INVESTMENTS: Tomorrow is Earth Day, which marks the anniversary of the birth of the modern environmental movement in 1970. The theme for the 53rd annual Day is ‘invest in our planet’. Cleantech and renewables is the number one thematic investment priority in every country and demographic in our latest global retail survey. This has driven resilient fund inflows that bucked the strong outflows seen by broader funds. This comes even as renewables ETFs and stocks have lagged behind higher flying tech themes this year. And as broader ESG seen a backlash. This combination of investor interest and fund flows will keep the pressure on governments and companies to meet decarbonation and net zero goals. And underpins demand for the stocks making the most progress. See @RenewableEnergy, @BatteryTech and our ESG stock ratings.

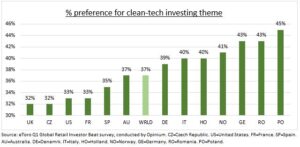

Q1 SURVEY: Clean tech investment themes, like EV’s, batteries, and renewables, were the overwhelming focus by 37% of global retail investors in our Q1 survey. This is well ahead of all other themes, including tech (27%), crypto (26%), consumer (22%), demographics (21%) and deglobalization (15%). It was the most popular theme in all markets and demographics. But there were variations within this. Its popularity is highest in continental Europe vs UK and US (see chart). And favoured by young vs older, men over women, and better off over less well off.

FLOWS: There was an estimated $2.5 trillion invested in sustainable investment funds at the end 2022, per Morningstar. This is dominated by Europe (83% total) and followed by the US (11%). Sustainable funds saw $37 billion of inflows in Q4 2022, the latest data available, and continued to outpace conventional ETFs and mutual funds which saw $200 billion new outflows.

All data, figures & charts are valid as of 20/04/2023