1. Introduction

Greggs ($GRG.L), the UK’s leading bakery chain, has long been a staple on British streets, renowned for its affordable and convenient food on the go. However, the economic landscape in the UK is shifting, presenting new challenges. Despite these pressures, Greggs continues to expand, posting strong financial performance and refining its strategic approach to sustain growth.

For investors, the question remains: Is Greggs well-positioned to withstand these challenges and deliver long-term value? This article delves into Greggs’ financial performance, the broader economic context, and the strategic initiatives that could help the company navigate uncertain times.

2. Financial Performance: A Balancing Act

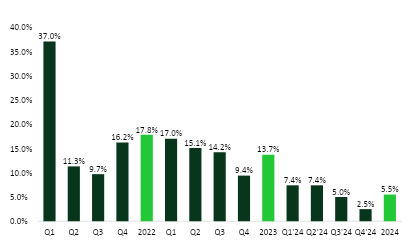

Greggs reported robust financials for 2024, with total sales reaching £2.014 billion, reflecting an 11.3% year-over-year increase. Like-for-like (LFL) sales in company-managed stores rose by 5.5%, underscoring consumer resilience.

However, a notable deceleration in sales growth was observed throughout the year:

- First half of 2024: 7.4% LFL sales growth

- Third quarter: 5.0% growth

- Fourth quarter: 2.5% growth

Greggs’ management attributes this slowdown to reduced foot traffic on high streets, signaling that even strong brands aren’t immune to macroeconomic forces.

Source: Greggs filings, Author analysis

From an operational perspective, Greggs’ cost structure remains under pressure. Inflationary pressures have increased expenses related to raw materials and wages affected by the increases in National Minimum Wage and the additional national insurance contributions, impacting overall profitability. In response, Greggs has implemented selective price hikes, such as increasing the price of its iconic sausage roll from £1.20 last year (was £1 in 2022) to £1.30, representing an 8% increase.

