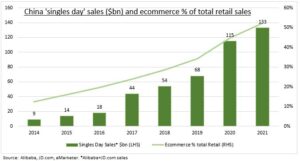

SINGLES: Sunday, November 11th, is China’s ‘Singles Day’. The world’s largest shopping event and finale of a three-week retail extravaganza. It will give an important read on the economic recovery, online penetration, and local and foreign retailers health. The consumer is the third leg of China’s struggling economic stool. A decent Singles Day would validate the pick up in retail sales and complement the Government’s new infrastructure spend. It’ll show how high its world leading e-commerce penetration can go. May refocus attention on the big valuation discount on online giants Alibaba (BABA) and JD.COM (JD.US). And give a halo to foreign retailers, from LVMH (LVMH) to Nike (NKE), with strong China exposure.@ShoppingCart and @ChinaTech.

CONTEXT: Singles Day sales are 2-3x those over the US Thanksgiving weekend that includes ‘Black Friday’ and ‘Cyber Monday’ and starts the Christmas spending season. It’s also a timely read on China’s economy. Private consumption is half of GDP and holding back the economy, alongside a languishing property sector and global manufacturing recession. But been showing some improvement, with latest retail sales +5.5% and imports up for first time in seven months. It’s also an indicator of how high online penetration can go. It’s 45% of retail sales vs 16% in US.

LOW: It’s the 30th anniversary of the start of Singles Day, the anti-valentine’s day singletons celebration that has now grown into this $150 billion spending juggernaut. This year’s sales expectations are low, with the Bain preview showing three quarters of consumers not looking to increase spending, and nearly half planning to trade down to cheaper brands or to private label. But it remains a laboratory for innovation, from livestreaming to AI chatbots, and the competition with aggressive discounters like PDD Holdings (PDD) and unlisted ByteDance, is relentless.

All data, figures & charts are valid as of 08/11/2023.