Summary

A rare case of overseas stock outperformance

Overseas stocks are outperforming US, with their combo of 30% cheaper valuations and surprising resilient economies. Europe hitting new all-time highs without tech’s help. Japan sights on 1989 record. International stocks only beaten US twice in past 35 years. More outperformance needs a soft macro landing, with overseas stocks more cyclical. But best global market always one of the 46 that are 40% of global mkt. cap.

Roller-coaster of debt ceiling fear and AI relief

Debt ceiling fear and rising bond yields held back markets and set for cautious May, with China and UK falls. Dollar rose and global PMIs again resilient but UK inflation a big negative. Markets were boosted by AI optimism after NVDA shock guidance. PFE helped by positive weight-loss trial. NFLX from its widening password sharing crackdown. See our Q2 Outlook HERE. Video updates, twitter @laidler_ben.

The four debt ceiling costs

A deal will be done but with four costs. Short term harms debt market and saps consumer confidence to long term spending cut GDP drag to $1 trillion issuance liquidity drain.

The double credit whammy

A double whammy of tighter loan standards and high interest rates at same time unprecedented. Will slow GDP but with benefit of early rate cuts to long duration heavy stock market.

The UK is down but not out

UK struggles behind US juggernaut. But FTSE 100 near highs and Sterling best major FX this year. UK markets punch above weight and tech stocks have higher valuations vs US peers.

Weak trading volumes don’t mean much

S&P 500 and Stoxx 600 seen low volume May. Confounded sceptics as come with low volatility and positive stock returns. Our analysis shows volume is not equal to performance.

Crypto assets not immune to macro

BTC fell toward $26,000 on debt ceiling and Fed rates concern. Whilst its NASDAQ correlation falls to lows. TRX was performance outlier on rising adoption. Stablecoins market cap. falls to a 14- month low $130 billion on lower ecosystem liquidity. Global securities regulator assoc. calls for quicker and bigger crypto regs.

Commodity prices hit a new 12-month low

Asset class -25% in past year, with stronger dollar and global growth concern as China reopening lags. Brent oil firm as Saudi warns short sellers ahead of next OPEC meeting. OJ surges to new all-time-high on supply fears. Shell AGM saw climate disruption, whilst IEA highlights solar investment besting oil for a first time.

The week ahead: Debt ceiling, June, Jobs

1) US debt ceiling showdown to June X-Date (Thu) after weak May. 2) Macro US JOLTS openings and jobs reports, Euro inflation fall, and China PMI. 3) Tech CRM, AVGO, HPQ earnings and LULU, CHWY, GME consumers and META, XOM, GOOG AGMs. 4) Monday US, UK, EU holiday.

Our key views: Accelerated macro-outlook

Low stock volumes and volatility obscuring rising growth slowdown risks and hastening of interest rate cuts. We see a market recovery with coming bumps in road. Slowdown hurts earnings. But low yields help valuations. Focus on cheap and defensive assets from healthcare to big tech. More cautious on cyclicals and banks.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -1.00% | -2.95% | -0.16% |

| SPX500 | 0.32% | 0.86% | 9.53% |

| NASDAQ | 2.51% | 6.13% | 23.97% |

| UK100 | -1.67% | -3.09% | 2.35% |

| GER30 | -1.79% | 0.39% | 14.48% |

| JPN225 | 0.35% | 7.14% | 18.48% |

| HKG50 | -4.97% | -5.51% | -5.23% |

*Data accurate as of 29/05/2023

Market Views

A roller-coaster of debt ceiling fears and AI relief

- Debt ceiling fears and rising bond yields held stock markets back and set for a cautious May. US dollar rose and global PMIs again resilient but UK inflation a big negative. Markets were supported by AI optimism after NVDA shock outlook. PFE helped by positive weight-loss trial. NFLX from its widening password sharing crackdown. See our Q2 Outlook HERE.

The four debt ceiling costs

- A deal will ultimately be done, but not without four costs to the US economy and markets. Short term 1) unnerving of bedrock debt markets, and 2) a possible payment prioritization hitting consumer spending. Longer term 3) spending cuts become a meaningful GDP drag, and 4) catch-up bond issuance tightens liquidity.

- This is negative and self-inflicted. Stock investors are complacent about this, and see risk of high volatility. But ultimately, we will see the positive drivers of lower inflation and speedier interest rate cuts boosting the long-duration heavy stock market versus real economy cyclicals.

The double credit whammy

- The US economy has dodged long standing calls for its slowdown and a recession so far. Consumers still have pandemic savings. Corporate profits been resilient. PMIs are at an expansionary 54. But the slowdown is delayed not cancelled. From the lagged impact of 5% interest rates. The smouldering banks scare. And the coming debt ceiling spending cuts.

