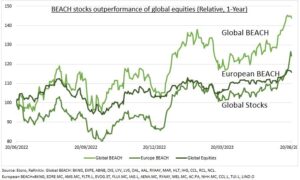

REBOUND: With the peak summer holiday season well underway the so-called BEACH travel and tourism stocks are doing very well. Our global and European leisure stock baskets of major booking sites, entertainment, airline, cruise, and hotel stocks are outpacing even high-flying big tech. This strong performance is driven by resilient consumer demand and travel company price rises. Travelers are willing to prioritize their holiday spending despite the cost-of-living squeeze. Whilst company managements are being disciplined in managing new capacity as they seek to recover big pandemic losses. Global travel and tourism revenues are estimated to surge 23% this year, boosting economies from Greece to Mexico, but to still be below pre-pandemic levels.

BEACH: BEACH is an acronym of Booking sites (like BKNG, EXPE, ABNB), Entertainment (DIS, LYV, LVS), Airlines (DAL, RYAAY, AAL), Cruise Lines (CCL, RCL, NCL), and Hotels (MAR, HLT, IHG) stocks. We created equal-weight 15-stock BEACH baskets to track. One for US-focused global players (above) and another for more European focused stocks (from AMS.MC to AC.PA). Both have outperformed global equities this year, with the 44% global BEACH basket gain even outpacing the high-flying NASDAQ-100 this year. See @TravelKit.

TRENDS: The global travel & tourism industry represents around 8% of the global economy and is forecast to grow 23% this year to $9.5 trillion. This would be its third straight year of 20%+ growth, but still leaves it 5% below pre-pandemic levels. Similarly, the global airline industry is targeting a 27% passenger revenue rebound, and doubling of profits, this year. But this would still leave revenues 12% lower than pre-pandemic 2019. Tourism is over 50% of GDP in smaller economies, like Maldives and Macau, and around 15% from Greece to Portugal and Mexico.

All data, figures & charts are valid as of 21/06/2023.