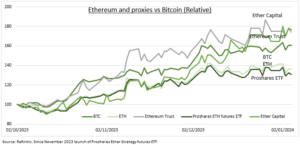

CRYPTO: Crypto optimism is back ahead of Thursday’s first final SEC decision on a spot Ethereum ETF. Bitcoin is back over $70,000 but it’s Ethereum that has taken the recent performance lead after lagging all year (see chart). An Ethereum ETF approval in the world’s largest capital market is a long shot but hopes are rising. And even an SEC rejection may come with a pathway to an eventual green light. And be significant in the development and institutionalisation of what remains the newest, smallest, and most retail dominated of asset classes. This decision is the latest in a string of important crypto catalysts coming this year. @Crypto-currency.

DEADLINE: Thursday, May 23rd, is the first final deadline for the SEC to decide on whether to approve an Ethereum spot ETF, ruling on the VanEck filling proposal. Similar to what it did with Bitcoin ETFs back in January and whose approval has driven $12 billion net inflows since then and helped make Bitcoin one of the best performing assets this year. Expectations are lower for an ETH approval 1) so soon after the Bitcoin ETF approval, 2) with less legal pressures to do so than for Bitcoin, and 3) with a more difficult commodity versus security regulatory interpretation. But this would make any long-shot ETF approval price reaction likely just more dramatic.

PROXIES: There are less direct Ethereum proxies than for Bitcoin. With no MicroStrategy (MSTR) or Bitcoin miners’ equivalent. The discount to net asset value (NAV) of the Grayscale Ethereum Trust is the clearest sentiment proxy. It has narrowed sharply from a -55% trough last July to a still discounted -12% today. The US-listed Proshares Ethereum ETF is the first to invest wholly in the Ether futures trading on CME. Canada’ Ether Capital is a small cap focused on Ethereum staking and owning 46,000 ETH. Ethereum’ risk/reward has deteriorated into the SEC decision with the latest rally. But any SEC pathway to approval would be taken positively.

All data, figures & charts are valid as of 21/04/2024.