- A double whammy of tighter lending standards and high interest rates at the same time is unprecedented. Could drive market volatility up from current levels. But comes with a silver lining of lower inflation and early rate cuts. The long duration heavy stock market is more sensitive to this than to the macro slowdown.

The UK is down but not out

- Angst over the UK’s lagging economic performance and its weakening place in the global capital markets is running high. But capital markets are not economies, and UK assets have continued to perform resiliently on the global stage. Sterling is the best performing major currency this year. And the FTSE 100 was least bad global stock market last.

- All countries face tough competition from the tech driven and super-sized US capital markets. UK stock and FX markets continue to punch above the country’s economic weight. And there are benefits to being a big fish in a smaller pond. With UK tech stocks more highly rated than in US.

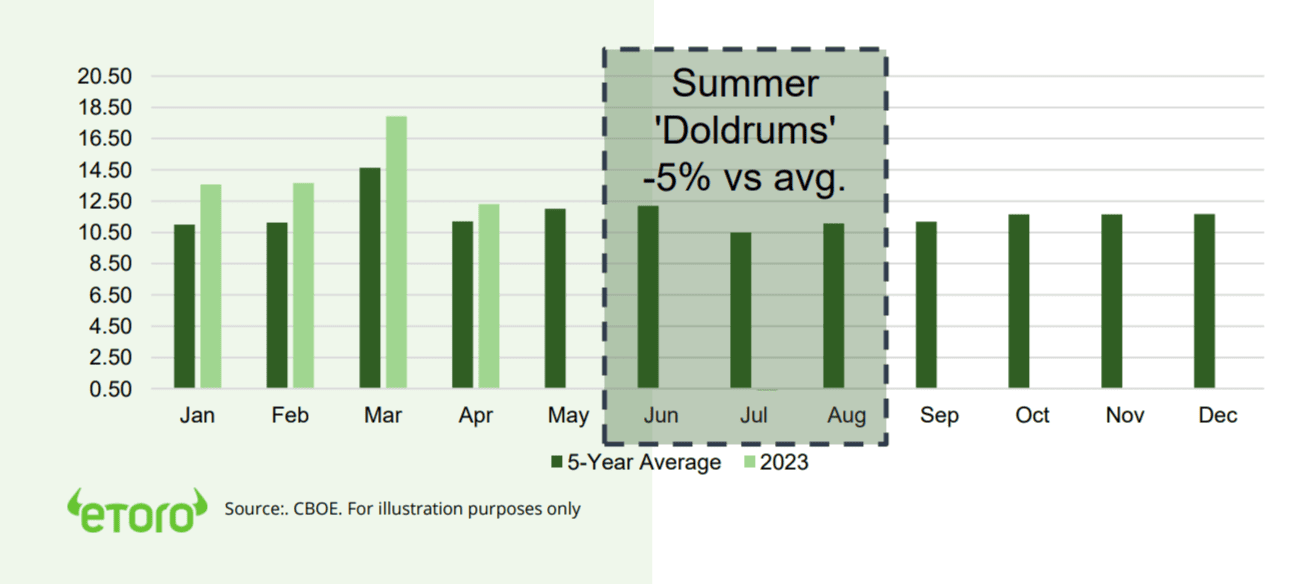

Weak trading volumes don’t mean much

- The S&P 500 and Europe’ Stoxx 600 indices have seen a very low volume May. This has confounded market sceptics, as it has come alongside both low volatility and generally positive stock returns.

- Our seasonality analysis shows volumes not equal performance. US equity volumes are running well ahead of average this year, thanks to options and retail markets. Whilst summer volumes set to only 5% below rest of year is history is any guide.

US equities trading volumes (YTD versus Average, billions of Shares)

Bitcoin not immune to macro concerns

- Bitcoin (BTC) eased further towards $26,000 and not immune to broader concerns over the US debt ceiling and more balanced expectations for future Fed rate cuts. Whilst its correlation with the surging NASDAQ fell to an annual low of 0.3.

- Decentralized operating system TRON (TRX) was the performance outlier among major coins, benefitting from rising adoptions stats.

- Stablecoins market cap fell to 14-month low $130 billion reflecting lower crypto ecosystem liquidity.

Commodities prices hit a new 12-month low

- Broad based Bloomberg Commodity Index hit a new 1-year low, down 25% under the combined wight of a stronger US dollar and further global growth concerns from the US debt ceiling and slow-moving China economic recovery.

- Brent oil prices were firm at $75/bbl., supported by Saudi Arabia warning speculators not to bet on lower prices, as look to June 4th OPEC+ meet.

- Orange juice prices surged to a new all time high, and are up 60% in the past year, on continued US and Brazil supply concerns after poor weather.