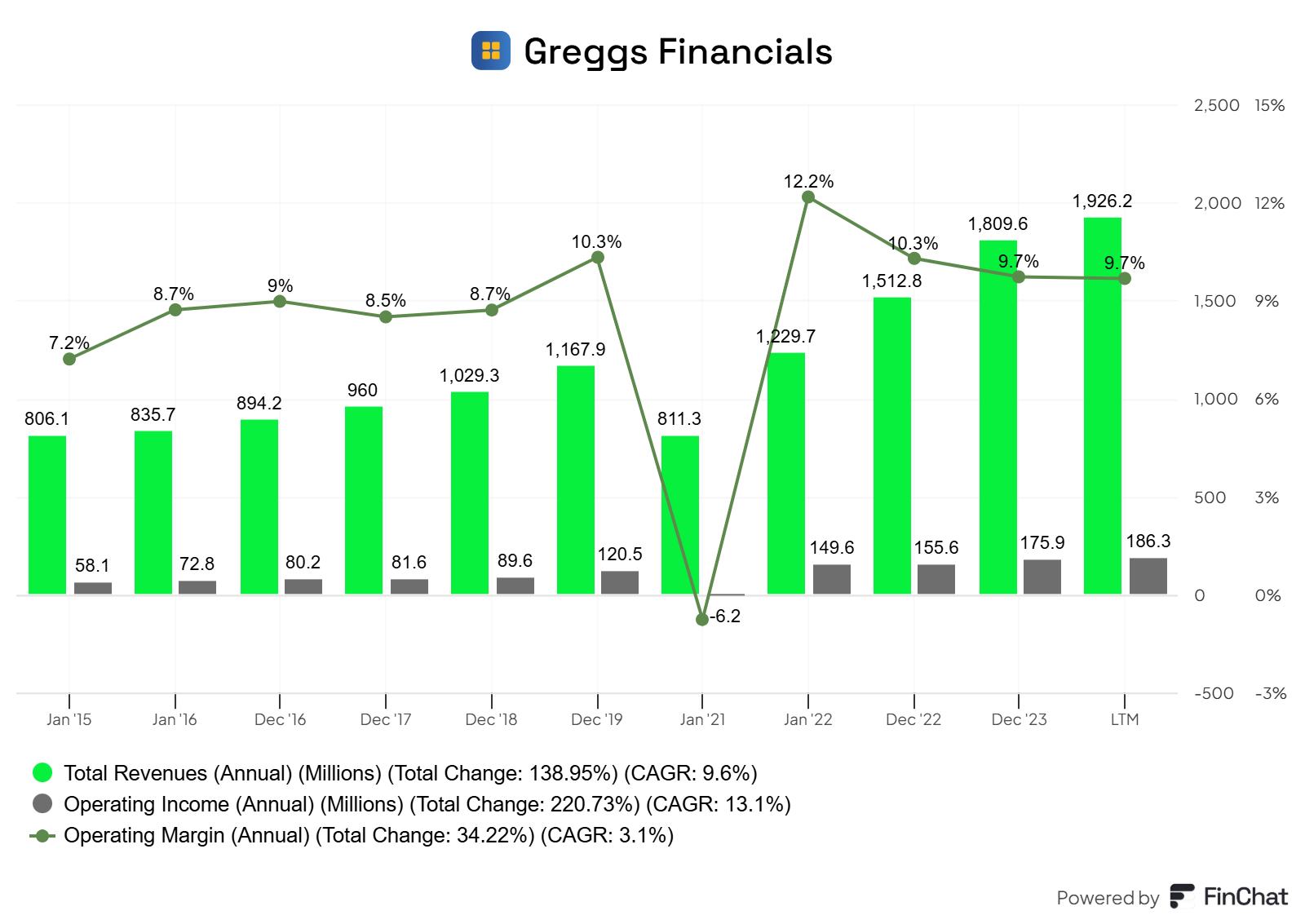

Source: Finchat.io, Note: This chart does not include the latest 2 quarters as Greggs doesn’t report profitability metrics in the quarterly results.

Despite these cost pressures, the company’s operational efficiencies and economies of scale have helped mitigate margin erosion, demonstrating the resilience of its business model. As a result, operating margins at levels close to 10% remain above those seen in the pre-pandemic periods (except 2019 that stood at 10.3%).

3. Economic Headwinds: GDP and Consumer Confidence

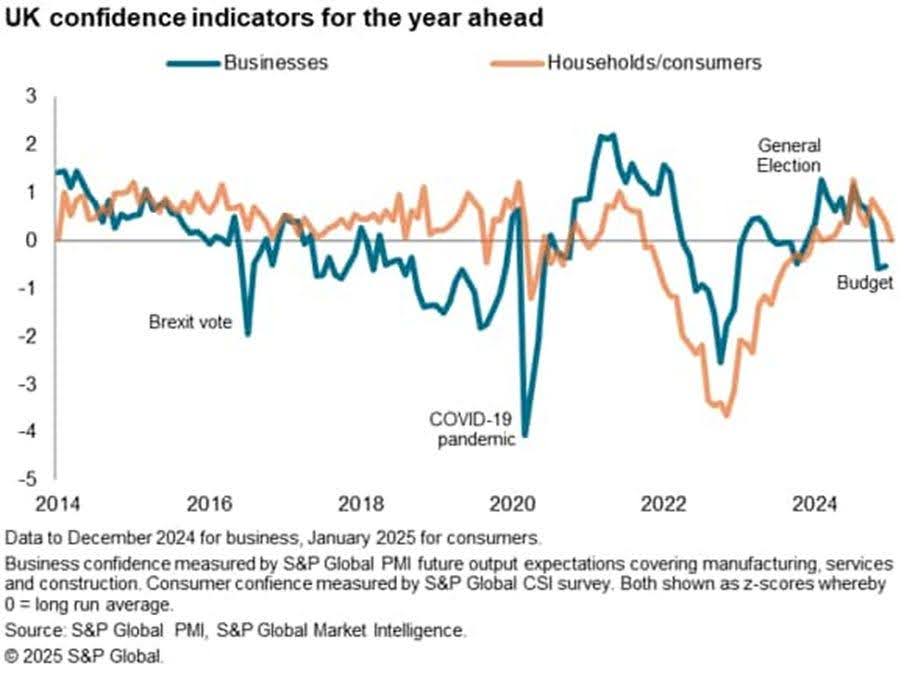

The UK economy is currently facing a challenging period, with weak consumer confidence and stagnant GDP growth reshaping spending habits. Although the Bank of England recently reduced interest rates from 4.75% to 4.5%, this move seems insufficient to drive growth.

This chart also highlights the lack of confidence among both consumers and households, following the recent budget announcement.

