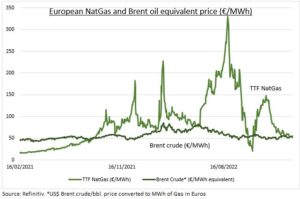

HIGH-FOR-LONGER: European natural gas prices have plunged 85% since the summer. They are back to parity with Brent oil equivalent prices (see chart). This has delivered huge relief to the region’s economic outlook and stoked its world-leading stock market performance. PMI’s have risen for three months, headline inflation similarly fallen, and many regional stock markets are at all-time-highs. But the benchmark TTF natgas price is still three times 2020 levels and a big economic drag. It likely needs to stay ‘high-for-longer’ with the biggest declines behind it. To incentivize demand savings and pull in enough LNG vs China’s re-opening. And with Russia set to potentially cut off its remaining EU flows. Much more natgas price relief may not be coming.

DYNAMICS: Lower TTF natgas prices have mostly been driven by less demand. This has been split equally between lower consumer and industrial needs. With unseasonally warm weather and high prices destroying demand. High winter gas storage levels were boosted by a 70% rise in LNG imports last year. Helped by opening three new import facilities. Storage has now only been drawn to 64%, fully 10 points higher than average. This makes refilling for next winter, and hitting the region’s 90% November 1st target, easier. Supply will see cross-currents of further Russia cuts but boosts as reopened or new Freeport and BP LNG capacity comes on stream.

TTF: The Dutch Transfer Title Facility (TTF) was established in 2003 and is now the continent’s most liquid natgas pricing location and the region’s proxy. TTF now trades more than 14 times the amount of gas used in the Netherlands, and twice that of all other of the continent’s gas platforms combined. This is similar to the role of Louisiana’s Henry Hub in US natgas market.

All data, figures & charts are valid as of 20/02/2023