We spotlight five key takeaways from our latest quarterly survey of self-directed investors across the world. They are more positive, more diversified, and increasingly looking outside home markets. There are also now more of them, and they are often contrarian.

Investor confidence continues to make a comeback. Whilst geopolitics rises up the risk ranking to challenge inflation

The latest Retail Investor Beat found that retail investor confidence has rebounded to its highest level since the 2021 bull market. 76% of those surveyed are confident in their portfolios versus 69% in the previous quarter. More than two in five (44%) have upped their investment contributions in 2023. This has been led by younger, and wealthier investors. Whilst only 10% have cut their investments. This has helped investors, with markets now well up from their October 2022 lows.

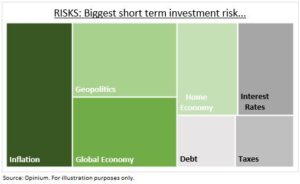

In terms of risks, inflation remains the biggest perceived threat amongst retail investors, with 22% citing this. Whilst international conflict (18%) has risen to become the second biggest perceived threat, as the Ukraine war and US-China tensions continued. This is now ahead of the global economy (17%), likely as recent economic activity has strengthened. Rising interest rates (14%) was perceived as a higher risk by younger investors.

All about other asset classes as volatility sours interest from commodities to currencies

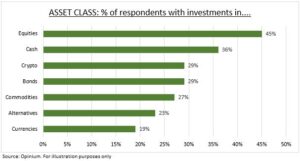

After 15 months of faltering markets, retail investors are also increasingly diversifying into different asset classes. The percentage holding commodities has jumped from 16% to 27%. Those with foreign bonds has risen from 12% to 17%. Those with alternative investments (for example, listed real estate) is up from 21% to 23%. Those with FX exposure has surged from 9% to 19%. Whilst those with crypto exposure has remained steady at an already high 29%.

This asset class diversification makes sense. Commodities was the best asset class performer for the past two years. Whilst crypto assets have decisively led up this year. Alternatives, like listed real estate, have traditionally been a good long term inflation hedge. Whilst the recent US dollar fall, after its big 2022 rally, has provided some performance relief to other currencies.

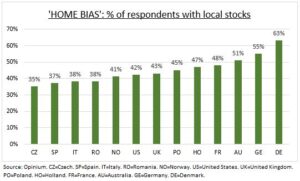

‘Home bias’ declines as turbulent markets drive global diversification

The percentage of global retail investors with exposure to domestic equities has fallen from 51% in Q1 2022 to 45% a year later in Q1 2023. The move away from the home equity market is most prevalent in the US, where the proportion of retail investors holding domestic equities has fallen from 60% in Q1 2022 to 42% in Q1 2023.

It has never been easier or cheaper for investors to take advantage of the diversification and investment opportunities in the rest of the world, with more ETF’s and commission free trading, for example. The market volatility of the last year seems to have been the catalyst, with the proportion of investors looking to their home markets falling below 50% for the first time. This certainly feels like a long awaited turning point.

Taking more control of their finances for the long term. With a recent focus on US and Financials

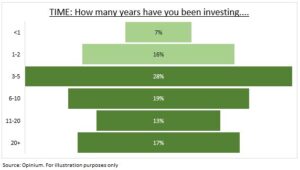

Investors have continued to move to take control of their finances. This has been regardless – or potentially because of – the market downturn. 23% have started investing in the past two years. A significant number that comes on top of the significant growth in recent years. They remain focused on the long term. 64% are investing for years if not decades. Only 2% for days.

The main reason to invest is to provide long term financial security (46%) and to help fund retirement alongside a pension (36%). Only 12% of those surveyed say it’s for fun. The US is seen as having the best investment outlook (by 27%), followed by Europe (16%), and Emerging Markets (9%). Domestic stocks remains the most favoured asset class (45%), and financials (43%) has pulled ahead of tech (41%) as the favoured equity sector.

The younger and contrarian retail investor view point. With retail investors more important to broader markets than ever

Younger investors aged 18-34 are more active, more bullish, and more likely to use social media for investment research and decision making. They are focused on achieving financial independence (42%), are more likely to take an active (40%) rather than passive investment approach. They are also more bullish (65%), and social media more likely to be their top information source for research (34%).

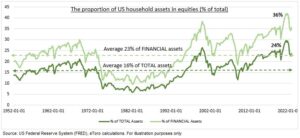

Retail investors are often contrarian. 40% consider lightening up the positions into market rallies. Whilst only 18% consider buying more in response to price surges. 37% stick to their investment plan and do nothing. This challenges the common trend-following perception of retail investors. Retail investors are increasingly important to financial markets. For example, the latest data from the US Federal Reserve shows US household equity allocations at 24% of their total assets. This is 50% above the long term average.

About the global RIB survey

The Retail Investor Beat was based on a survey of 10,000 retail investors across 13 countries and 3 continents. The following countries had 1,000 respondents: UK, US, Germany, France, Australia, Italy and Spain. The following countries had 500 respondents: Netherlands, Denmark, Norway, Poland, Romania, and the Czech Republic. The survey was conducted from 20th of February to 9th of March 20232022 and carried out by research company Opinium. Retail investors were defined as self-directed or advised and had to hold at least one investment product including shares, bonds, funds, investment ISAs or equivalent. They did not need to be eToro users.