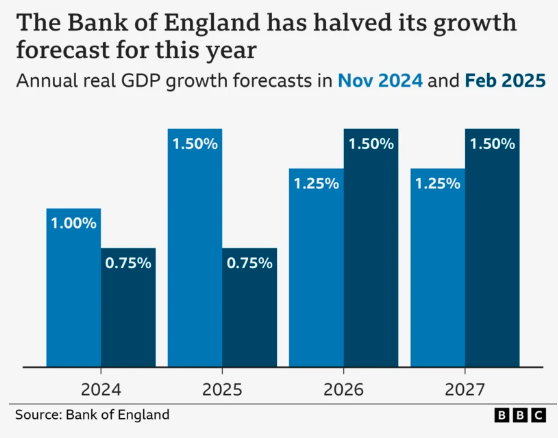

Additionally, the Bank of England has revised its GDP growth forecast, slashing its 2025 growth projection to just 0.75%, while inflation is expected to hit 3.7% by year-end. These factors suggest that the UK is entering a stagflationary environment, raising concerns about the future growth prospects of food-on-the-go retailers such as Greggs.

4. Strategic Initiatives: Growth Amid Uncertainty

Despite economic headwinds, Greggs remains committed to its long-term growth strategy. Several key initiatives underpin its resilience and potential for continued success.

Store Expansion and Market Penetration

Greggs ($GRG.L) continues to expand its physical footprint, opening 145 new stores in 2024, bringing its total locations to over 2,600 outlets. The company aims to reach 3,500 stores nationwide, capitalizing on strong brand loyalty and geographic expansion opportunities.

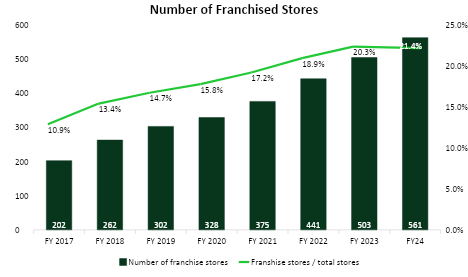

Source: Greggs filings, Author analysis

Key components of its expansion strategy include:

- More Drive-Thrus: Catering to the growing demand for convenience, particularly outside urban centers.

- New Formats: Smaller grab-and-go outlets and retail park locations to diversify its reach.

Franchise Partnerships: Collaborating with third-party operators to accelerate expansion.

Source: Greggs filings, Author analysis

This aggressive expansion strategy signals confidence in future long term demand, but the sustainability of this growth hinges on economic stability.

Digital Transformation, Delivery Growth and More

Recognizing evolving consumer habits, Greggs has heavily invested in digital transformation. The company has strengthened its delivery partnerships with Uber Eats and Just Eat, expanding its reach beyond traditional brick-and-mortar sales. Digital ordering and loyalty programs play a key role in its strategy, driving customer engagement and retention.

In H1 2024, 18.3% of transactions at company-owned stores were scanned through the Greggs App, up from 10.6% last year, signaling improved customer loyalty. Meanwhile, delivery sales grew to 6.7% of total sales, compared to 5.3% in H1 2023.

Another key growth driver is evening sales, which are outpacing the company’s overall like-for-like growth. Evening trade caters to a wider range of consumers beyond breakfast hours.

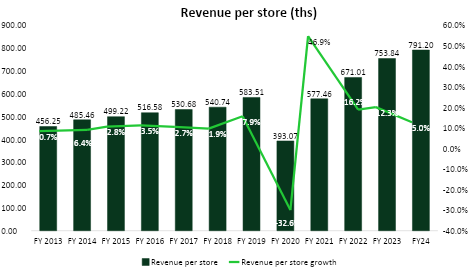

These developments all point to one thing: higher revenue per store. With consistent execution, Greggs is well-positioned for sustained expansion.

