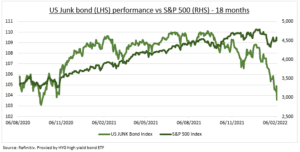

JUNK: US junk bonds (JNK, HYG) have been selling off and ignoring the recent equity rebound (see chart). This is unusual as they normally move together. And concerning as junk bonds are often a lead ‘canary-in-the-coalmine’ indicator. It is important to consider what fixed income markets tell us, from recession probabilities to equity risks. We think this is a false alarm, with earnings strong, GDP firm, and rate outlook already hawkish.

COMPOSITION: High yield aka ‘junk’ bonds are those issued by riskier companies with a less than investment grade credit rating. This market has boomed since the 1980’s and the advent of leveraged buyouts (LBO’s), immortalized in the book ‘Barbarians at the Gate’. Junk bond index composition is deeply cyclical, with big weights in commodities, discretionary and retail. It is also underweight in tech. This makes them very sensitive to economic conditions and helps to drive the normally high correlation with equities.

MATTERS: 80% US corporate finance is raised via the bond market, making it crucial to the economy, and explaining Fed’s strong support in the 2020 crisis. This is different elsewhere, such as Europe and China, where bank finance is much more important. The US junk market has been healthy, with surging issuance (record $460 billion last year), low default rates (2%), and tight credit spreads (3.6% over 10-year government bonds). But higher interest rates will make bond refinancing’s and new issuance more expensive.

All data, figures & charts are valid as of 10/02/2022