Summary

Earnings outlook is not so bad

A slump in company earnings is the biggest risk for next year as recession looms. Profit forecasts normally fall as the year progresses, but it needs a large unanticipated shock for a big profits miss. Earnings hope comes with a recession expected and historic earnings falls relatively modest. Plus we focus on valuations to provide some relief to this inevitably lower earnings growth. Investors can also take out added insurance, by owning more defensive, or cheaper, sectors.

Markets digesting the recent rally

Equities pulled back after rally, as recession fear rose more. Brent fell below $80/bbl. giving back 2022 gains. US 10-yr bond yields fell under 3.5%, as bond prices surged. China continued to ease zero-covid policy. META and MSFT saw regulation headwinds. Musk (TSLA) and Bezos (AMZN) being overtaken as world’s richest by Arnault (LVMH). See our 2023 Year Ahead View HERE. See video updates, twitter @laidler_ben.

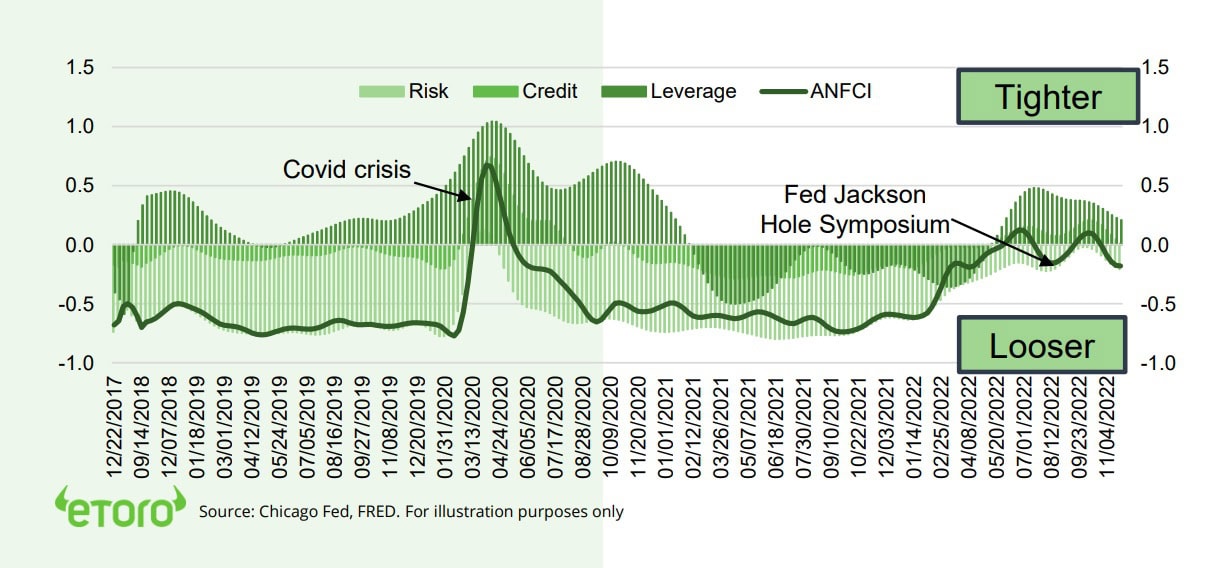

A Fed markets reality check

Markets have loosened US financial conditions. Investors are ‘fighting the Fed’ again. This risks a FOMC meeting reality check as the Fed seeks to keep pressure on lowering inflation.

The world’s most important number

Tuesday’ Nov. US inflation report most important remaining data point of year. Our own tracker reassures that underlying price pressures are easing. This is a key market support.

Bad investor sentiment is good

Bad investor sentiment a contrarian market help. If everyone is bearish there are few left to sell. Sentiment off its lows but still depressed. Been this low only few times in 15 years.

The chasm in the oil market

Chasm between 40% fall in oil from highs vs oil stocks. Something is going to give.

Crypto resilient to continued contagion

BTC remains off its post-FTX price bottom, with low correlation to other assets. Been resilient to continued industry contagion, that seen GBTC discount widen to 50%, SI fall to 2-year lows, and COIN warn of a 50% revenue fall. But crypto VC funding has still risen 41% to $20 billion this year led by rising Web 3.0 investments.

Oil prices have given back 2022 gains

Brent fell under $80/bbl. as rising recession risks offset the weaker US$ dollar and China covid reopening positives. This reopening has driven industrial metals higher, led by nickel, iron ore, and copper where China is over 50% of world demand. It also boosted soybeans, that further supported by Argentina’s drought.

The week ahead: a crazy busy end to year

1) US inflation to ease from 7.7% (Tue). 2) Fed (Wed), ECB, and BoE to all ease hiking pace from 0.75% to 0.50%. 3) Triple-witching US futures and options expiry huge volume day (Fri). 4) Global PMI (Fri) health check from JP, AU, UK, EU, US. 5) Results from ORCL, ADBE, ACN, DRI.

