RALLY: Gold is having a moment in the sun. Up strongly this year and near its $2,070 all-time multi millennial high, after a disappointing 2022. The rally has been driven by a perfect trifecta of 1) lower US interest rate expectations, boosting long duration and non-yielding assets like gold (and ‘digital gold’ bitcoin). 2) A weaker US dollar, making it cheaper for the biggest buyers in India and China. 3) And some demand for ‘safer-haven’ and uncorrelated assets, with March’s US bank ‘scare’ and still high recession risks. We are positive long duration assets, like gold, but greater opportunity may be in a gold equity catch up and the potential for industry consolidation.

DRIVERS: The gold price rally is being driven by a return of investment demand, which usually accounts for c.55% of all demand. Gold ETFs, like the massive $60 billion GLD, saw their first inflows for ten months in March. This demand had been lagging, because of less inflation hedge needs and surging competition from higher US interest rates and also bitcoin. The recent demand pick up has built on the central bank buying surge seen last year. This is offsetting weak jewellery and tech demand, that is the other 45% of the market, as global economies slow.

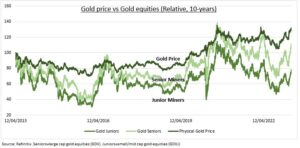

OPTIONS: Gold equities have seen a big catch up to the rising physical price (see chart), given their equity leverage. This could be further boosted by industry consolidation. Newmont (NEM) is bidding for Newcrest (NCM) to create the world’s biggest gold miner, with the industry by far least consolidated of all major metals. The top 10 gold miners are only 28% of total production. See @GoldWorldWide. The recent gold rally has also refocused attention on its more volatile peer silver. The long term gold/silver ratio shows clear value but silver is also more exposed to the slowing global economy with its high real world (75%) vs investment (25%) demand focus.

All data, figures & charts are valid as of 19/04/2023