Source: Greggs filings, Author analysis

5. Valuation

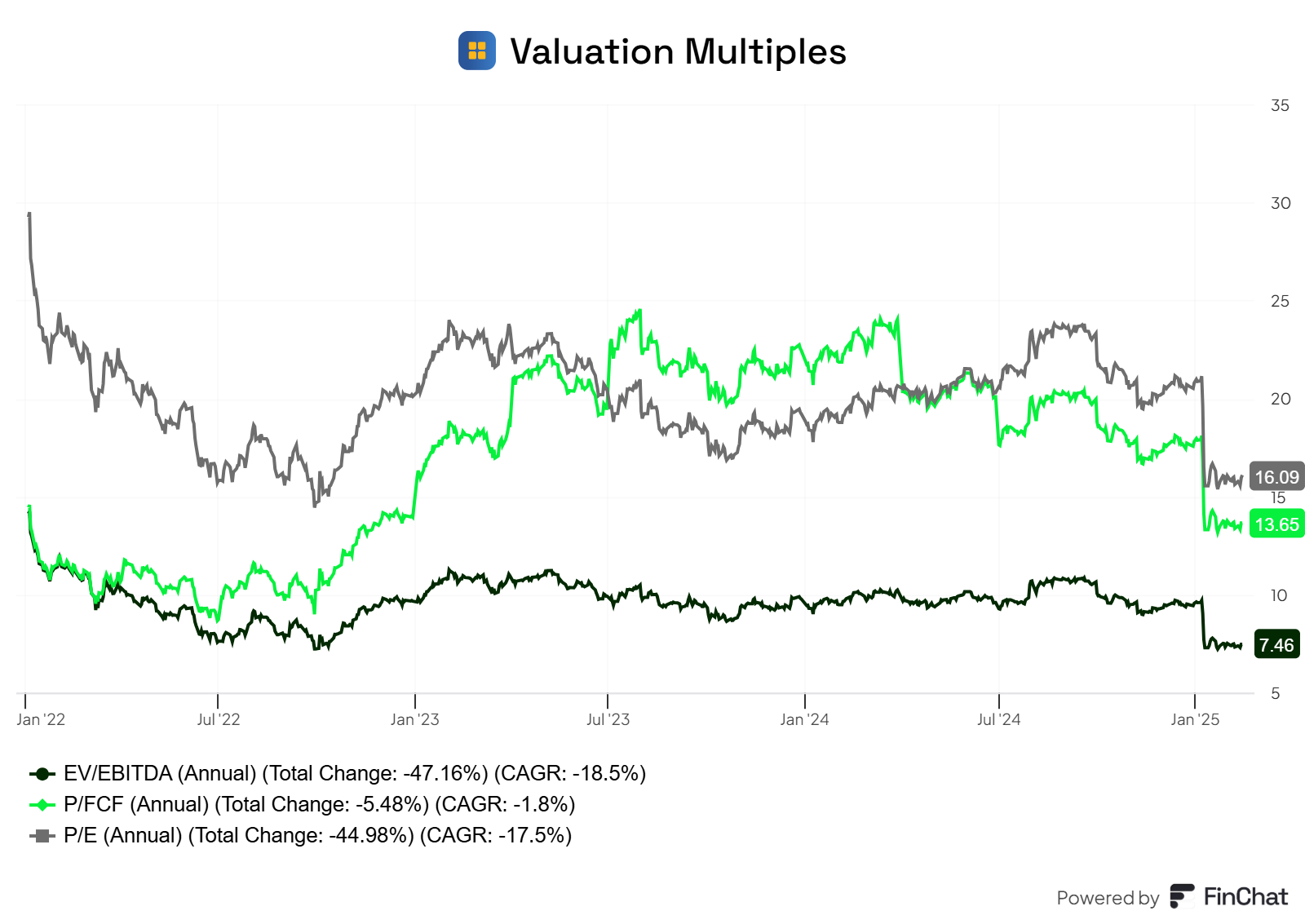

Greggs is currently trading at one of its most attractive valuations in the past decade. With a P/FCF of 13.6x, among the lowest levels since 2015, it reflects a compelling 7.3% FCF yield. Looking at EV/EBITDA, the only time it was lower in the last 10 years was in 2015 at 7.4x, with today’s 7.5x being the second lowest.

Over the same period, EBITDA has grown from £95.5M to £258.9M, reflecting an 11% CAGR, while FCF has expanded from £52.6M to £158.8M, a 12.3% CAGR. Meanwhile, its Return on Equity has increased from 15.6% in 2015 to 28.7% in the first half of 2024!

Given this strong performance and Greggs’ ongoing growth strategy, the current valuation appears overly conservative.

Source: Finchat.io

6. Risks and Opportunities

Greggs ($GRG.L) presents a mixed but compelling investment case. While economic headwinds persist, the company’s strategic adaptations and strong brand equity support its long-term potential.

Investment Risks

- Economic Uncertainty: Prolonged inflation and weak consumer confidence could continue to hinder sales growth.

- Cost Pressures: Rising wages, ingredient costs, and energy expenses may erode profit margins.

- Competitive Landscape: Greggs faces increasing competition from supermarket meal deals and quick-service restaurant chains.

Investment Opportunity

- Resilient Business Model: Greggs’ value-focused proposition positions it well in times of economic uncertainty.

- Expansion Potential: Strong pipeline of new store openings and alternative sales channels.

- Digital and Delivery Growth: Investments in digital ordering and delivery services provide additional revenue streams.

7. Conclusion: Is Greggs a Buy?

While short-term volatility is expected, long-term investors may see value in Greggs’ steady revenue growth, strong brand, and strategic positioning. For those looking to gain exposure to the UK consumer sector, Greggs stands out as a high-quality stock with solid fundamentals and long-term growth potential. Let me know in the comments if you agree!

Disclosure: I own Greggs in my eToro portfolio.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.