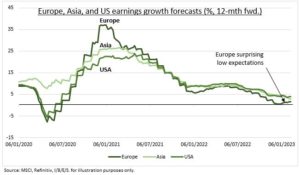

SURPRISE: Europe’s Stoxx 600 index is within 5% of its all-time high and is the best performing region this year. Some, like the UK’s FTSE 100 and France’s CAC 40, are already at record highs. A big driver is the surprising earnings performance. Europe’s 11% Q4 growth is outpacing the S&P 500’s. And confounding low investor expectations (see chart). The surprises are driven by heavy-weighted energy and financial stocks, and with a weaker Euro tailwind. This is driving higher profit margins, in contrast to the US. It’s still below-average valuations give extra support, alongside fundamentals of lower natgas prices and a reopening China. See @EuropeEconomy.

EARNINGS: Nearly half the Europe’ Stoxx 600 has reported Q4 so far. Revenue growth is 6% and earnings 11%. Both are handily beating significantly lowered consensus forecasts and are positive even when excluding the energy sector. Absolute growth, and upside surprises’, have been led by energy and financials. They are respectively benefitting from high-for-longer $70 oil prices, and ECB rate rises to 3%, the most in thirteen years. The best profits growth has come from Italy (+26%) and UK (+26%), with Sweden (-40%) and France (+6%) the relative laggards.

OUTLOOK: There are still plenty of clouds on the horizon. Recession risks remain high, and a recently strengthening Euro is a headwind to the region’s many exporters. Its earnings are more cyclical and with lower net profit margins than most. But earnings growth expectations already foresee a sharp slowdown and are the lowest of major regions. Whilst low valuations, even after the recent rally, are a support. Its 13x P/E ratio is 10% below long term average and 30% under the US. Fund flows have been returning but have far to go after a decade of underperformance.

All data, figures & charts are valid as of 14/02/2023