Summary

Dodging the earnings cliff again

Half S&P 500 reported Q1 earnings, and markets breathe sigh of relief. Less-bad results give more time for inflation medicine to work. Help from low expectations, US consumer, better overseas markets. Banks set tone, but with underlying deposit outflows. Big Tech saw return to growth, talks AI, and leverages huge financial flexibility. Staples stoked ‘greedflation’ narrative with price increases. Cyclicals lead growth but set to bear the brunt of a faster GDP slowdown.

Bank and debt fears balance Big Tech profits

Stocks rose to end April in the green. Relief from big tech MSFT, GOOG, META, AMZN earnings offset returning banking sector and debt ceiling fears. Kept safer haven bonds, dollar, gold well supported. Other news saw UK regulators doom the ATVI/MSFT deal, CARR make a $13 billion German renewables buy, and BBBY declare bankruptcy. See 2023 Year Ahead HERE. Video updates, twitter @laidler_ben.

Don’t sweat the dominance of big-tech

Concerns that tech is too big and too expensive are overdone. S&P 500 index concentration not new, dramatic, or unprecedented. See 5 reasons that tech high valuations justified.

Stocks complacent to rising debt ceiling risks

Bond yield and CDS warnings above levels of dramatic 2011 showdown, as default deadline is accelerating. Stocks are at risk with volatility low and liquidity support fading.

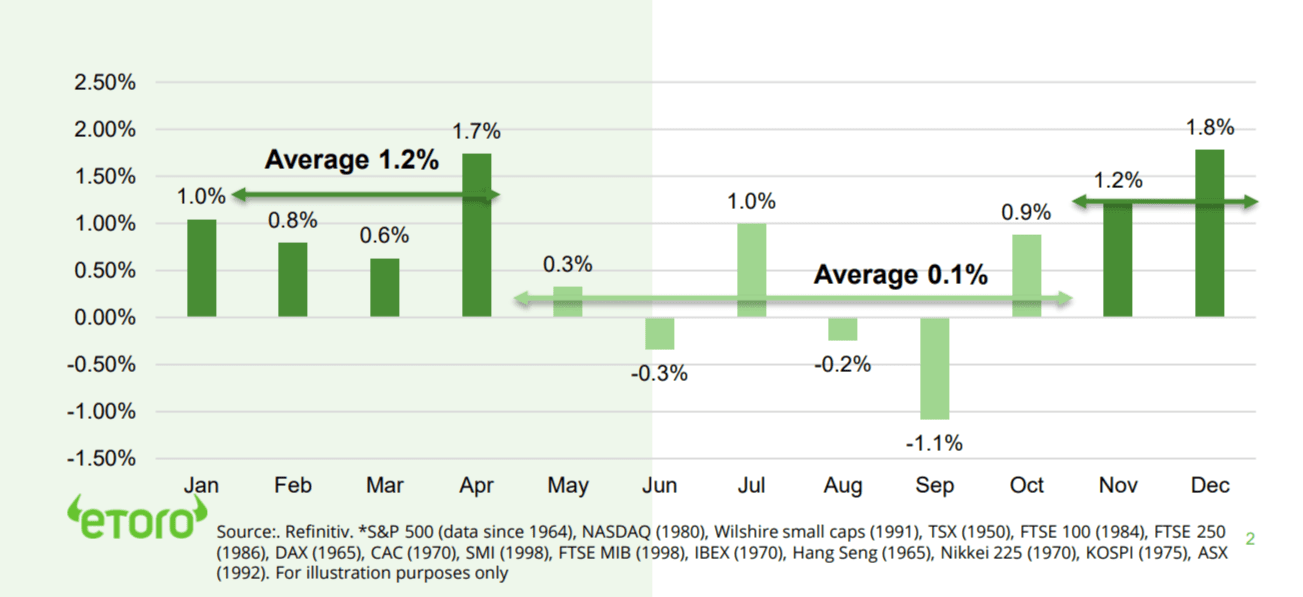

Buckle up for poor seasonality everywhere

Positive fundamental view loses big technical support as May kicks off 6 months of weaker performance. Is global, with average monthly returns falling from 1.2% to 0.1%.