- Shell the latest AGM to see climate campaigner disruption. Whilst the IEA says solar investments exceeding those for oil for the first time ever.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 3.66% | 12.43% | 32.03% |

| Healthcare | -2.82% | -2.77% | -5.33% |

| C Cyclicals | -0.21% | 3.87% | 14.94% |

| Small Caps | -0.04% | 2.46% | 0.67% |

| Value | -1.27% | -1.46% | -4.09% |

| Bitcoin | -0.23% | -6.66% | 61.96% |

| Ethereum | 1.24% | -2.19% | 53.49% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Debt Ceiling, Jobs, June, Holiday

- US debt ceiling stand-off with bonds pressured, stocks complacent, Congress divided as June 1 (Thu) X-date near. And close weak and low volume May, led down by China, UK and up by LatAm.

- Macro highlights sees an est. easing in US job opening JOLTS (Wed) and non-farm payrolls (Fri) reports. Alongside a China est. 50 borderline PMI (Thu) and EU inflation (Thu) falling to an est. 6.5%

- See eventful end-of-season US Q1 earnings with tech stock AI hype and CRM, AVGO, HPQ, CRWD reports plus consumer LULU, CHWY, GME. Annual General Meetings at Meta, Exxon, and Alphabet.

- It’s a shortened week with US markets closed Monday for the Memorial Day remembrance holiday, alongside a UK bank holiday and Whit Monday holidays across much of Europe.

Our key views: An accelerated macro-outlook

- Low stock volumes and volatility obscuring rising growth slowdown risks and hastening interest rate cuts. Banking sector fears doing the Fed’s job for it. Alongside the lagged 5% interest rate impact and spending cuts to come from a debt ceiling deal.

- See a V-shaped market recovery with plenty bumps in road. Faster slowdown hurts earnings. But lower bond yields helps valuation. Focus on cheaper and more recession defensive assets, from healthcare to derated big tech. More cautious on assets most exposed to recession risk, like cyclicals, small caps, and commodities. Or lower yields, like banks.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -0.98% | -4.06% | -11.28% |

| Brent Oil | 2.09% | -3.85% | -10.26% |

| Gold Spot | -1.71% | -2.66% | 6.34% |

| DXY USD | 1.00% | 2.53% | 0.68% |

| EUR/USD | -0.71% | -2.63% | 0.24% |

| US 10Yr Yld | 12.30 | 38.41 | -7.34 |

| VIX Vol. | 6.78% | 13.75% | -17.17% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point

Focus of Week: Foreign stocks in from the cold

Overseas stocks outperforming with valuations cheap and economies resilient

Overseas stocks have started to outperform the US after a long 15 years in the wilderness. Japanese and European indices have broken out to new highs, even without help from tech titans. Valuations are cheap and earnings still rising. But these more cyclical markets are more exposed to any sharp economic slowdown. There are benefits to global diversification. The US is super-sized at 60% the market cap. of global equities. But the world’s top performer in any year is always one of the 46 overseas markets.

European stocks hit new all-time-highs without tech help. Japan sights on 1989 record

Germany’s benchmark DAX index hit a new all-time-high last week. The UK’s FTSE 100 and France’s CAC hit new highs earlier this year. Japan’s Nikkei 225 surged through the symbolic 30,000 level, putting its 1989 high within sights. By contrast the US’s S&P 500 and NASDAQ indices remain 10-20% below peak levels.