Our key views: A gradual U-shaped recovery

Lower reported inflation and more gradual Fed rate hikes a market relief. But sustained market recovery to be gradual and U-shaped. Focus for now on defensive assets like healthcare, styles like dividend yield, and related markets like UK. Until the inflation decline accelerates, de-risking markets, and starts next bull market.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -2.77% | -0.80% | -7.88% |

| SPX500 | -3.37% | -1.47% | -17.45% |

| NASDAQ | -3.99% | -2.81% | -29.66% |

| UK100 | -1.05% | 2.17% | 1.25% |

| GER30 | -1.09% | 1.03% | -9.53% |

| JPN225 | 0.44% | -1.28% | -3.09% |

| HKG50 | 6.56% | 14.86% | -14.95% |

*Data accurate as of 12/12/2022

Market Views

Markets digesting the recent rally

- Equities pulled back after recent strong rally and with global recessions fears rising even more. Saw Brent oil fall below $80/bbl. and give back 2022 gains. Whilst US 10-yr bond yields fell under 3.5%, with bond prices surging. Despite China continuing to ease its zero-covid lockdown. META and MSFT faced new regulation headwinds. In sign of times Musk (TSLA) and Bezos (AMZN) are being overtaken as world’s richest by Arnault (LVMH). See Page 6 Resource reports and videos. See our 2023 Year Ahead View HERE.

A Fed markets reality check

- Rallying markets have significantly loosened US financial conditions (see chart). The market is ‘fighting the Fed’ again. Unwinding its hard-won tightening since March to try slow inflation. As at August’s Jackson Hole Fed could now respond.

- Telegraphing an end Fed funds rate above 5% at its Dec. 14th meeting. Would be a reality check to markets. We think we’ve seen lows, and would add on significant weakness. But this is likely a 6th bear market rally of this correction, with only a gradual U-shaped recovery ahead.

The world’s most important number

- Tuesday’ Nov. US inflation report most important remaining data point of year. Consensus is for a worryingly small fall in both the 7.7% headline and 6.3% core year-on-year rates. But our own inflation tracker is reassuring that the underlying price pressures are easing. This is led down by supply chains, with the labour market lagging.

- Inflation is driving everything, from the Fed hikes to rising recession risks and lower earnings. Our own inflation tracker looks beyond the backward looking CPI report and gives comfort a gradual stock market recovery is supported.

Bad investor sentiment is good

- Bad investor sentiment has been a contrarian help to the recent rally, and remains a key support. If everyone is bearish there are few left to sell, and many could buy. A little ‘less-bad’ news goes a long way. Sentiment is off its lows but still depressed. It’s only been this low a handful of times in 15 years.

- The rebounded VIX captures attention but it’s the outlier. Other sentiment indicators are very low, led by the equity put/call ratio. We expect the bear rally to ease. But fundamentals, from easing inflation to firm earnings, support a low being in.

The chasm in the oil market

- A yawning chasm opened up between 40% fall in oil prices from highs versus flat oil stocks. Something is going to give. We think the risk is oil prices move up to support stocks. With a ‘high-for-longer’ Brent crude price driven by chronically tight supply and still-resilient demand as China starts reopening. This risks dampening the lower inflation outlook.

- Whilst oil stocks are helped by low production costs vs current prices, still rising earnings estimates, and the S&P 500’s lowest valuations. We see physical oil and equities supported but not likely to repeat their strong performance in 2023. New sector leadership is due. @OilWorldWide.

US Financial Conditions Index (Last five years)

Crypto resilient to continued contagion

- The Bitcoin (BTC) price remained off the post FTX November low of $15,800. Contagion is real but relatively well contained and the performance correlation with equities is at its low of the year.

- FTX impact continued to be seen. From Grayscale Bitcoin Trust’s discount to NAV widening to 50%. Crypto-forward bank Silvergate Capital (SI) falling to a 2-year low. Whilst Coinbase (COIN) CEO warned of a 50% or more revenue fall this year.

- Pitchbook said crypto projects VC funding falling but still $20 billion in first three quarters of 2022. Up 41% year-on-year and led by Web3.0 interest.

Oil prices give back all their 2022 strength

- Brent crude prices fell under $80/bbl., the lowest levels in nearly a year. As rising global recession fears offset the continued loosening of China’s covid restrictions and the first week of new EU and G7 sanctions and price cap on Russian oil.

