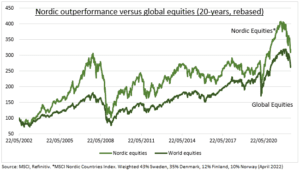

IDEA: Scandinavian stock markets have a long-term outperformance record (see chart), with a Nordic market the top developed world performer 7 of the past 15 years. This punches way-above their weight, at only 2% of global GDP and market capitalisation, and 0.3% population. But this outperformance comes with higher risk, seen this year with Nordics 20% price fall, given global cyclical focus and Russia proximity. But if global recession is avoided, these quality cyclical, and cheaper, markets should be on the shopping list to lead a eventual recovery, as before (see chart).

CHARACTERISTICS: The region has long been an innovation and sustainability leader, from dynamite to LEGO, Nokia to Spotify, and dominates global competitiveness, innovation, and sustainability ranks. The ‘nordic model’ economies and stock markets are relatively ‘open’ to the world. Most are outside the Euro (EUR), and their weaker currencies have been a growth buffer this year, alongside stronger defence-led government spending, and mostly dovish central banks.

MARKETS: Nordic markets are dominated by Sweden, led by industrials (INVEB, ATCO-A) and banks (NDA_SE), and Denmark, with healthcare (NOVO-B), shipping (MAERSKB), and renewables (ORSTED). Norway and Finland round the region out with their energy (EQNR) and tech (NOK) slants. For more see @NordicEconomy and @StartupNations. The region now has a cheaper-than-global 14x price/earnings valuation but higher 14% profit growth and 3% dividend.

All data, figures & charts are valid as of 25/05/2022