The return of ‘resource nationalism’

Chile’ plan to nationalise lithium industry latest by countries taking more control. See tighter supply and high-for-longer prices.

Bitcoin leads crypto as regulation in focus

BTC rallied back toward $30,000, supported by a rangebound dollar and US 10-yr bond yields, and returning bank sector jitters. STAN published a $100,000 target. Altcoins LINK, AVAX and meme coins DOGE and SHIBxM all lagged. Regulation stayed in focus as COIN sued SEC and Templeton (BEN) CEO welcomed clearer rules.

Commodities hurt by renewed growth fears

US banking and debt ceiling fears restoked commodity demand fears. Brent oil back to $80/bbl. level at time of OPEC+ latest surprise cut. Industrial metals were hurt by lagging China property sector. Sugar set new highs as supply squeeze spread to Brazil. Renewables stocks hit by Republican subsidy cut plan.

The week ahead: Fed and ECB hikes, AAPL Q1

1) Final 0.25% Fed rate hike (Wed) and <200k jobs report. 2) 7th ECB rate hike, to 3.75%, and inflation easing to 6.5%. 3) AAPL (Thu) headline busy Q1 earnings w/ AMD, SBUX, UBER, HSBC, ADS. 4) UK/EU/LatAm labour day holiday (Mon) and start weaker seasonality May.

Our key views: Accelerated macro outlook

Banking fears individual not systemic. But doing Fed’s job for it. Accelerating GDP and inflation slowdown and interest rate peak. See market recovery with bumps in road. Slowdown hurts earnings. Low yields help valuation. Focus cheap and defensive assets, from healthcare to big tech More cautious on cyclicals and banks.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 0.86% | 2.48% | 2.87% |

| SPX500 | 0.87% | 1.46% | 8.59% |

| NASDAQ | 1.28% | 0.04% | 16.82% |

| UK100 | -0.55% | 3.13% | 5.62% |

| GER30 | 0.26% | 1.88% | 14.36% |

| JPN225 | 1.02% | 2.91% | 10.58% |

| HKG50 | -0.90% | -2.48% | 0.57% |

*Data accurate as of 01/05/2023

Market Views

Bank and debt fears balance Big Tech strength

- Stocks rose to end April in green. Relief from big tech MSFT, GOOG, META, AMZN earnings offset returning bank sector and debt ceiling fears. This kept safer haven bonds, the dollar, and gold well supported. Other news saw UK regulators doom the ATVI/MSFT deal, CARR make a $13 billion German renewables buy, and BBBY declare bankruptcy. See our 2023 Year Ahead HERE.

Don’t sweat the dominance of big tech

- Strong Alphabet (GOOG), Microsoft (MSFT), and Meta (META) results stoked concern over big-tech’ dominance of US markets and rally this year. That are too big and too expensive. This is overdone. Big Tech’s index concentration is not new, dramatic, nor unprecedented. And there are many reasons its high valuations are justified.

- Five largest S&P 500 stocks (AAPL, MSFT, AMZN, GOOG, NVDA) totalled over 20% of index since 2019. Vs a chunky 50-year average concentration of 15%. In the 1970’s ‘nifty fifty’ growth stock era it hit 25%. The relative performance gap (see chart) is also still small. @BigTech

Stocks complacent to rising debt ceiling risks

- The US debt ceiling deadline, the ‘X-date’, may be closer than thought. The government’s Fed checking account is drying up, making it more dependent on tax inflows to pay the bills. These inflows are weaker than hoped after the recent annual filing deadline. This could accelerate the X date to as early as June vs an assumed August, and pile more pressure on markets.

- Is being priced into short term bonds and CDS, but stocks complacent. VIX below average, liquidity boost from falling Treasury General Account fading. S&P 500 index fell 15% in 2011 showdown. Volatility would help safer haven long bonds, dollar, gold. In equities favour big-tech and defensives.

