DIFFERENCES: We think we are set for a positive year of rate cuts and accelerating earnings. With market returns likely well-above the single-digit S&P 500 sell-side consensus forecast. But similarities with last year’s rally end there. 1) Returns will likely be lower than 2023. With its 26% S&P 500 rally double average, valuations already full, and some returns pulled forward. 2). This may see back-ended 2024 returns, as markets digest the recent rally, face reality-check risks, and wait for validation from mid-year rate cuts. 3) We see a big change in stock market leadership, rotating from tech to the unloved cyclical and cheaper assets most sensitive to rate cuts. 4) Giving room for Europe to emerging markets to do better vs the tech-led US juggernaut.

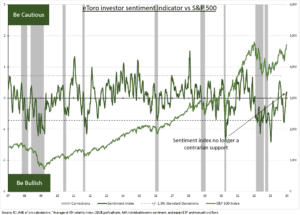

RISKS: These are balanced. With room for disappointment on the pace, rather than direction, of interest rates. With consensus calling for an aggressive six cuts starting as early as Q1 for both the ECB and Fed, double the ‘dot plot’. Whilst the investor sentiment backdrop is no longer as contrarian supportive (see chart). By contrast, the idiosyncratic profit drivers from AI-tech trends to less inflation pressure on margins should be on show in the imminent and improving earnings season. Whilst lower inflation and interest rates should help keep valuations above average.

JANUARY: It’s historically one of the better performing months of the year, and typically sets the tone for the full year. This so-called ‘January barometer’ is not infallible but has a significant 70% hit rate. But it faces short term risks of a data-dependent reality check. From the FOMC minutes of the Dec. 13th meeting that were less dovish than Powell’s perceived pivot. Whilst Friday’s likely slowly easing US payrolls and Europe’s estimated rise in headline inflation are unlikely to validate the aggressive six rate cuts currently priced in on both sides of the Atlantic.

All data, figures & charts are valid as of 03/01/2024.