The two-year US debt ceiling deal is positive, but reaction likely muted as most markets never sold off and the deal has some modest negative bond market and economic growth consequences. Lower income consumers will bear the brunt of the spending cuts, whilst defence, healthcare, and energy are likely relative winners. Here are the 8 things to know –

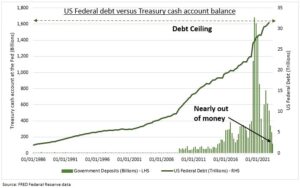

1. DEAL: A deal has been reached to suspend the $31.4 trillion US debt ceiling for two years, in return for government spending caps for two years. The ceiling was hit in January 2023 and has now been suspended until January 2025, after the November 2024 Presidential election. This is more modest than the 10-year deal needed to solve the last major debt ceiling showdown in 2011.

2. VOTE: The debt ceiling deal needs to be approved by the US Congress. The US House of Representatives easily passed the bill 314 to 117 votes, with Senate passage expected this week before Monday’s June 5th estimated ‘X-Date’ when the government could run out of money.

3. MARKET: An end to the debt ceiling showdown is a relief to markets, and one less thing to worry about. But any rebound will be limited by the fact that 1) markets never really sold off ahead of the deal. With S&P 500 closing May flat and NASDAQ up 6%, and 2) that there are macro economic and market costs.

4. SPENDING: The deal will see around $100 billion a year of less government spending in 2024 and 2025. Focused on the 25% of the budget that is not mandatory spending, like social security or medicare, or interest payments. These cuts are equal to only 0.05% of GDP, but would take a chunk out of the expected US GDP growth rate of 0.8% next year. This will combine with 5% interest rates and less bank lending to slow the economy.

5. LOSERS: Specific spending winners and losers will not be clearly known until the annual September budget bill negotiations. Cuts will be most felt at welfare programs, where work requirements are being raised, and for student loans, where repayments are set to resume in August after a 3.5 year pause. Both measures will fall hardest on low income consumer spending, already seeing drained pandemic savings and rising labour market uncertainty.

6. WINNERS: The defense and healthcare sectors are seeing some relief as spending will still grow somewhat, or be completely untouched, under the debt deal. Energy permitting requirements are set to be eased. Whilst Virginia’s Mountain Valley natgas pipeline, involving NextEra (NEE) and Consolidated Edison (ED), approved.

7. ISSUANCE: With the ceiling now raised the US Treasury is set to issue around $1 trillion of bonds to fund itself. Markets have already been pushing down bond prices in anticipation of this supply glut. This is a technical factor, and the lower growth and inflation fundamentals still argue for higher prices medium term.

8. RATINGS: The US could still be downgraded by the third-largest credit rating agency Fitch, which put the US on negative review for a downgrade from the highest AAA debt rating level. A downgrade would follow that by S&P Global which cut the US in 2011, the last time the US nearly defaulted.