OPEN-DOOR: European equities are on a roll, besting the US by 17pp the past three months. This is confounding skeptics and denting Europe’s multi-year under performance. Poor investor sentiment and low valuations (12x P/E, 30% discount to US) have been an open door for its ‘less-bad’ fundamentals to push on. Natgas prices have plunged, China is now reopening, and the continent’s growth avoided recession. Q4 earnings (est. +14% YoY) should provide a further resilience reminder. Europe is still a long way from out-of-the-woods. Inflation has barely peaked (9.2% vs 10.6% October peak) and a stronger Euro (15% off lows) is a mixed blessing. But we think it remains an attractive contrarian hunting ground for the brave. See @EuropeEconomy.

INFLATION: A second straight fall in Euro area inflation has been helped by plunging natgas. Prices are down 80% from August’s peak. This relieves growth and price pressure now. But also later by saving precious natgas storage. The Euro inflation fall lags the US’ six monthly declines. But it could catch up, with its more energy driven inflation. Non-core prices are fully half of EU inflation vs only 15% in the US. The Euro rally has been a further inflation help, and the ECB still on the front foot. With at least 100bps hikes to come and little appetite to cut until well into 2024.

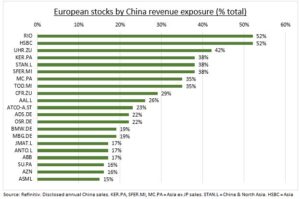

CHINA: China’s accelerated economic re-opening has the potential to be a strong boost to the continent, and help balance a slowing US. 10% Europe’s exports go to China, led by Germany (16%) and France (11%). It’s forecast to be the only major economy growing significantly more this year. Many listed sectors, from industrials to commodities and luxury (see chart), also have big sales exposure. This demand recovery could help offset headwinds from a stronger Euro.

All data, figures & charts are valid as of 16/01/2023