- Industrial metals, led by nickel, were the main beneficiary of China’s covid changes and further property sector (25% of GDP) help. The country is over 50% of industrial metals demand. Copper was also supported by political instability in Peru, the world’s no.2 producer. as President arrested,

- Soybeans also boosted by outlook for stronger China demand but also supply concerns with the ongoing Argentina drought. The FAO Food Price Index is now at the lowest level since January.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -3.83% | 7.83% | -30.55% |

| Healthcare | -1.80% | 4.85% | -6.45% |

| C Cyclicals | -4.58% | 5.47% | -32.60% |

| Small Caps | -5.08% | 2.06% | -19.98% |

| Value | -2.95% | 3.19% | -8.02% |

| Bitcoin | 0.76% | 3.22% | -63.93% |

| Ethereum | -1.77% | 7.26% | -66.18% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Calm before the storm

- Tuesday’s US November CPI report kicks off a huge economic week. Consensus for a small ease from Oct. 7.7% headline and 6.3%.

- Wednesday’s US Fed interest rate hike slowdown from 0.75% to 0.50%. Plus focus on possible ‘dot plot’ terminal rate hike above 5%, and Chair Powell’s key press conference.

- Thursday’s also Europe’s ECB and Bank of England rate hike slowdown from 0.75% to 0.50% slowdown, forecasts, and bond plans.

- Friday’s quarterly ‘triple-witching’ futures and options expiry one of four most traded days of year. Also US government shutdown funding deadline, plus flash JP, EU, UK, US PMI growth and inflation check up. Q3 results during week from ORCL, ADBE, ACN, DRI, and ITX.MC.

Our key views: A gradual U-shaped recovery

- Lower reported inflation and more gradual Fed rate hike outlook a investor relief. But sustained market recovery to be gradual and U-shaped with prices sticky and risks still high. 2023 to see more earnings pressure, but less on valuations.

- Focus on core cheap and defensive assets to be invested in this ‘new’ world, of higher inflation and lower growth, and to manage high risks. Sectors like healthcare, defensive styles like div. yield, and UK to Japan markets. Until inflation decline accelerates, de-risking markets, raising risk appetites, and starting the next bull market.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -2.39% | -4.40% | 12.67% |

| Brent Oil | -10.07% | -19.78% | -1.44% |

| Gold Spot | -0.11% | 1.98% | -1.15% |

| DXY USD | 0.37% | -1.28% | 9.34% |

| EUR/USD | 0.09% | -1.71% | 7.95% |

| US 10Yr Yld | 8.94% | -23.53% | 207.02% |

| VIX Vol. | 19.78% | 1.38% | 32.58% |

Source: Refinitiv. * Broad based Bloomberg commodity index

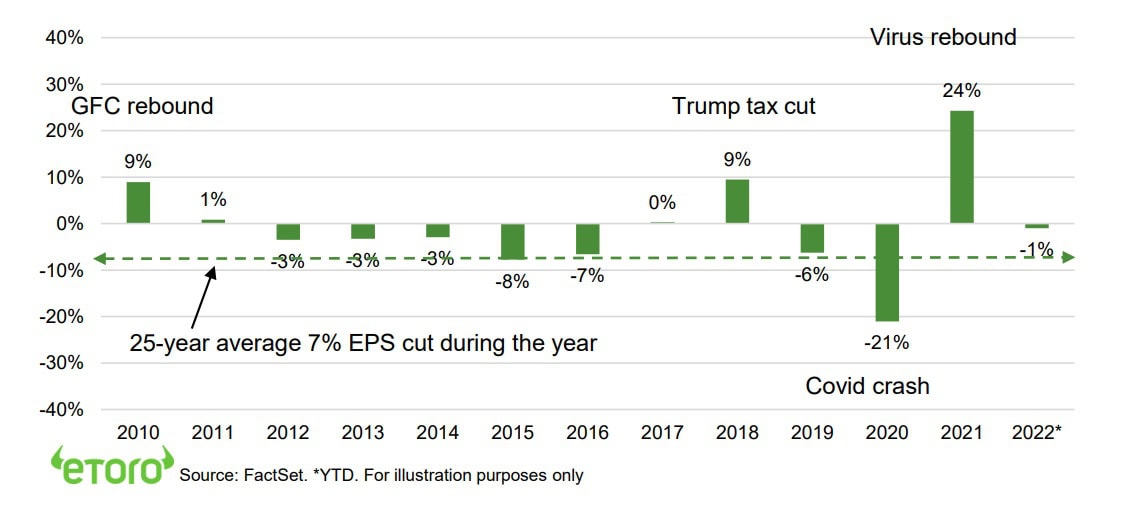

Focus of Week: Earnings outlook not as bad as it seems

Corporate earnings is seen as the biggest stock market risk for next year

A big threat to our 2023 outlook of a better year for stocks is the risk to company earnings. They have been remarkably resilient. The S&P 500 is on track to grow EPS by 6% vs 2021. This has been helped by their large cap focus, index composition, and inflation boosting nominal growth. Forecasts are for 5% growth next year. Even as GDP growth cools sharply as Fed hikes catch up with economy. But history shows only an average 7% downside to earnings, the slowdown well-telegraphed, and valuations to see some relief.

