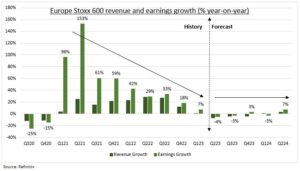

SURPRISE: The UK and Europe’s largest stocks are on track to grow earnings 7% in Q1. This continued resilient performance is led by rebounding profit margins, the opposite of the US, and supports Europe’s world-leading stock market performance this year. Investment risks are still higher in Europe than elsewhere, with slower economic growth, slimmer profit margins, and both more cyclicals and global-focused stock markets. Another earnings surprise, plus still lower profits growth forecasts (see chart), are key supports to the inevitable setbacks. Additionally, Europe has the support of a 30% lower P/E valuation versus the US. See @EuropeEconomy.

FIRST QUARTER: Two-thirds Europe’s Stoxx 600 index have reported Q1 earnings. Revenues are flat and narrowly missed expectations, despite the upside GDP surprise. Whilst bottom line profits rose 7% versus last year and were ahead of forecasts by 11% as margins expanded 60 bps to 9.4%. Earnings growth was led up by financials (+50%), the biggest sector in Europe, and by tech (+30%). These two also led the ‘beats’ vs analyst expectations. The only two sector disappointments were energy, and especially real estate. Italy (+39% versus last year), Spain (17%) and UK (17%) led profits growth, whilst Switzerland (-16%) and Germany (-9%) lagged.

OUTLOOK: Revenues are being supported by the local economy avoiding recession and PMI’s strengthening to an expansionary 54. China’s reopening and further US consumer growth are positives for the most global facing region, where over 50% revenues come from abroad. Though Euro strength may become a headwind. Unlike the US, the best growth is coming from the most defensive sectors. Financials profit margins are helped by higher interest rates, whilst others enjoy the 60% plunge in natgas prices vs a year ago. All are enjoying still low analyst earnings expectations. Plus Europe’s 13x P/E ratio is 10% below average and 30% under US.

All data, figures & charts are valid as of 11/05/2023