidence in the country’s growth story.

What caused this sudden shift?

Sky-High Valuations: A Bubble Waiting to Burst

One major factor behind the market downturn is valuation. Over the past few years, the enthusiasm for “playing the India story” led to exuberant market behavior. Stock prices soared to stratospheric levels, creating valuations that often defied logic. Investors clamored to participate in what they believed was a bulletproof growth trajectory, but many failed to account for the risks of a bubble-like scenario. By late 2024, the unsustainable nature of these valuations became apparent, triggering a correction in the markets.

Macro-Economic Woes: A Sobering Reality Check

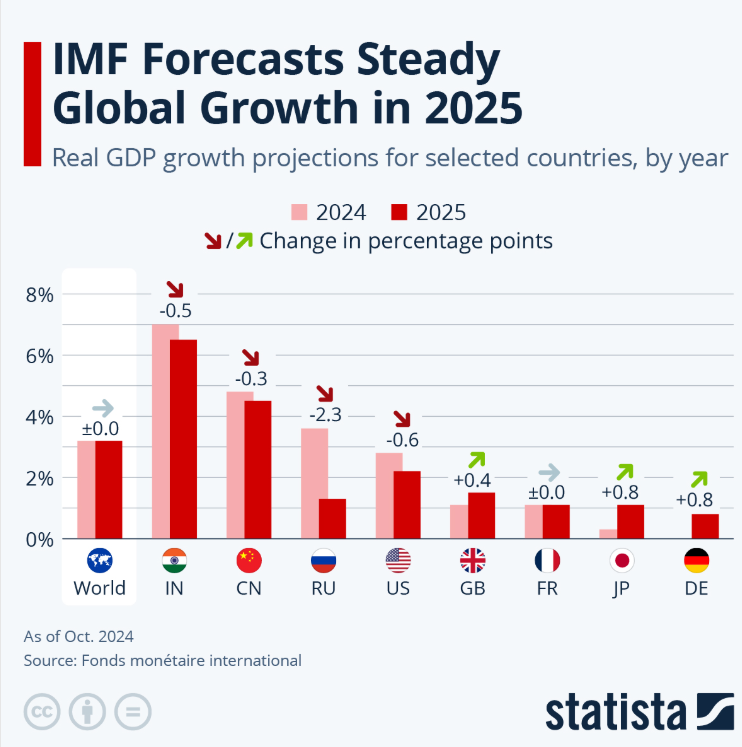

Beyond market valuations, the broader macroeconomic environment began to deteriorate. India’s GDP growth, while still robust by global standards, fell below 7%, edging closer to 5% by the end of the year. While 2024 saw an overall growth rate of 6.6%, projections for 2025 have been less optimistic. This slowdown marks a stark contrast to the double-digit growth rates many had hoped India would sustain.

