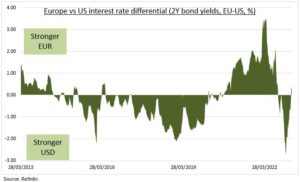

RALLY: Six months is a long time in FX markets. EUR/USD slumped below parity in mid-2022 and troughed at 0.95 late in Q3. Europe’s recession risks were spiking and the US interest rate differential hit 2% (see chart). The rally since was driven by the ECB’s more hawkish stance, as growth risks faded and inflation stayed sticky, and little sign of recent bank contagion. The GBP was helped by similar, if less dramatic, trends. Whilst the Fed neared the end of its rate upcycle, the market priced rate cuts soon, and its ‘safer haven’ bid faded. EUR gains will be harder won from here, with continent not immune to global growth fears and Fed cuts now well priced.

EURO: The EUR is being supported by a sharp swing in relative interest rate differentials in its favour. 2-year European bond yields are now higher than in the US (see chart), for example. Currency values have many drivers, making it one of the hardest asset classes to invest in. But relative interest rate differentials, that attract capital inflows, are arguably the most important of them. Valuations are also modestly supportive. The EUR is at a 7% valuation discount to the US dollar on a real effective exchange rate basis, but barely 1% cheaper on a ‘big mac’ basis.

DXY: The Euro is by far the biggest component of the widely traded US dollar (DXY) index. It has a fixed 57.6% weight, alongside the JPY (13.6%), GBP (11.9%), CAD (9.1%), SEK (4.2%), and CHF (3.6%). The dollar index was established in 1973 and has only been updated once, when the EUR was introduced in 1999. The BIS estimates global currency trading volumes at around $7.5 trillion daily, the most of any asset class. The US dollar dominates this, as one side of an estimated 90% of all transactions. The Euro is second as one side of 31% of transactions.

All data, figures & charts are valid as of 03/04/2023