CONTAGION: US banking system concerns, triggered by weakness at Silicon Valley, Signature, and Silvergate banks, has spread to Europe. The Stoxx 600 Banks index, Europe’s biggest sector, is down 15% in a week. This reflects nervous investors and the unique importance of banks to economies. But Europe’s banking system has key differences vs the US. This makes a big bank failure less likely. Capital is higher and regulations tighter. But a failure, however unlikely, could have a bigger impact and take longer to resolve. We see banking risks as specific not systemic on both sides of the Atlantic. And authorities with the tools to address. The Fed has acted. Swiss SNB gave support yesterday. ECB will address at its press conference today. But the support will be for the system and depositors not necessarily for share or bondholders.

GOOD: It’s barely ten years since the European debt crisis saw a new region- wide regulation and crisis fighting architecture, with European Banking Authority (EBA) regulator and European Stability Mechanism (ESM) rescue fund. It’s banks have generally higher capital and liquidity than in US. They are more tightly regulated from $50 billion asset level vs the $250 billion level in the US. Whilst Europe’s banks more consolidated, though with exceptions like Germany.

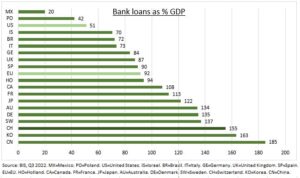

BAD: Less positive are the impacts if a major bank was to fail. Bank loans as a percentage of European economies are much higher (see chart) than the US. Banks are the source of most company loans in Europe, whereas US companies much prefer the bond market. The sector plumbing in Europe is different across the 27-member EU. Ranging from country-based deposit insurance to cumbersome bank work-out schemes. It is more complex than the US.

All data, figures & charts are valid as of 15/03/2023