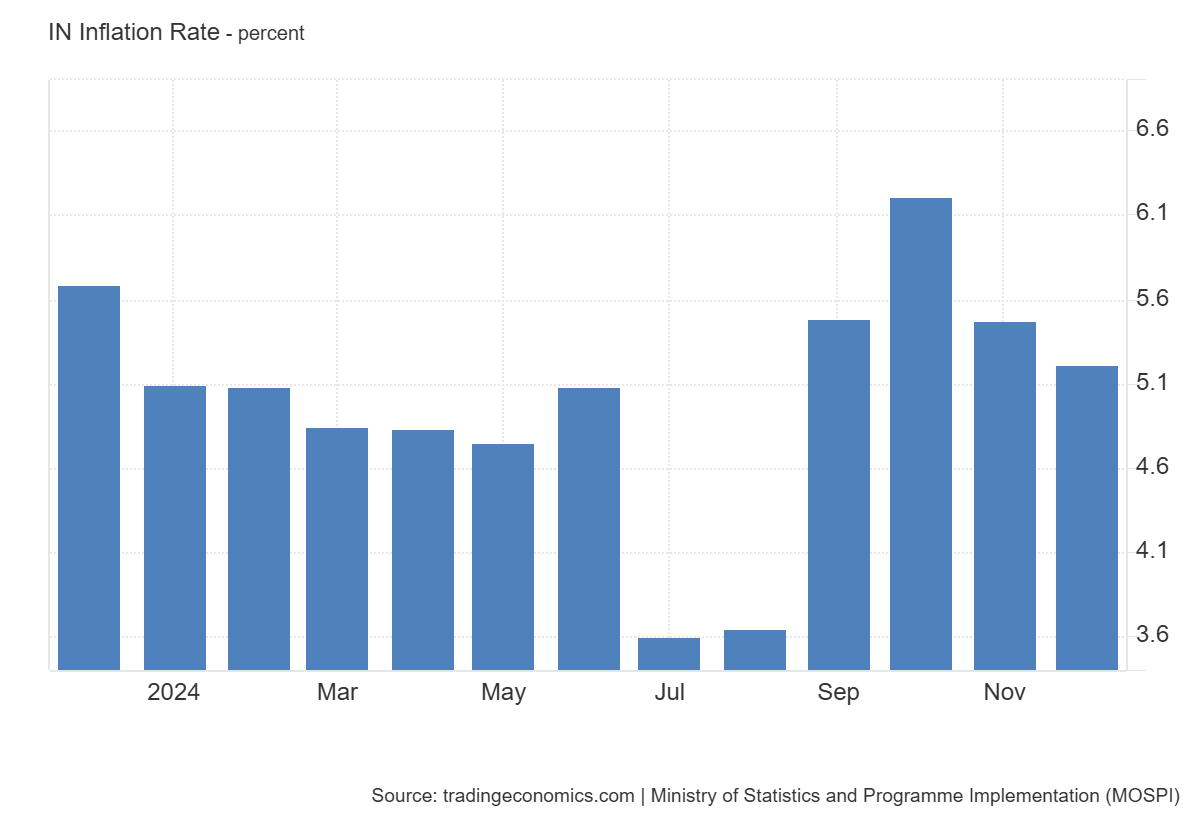

Inflation has also emerged as a persistent challenge. With price increases hovering above 6%, Indian households have seen their purchasing power eroded. Household debt has risen to concerning levels, further straining consumer confidence. Compounding these issues, business investments a critical driver of future growth have slowed considerably.

The result? A dampening of the bullish sentiment that once surrounded the Indian economy.

A Period of Normalization

While the recent market correction and economic slowdown may appear alarming, it is important to view these developments in context. India’s growth is not collapsing; rather, it is normalizing. Double-digit growth is difficult to sustain indefinitely, and even a 6.6% growth rate places India among the fastest-growing major economies in the world.

Despite the challenges, India remains an essential engine of global growth. Its economy may account for just 4% of global GDP today, but its strategic importance is far greater. With a young and growing population, increasing urbanization, and a burgeoning middle class, India has immense long-term potential.

Moreover, India occupies a favorable geopolitical position. As tensions rise between China and the United States, India stands to benefit from its status as a strategic partner for Western nations. The global diversification of supply chains partly driven by the desire to reduce dependence on China has also created opportunities for India to emerge as a manufacturing and technology hub.

What’s Next for Investors?

For those considering their next moves, it’s crucial not to “throw the baby out with the bathwater,” as the saying goes. The recent market correction, while painful, could present opportunities for investors willing to adopt a long-term perspective. Indian equities, after their pullback, may now offer more reasonable valuations, making them an attractive option for those who believe in the country’s growth story.

However, a cautious approach is warranted. Inflation must be closely monitored, as it has the potential to stifle consumer spending and hinder economic recovery. Additionally, structural reforms and policy initiatives will be critical in addressing some of the deeper challenges facing the economy, such as income inequality, infrastructure deficits, and regulatory bottlenecks.

India remains a vital player on the global stage, and its potential as a growth driver is undeniable. The recent turbulence, while unsettling, is part of the growing pains of an economy transitioning from emerging-market darling to a more mature and stable growth engine. Investors should keep an eye on the horizon opportunities in India are likely to re-emerge sooner rather than later.

Risks of Investing in the Indian Stock Index

Investing in an Indian stock index like the Nifty 50 or BSE Sensex offers opportunities due to India’s rapid growth, but it comes with risks:

- Emerging Market Volatility: Indian markets are more volatile, as seen with a 5.15% Nifty drop post-2024 elections.

- High Valuations: Elevated price-to-earnings ratios signal potential overvaluation, risking corrections like the 10% drop in late 2024.

- Political and Regulatory Risks: Policy shifts or governance issues (e.g., the 2023 Adani scandal) can impact markets.

- Global Economic Exposure: Slowdowns or commodity price spikes (e.g., oil) affect growth and indices.

- Currency Risk: Rupee depreciation (e.g., 83.48 vs. USD in 2024) can erode returns for foreign investors.

Mitigation: Diversify via ETFs, adopt a long-term view (6-7% annual growth), and enter after corrections.

Despite growth potential, volatility and external risks require caution.

Conclusion

In conclusion, India’s growth story is far from over. While the journey ahead may be marked by occasional setbacks, the country’s fundamentals remain strong. The “Next China” still holds promise, even if the road is bumpier than initially expected. For those with patience and conviction, the Indian growth narrative is one worth watching and investing in.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.