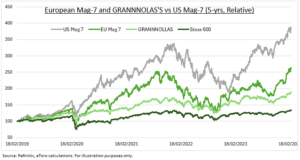

CONCENTRATION: US tech stock leadership and rising stock concentration are being echoed in Europe. It’s much smaller ‘magnificent 7’ tech stocks have led European performance (see chart) and potentially benefitted from a scarcity valuation premium. Whilst the broader-mix of quality-growth ‘GRANNNOLAS’S’ that are Europe’s equivalent of US big-tech have driven recent performance. They are now a quarter of the Stoxx 600 index, and trade at a similarly big local valuation premium. We see a broadening of performance as the year progresses. Into smaller, more cyclical, and cheaper segments most sensitive to lower interest rates and GDP recovery. @EuropeEconomy.

‘MAGNIFICENT 7’: We created a basket of Europe’ seven largest tech stocks. They’ve healthily outperformed the Stoxx 600 but lagged US peers. They have a similar 30x fwd. P/E, but lower profitability and growth. And a fraction of the US’s $12 trillion market value at under $1 trillion. They are Netherland’s ASML (ASML), ADYEN (ADYEN.NV), Germany’s SAP (SAP), Infineon (IFX.DE), France’s STMicro (STM.US), Capgemini (CAP.PA), and UK’s RELX (REL.L). The tech and communications sectors are 11% the European market vs 39% in the US. But benefit from a scarcity premium. With UK tech stocks, for example, the only sector at a premium to US. @EuropeTech.

‘GRANNNOLAS’S’: This acronym was coined by Goldman Sachs (GS) out of 11 of Europe’s biggest stocks. They have similarly driven market performance, making up half Stoxx 600 gains the past year. And dominating the index, with a 25% weight only a little under big tech in the S&P 500. And a similar local premium 21x fwd. P/E valuation. But less growth and profitability and a broader sector base. The eleven are Switzerland’s Nestle (NESN.ZU), Roche (ROG.ZU), Novartis (NVS), UK’s Glaxo (GSK.L), AstraZeneca (AZN.L), France’s LVMH (MC.PA), L’Oreal (OR.PA), Denmark’s Novo-Nordisk (NVO), Germany’s SAP (SAP), Netherlands’ ASML (ASML).

All data, figures & charts are valid as of 27/02/2024.