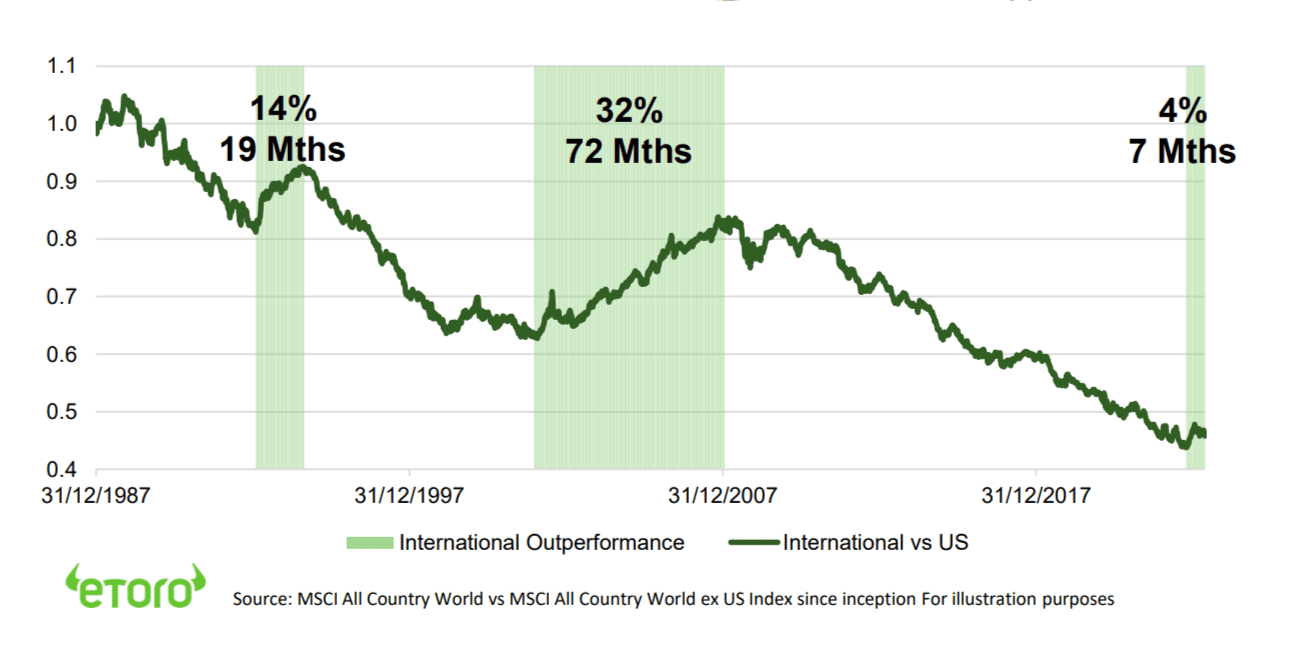

International stocks have only outperformed twice in the past three decades

US stocks dominate global markets. Whilst the US economy is only 20% of the world’s total, its stock markets make up 60% of total investable market capitalisation. Going all the way back to the mid-1980’s when global investing started to take off shows how rare the periods of overseas outperformance have been. The longest stretch was the 2000’s (see chart) when the US was still recovering from its tech bust hangover whilst much of the rest of the world rode a China-driven commodities super cycle.

Current outperformance driven by combined macro growth surprise and low valuations

The recent bout of outperformance started with China’s Q4 2022 reopening rebound. This was continued by Europe’s natgas price plunge and upside GDP growth surprise. With Japan most recently taking up the outperformance baton as its economy started to find its feet helped by the weak Yen. This has all raised the earnings growth outlook. And pushed on an open door of cheap valuations that had slumped to record lows in the 15-years of weakness vs the US. Outperformance came even as US tech rebounded.

More outperformance needs a soft landing. But the best market will be overseas

Overseas valuations remain cheap. Their 13x prospective P/E is a 30% discount to the US, 20 points wider than a decade ago. Markets like China, Brazil, Italy, UK, and Norway have single-digit, or close to that, P/E valuations. The world also remains a big place, with 23 investable developed and 24 emerging markets. These 46 international markets have always contained the world’s best performer in every year.

International versus US equities performance (35-Years)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle, stubborn inflation, and now financial sector concerns, is accelerating our 2023 view. Of a quicker GDP slowdown, lower inflation, and a peaking Fed interest rate cycle. Will pressure earnings further but also lower bond yields and take pressure off de-rated valuations. We are invested, believing Oct 2022 was the low, and focus on cheap and defensive assets for a faster ‘V-shaped’ market recovery. See our Q2 Outlook HERE |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the market rout, and now at average levels, and are supported high company profitability and near peak bond yields. Focus on cash-flows defensives, like healthcare and high dividend. Big-tech supported by defensive growth. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and tech/small cap/crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices amd reopening China with high ‘buffers’ of rising fiscal spending (defence and refugees) and weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by lack of big tech sector and 30% cheaper valuations vs US. Banks better capitalised and regulated but loans/GDP much higher. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. Broader EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia have benefitted from strong equity market weight in commodities and financials, as global growth resilient and bond yields risen. Now could be becoming headwinds. Japanese equities among worlds cheapest with own and China-proxy growth and governance improving but threats of tighter monetary policy and stronger Yen. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Hurt by higher bond yields and above average valuations. But structural stories with good growth, high margins, fortress balance sheets support some. ‘Big-tech’ attractive new recession defensives. ‘Disruptive’ tech is much more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors – like discretionary (autos, apparel, restaurants), industrials, energy, materials, and small caps – have cheap valuations, many with depressed earnings, and have been out-of-favour for many years. But they are significantly exposed to rising recession risks. Some especially cheap (energy) or see growth recovery (airlines). |

| Financials | Current stresses likely individual not systemic. Post GFC reforms boosted capital and size/speed of authorities response. But outlook for 1) less GDP growth, 2) lower bond yields and interest rates, and 3) valuation sensitivity after recent surprises, worsens outlook. Insurance and Diversifieds (like Berkshire Hatheway) more defensive. |

| Themes | Dividends and buyback themes attractive with resilient cash flows, rising pay-outs, and investor search for defensives. Power of compounding dividends under-estimated, at up to 1/2 of total long term return. Small caps pressured by rising recession risk. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has wide spread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attrative cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+. But commodities not to repeat their 2021 and 2022 performance leadership. Gold benefits from safer haven demand. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.