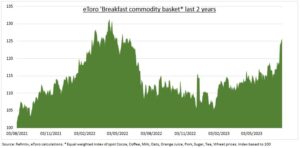

FOOD: Agriculture commodity prices bucked the 4% fall in the broad Bloomberg commodity index this year. The impact on ag prices from the 2022 Russian invasion of Ukraine has faded. But been replaced by weather-driven supply disruption. This may worsen as the Black Sea grain deal ends and El Nino builds. Our basket of nine breakfast commodities has surged 20% from its January low (see chart). This threatens the hoped for easing in supermarket prices, which dramatically led headline inflation, as it works through supply chains. It may help ag suppliers, from fertilizers to equipment (MOS to DE), but pressure producer margins (NESN.ZU to GIS).

BREAKFAST: Our basket is made up of nine equal-weight popular breakfast commodity items. Price gains this year have been led by orange juice (+50%), pork (+50%), cocoa (+33%), sugar (+30%), oats (+7%), and coffee (+3%). This has more than offset lower milk (-14%), tea (-11%), and wheat (-10%) prices. The main driver has been the supply side, and often weather driven. Florida citrus has seen weather damage. Hog (pork) numbers been culled given surging feed costs. Cocoa supply has been hit by heavy rain in the Ivory Coast. Sugar supply hit by India export curbs and Brazil rains. The building Pacific El Nino could drive further weather disruption.

EXAMPLE: The UK is a telling example. Food price inflation may be off its highs but it is still up 17.3%, nearly double the rate of headline inflation. Half of adults report buying less food now because of these big rises. We constructed a consumer basket of 15 breakfast essentials, from butter and milk to sausages, bacon, and jam. It has risen 19% in the past year. Supermarket sugar prices led, up by 54%, and jam and eggs were both up 29%. Whilst the lowest increases of ‘only’ 10% from tea and butter are still above the latest 7.9% rate of headline UK inflation.

All data, figures & charts are valid as of 27/07/2023.