Earnings forecasts normally fall but it requires a big unanticipated shock for a big miss

Earnings estimates normally fall during the year, rather than rising (see chart). This has happened near 70% of the time the past 25 years. The small number of big exceptions share two characteristics. Either a GDP rebound (like 2010 or 2021) or stimulus (like 2007 and 2021). Neither are on the cards for next year. The Fed is signalling ‘high-for-longer’ interest rates and US Congress gridlocked against new spending. The average peak-to-trough US earnings decline in recessions is 18%. If recession comes, we think it’ll be mild.

Hope with recession expected, historic earnings falls relatively modest, and relief from valuations

Earnings have been resilient so far and there are reasons for hope next year. 1) This is the most expected recession imaginable, and therefore at least part baked into to current estimates. The US yield curve has been inverted for months. 2) If history is the guide, the average decline in estimates is a modest 7% (2% excluding the big outlier years), with bigger numbers needing a macro shock – like Covid. This would put the S&P 500 on a 18.5x P/E valuation, and not 17x. Not dramatic, especially with the valuation relief we see.

Focus on valuations to provide some stock market relief to inevitably lower earnings growth

In many ways we expect next year to be the opposite of this year. With resilient earnings inevitably coming under more pressure as economies cool. But we also expect valuations to see some relief. Slumping valuations drove markets weaker this year. With inflation now falling and the Fed cycle near peaking we see room for some valuation multiple relief to help offset the weaker earnings that are coming.

Investors can take out added insurance, by owning cheaper or more earnings-defensive sectors

Investors can take out protection against these earnings risks. By owning companies or sectors with more defensive earnings, such as healthcare or consumer staples for example. Or by owning stocks more exposed to valuation relief, whether sharply derated tech, or the 10x P/E banks and energy sectors.

Change in S&P 500 EPS expectations (End of Year versus Start of Year)

Key Views

| The eToro Market Strategy View | |

| Global Overview | The aggressive Fed interest rate hiking cycle and stubborn inflation has boosted uncertainty, recession risk, and hit markets hard. We see this gradually fading, with global growth stressed but resilient, inflation pressure slowly easing, and valuations now more attractive. Focus on cheap and defensive assets for a gradual ‘U-shaped’ market recovery. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the market rout, and now below average levels, and are supported high company profitability and near peaked bond yields. Fast Fed hiking cycle boosted recession risks. Focus on cash-flows defensives, like healthcare and high dividend. Big-tech supported by defensive growth. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market. |

| Europe & UK | Favour defensive and cheap UK equities (‘Economies are not stock-markets’) over high risk/high return continental Europe. Recession risks high with Russia and energy crisis, threatening to overwhelm ‘buffers’ of rising fiscal spending (defence and refugees), low interest rates (slow to raise ECB), and weak Euro (50%+ sales from overseas). Equities partly cushioned by lack of tech, and 25% cheaper valuations vs US. Favour cheap and defensive UK over Continent. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. Broader EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, if global growth resilient and bond yields risen. Japanese equities among cheapest of any major market, benefit from weaker JPY and with low inflation, offsetting structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Hurt by higher bond yields and above average valuations. But structural stories with good growth, high margins, fortress balance sheets support some. ‘Big-tech’ attractive new recession defensives. ‘Disruptive’ tech is much more vulnerable. |

| Defensives | Core positions as macro risks rise and bond yields are better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | Higher risk cyclical sectors, like discretionary (autos, apparel, restaurants), industrials, energy, and materials, are cheap and attractive if see a ‘slowdown not recession’ scenario. Are select but high risk opportunities from energy to financials stocks. With often depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Benefits from high bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and with room for large dividend and buyback yields. But can be outweighed by high recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversifieds (like Berkshire Hathaway) the least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by rising Fed interest rates and ‘safer-haven’ bid. Many DM currencies hurt by still low interest rates and struggling growth. ‘Reverse FX war’ interventions ineffective. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. Stabler USD outlook as near top of Fed cycle. |

| Fixed Income | US 10-year bond yields risen above prior 3.5% peak, as Fed hikes continue aggressively and balance sheet runoff accelerates. Set to ease as recession risks rise and inflation expectations fall. Additionally US has a wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, low productivity. |

| Commodities | Strong USD and rising recession fears hitting commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, and Russia supply crisis. Industrial metals and battery materials well positioned. Oil by slow return of OPEC+ supply and Russia 10% world supply problems. |

| Crypto | In the latest ‘crypto winter’ (16th crash for bitcoin) with dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size under $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

Join our live Weekly Outlook webinars every Monday at 1pm GMT, or watch the replay at your convenience. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.