SHORT TERM: Price of European carbon emissions allowances has fallen with commodities in recent months. It’s now below the symbolic €100/tonne of CO2 reached for the first time in Q1. Europe’s industrial output has been resilient but still weakening, cutting demand for pollution allowances. Whilst the huge 80% natgas price slump led to less gas-to-coal switching and demand for allowances. But this cyclical weakness hides the passage of structural reforms to cut allowance supply and boost demand. This is likely to only push prices up in the long term.

LONG TERM: EU parliament last month approved wide ranging plans to expand its emission trading system (ETS), raise the cost of pollution, and globalize it with a border adjustment mechanism. The plans 1) deepen EU pollution emissions cuts to 62% by 2030 vs 2005. 2) Cut supply by phasing out free CO2 allowances by 2034 and removing 90 million allowances from market in 2024. 3) Boost demand by launching a buildings and transport ETS market in 2027 and adding shipping from 2024. 4) Phase in a EU carbon border levy from 2026. This effectively globalizes the ETS market given Europe’s role as the largest export market for 80 countries.

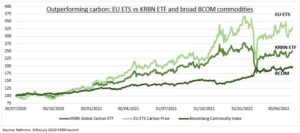

CARBON PRICES: Close to a quarter of all global CO2 emissions are now covered by carbon pricing initiatives, according to the World Bank. China’s scheme, introduced in 2021, is the world’s largest and covers 9% all global emissions. The EU scheme is the 2nd largest, covering 3.2% of global emissions. It’s been running since 2005, making it the oldest. Its ETS price has quintupled since 2020, partly in anticipation of these just approved reforms, and outpacing other carbon markets from California to the UK (see chart). This market generated an estimated $34 billion of revenue in 2022, that is returned to EU governments to invest in climate measures.

All data, figures & charts are valid as of 02/05/2023