Buckle up for poor seasonality

- ‘Sell in May and go away’ is one of the most famous finance adages. This market seasonality is strong and well-supported by the data. It is bigger globally than in US, led by higher beta markets like Italy’s FTSE MIB and small cap FSE 250. Average monthly returns fall from 1.2% to 0.1%. None of 15 indices analyzed did better in next six months than prior.

- This continued seasonality is driven by the calendar of positive Q1 company guidance and Q4 investors year-ahead repositioning versus lower volume summer doldrums. The fundamentals remain more important, but our positive market outlook is losing technical support for next few months.

The return of resource nationalism

- Chile’s plan to nationalize its huge lithium industry, led by SQM and ALB, surprised markets. It shouldn’t have. This ‘resource nationalism’, of more country control of resources, is not new. Is one ingredient for high-for-longer metals prices. And more mining investment to Australia, Canada, US.

- Tightening metals supply side offset to demand led price falls. Resource nationalism combines with under-investment, low ore grades, ESG needs, and investor demand for profit vs growth.

‘Global-15 Markets’* historic average monthly returns

Bitcoin leads crypto as regulation in focus

- Bitcoin (BTC) rallied back towards $30,000, and leading the whole asset class up. Supported by rangebound US dollar and lower 10-year US bond yields. Also as global bank Standard Chartered (STAN) put out a $100,000 objective.

- Bitcoin move came even as altcoins Chainlink (LINK), Avalanche (AVAX), and Dogecoin (DOGE) all saw meaningful price falls.

- Regulation was in focus as Coinbase (COIN) sued the SEC for oversight clarity. Whilst the CEO of top-10 global asset manager Templeton said the asset class would benefit from clearer rules.

Commodities hurt renewed growth fears

- Commodity prices fell on renewed demand growth fears. Driven by US banking sector and debt ceiling concerns. This supported safer haven assets like the US dollar and gold.

- Brent crude fell to $80/bbl., giving back all gains since OPEC+ surprise 1mbpd production cut announcement. Industrial metals eased on concern China’s property recovery is lagging.

- The sugar rally continued over $0.25/lb as supply fears spread from India to no.1 producer Brazil as its ongoing harvest is coming in weak.

- Large renewables stocks, from ENPH to SEDG, fell as US Republicans sought to cut sector subsidies as part of ongoing debt ceiling negotiations.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 2.18% | 5.10% | 21.63% |

| Healthcare | -0.78% | 5.06% | -1.37% |

| C Cyclicals | 0.15% | 4.24% | 13.76% |

| Small Caps | -1.26% | 0.93% | 0.44% |

| Value | -0.11% | 3.97% | -0.61% |

| Bitcoin | 7.16% | 7.50% | 77.63% |

| Ethereum | 2.48% | 6.79% | 58.71% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Fed and ECB hikes, AAPL earnings

- Wednesday could see final interest rate hike from Fed this cycle, with 0.25% rise to 5%, before cuts as soon as Sept. Much depends on labour market with the jobs report (Fri) est. at below 200,000.

- Europe’s ECB set for a 7th hike, by 0.25% to 3.75% (Thu) but likely has a few more hikes to go after. And this been driving the USD/EUR rally. Inflation is key driver and latest est. to fall to 6.5% (Tue).

- A busy earnings week including world’s largest stock AAPL (Thu) with fellow tech AMD, QCOM, and consumer giants PFE, BUD, SBUX, UBER and Europe’ HSBC, SHEL, NVO, ADS, and ORSTED.

- Markets closed Monday for Labour Day in UK, most Europe, and LatAm. Start of May and typical six months of weaker average market seasonality. Milken Global Conference runs until May 3rd.

Our key views: An accelerated macro outlook

- Banking sector fears are likely individual not systemic. Bank buffers are bigger now and the authorities response stronger. But this is doing the Fed’s job for it. By accelerating the GDP and inflation slowdown and the interest rate peak.

- See a V-shaped market recovery with plenty bumps in road. Faster slowdown hurts earnings. But lower bond yields helps valuation. Focus on cheaper and more recession defensive assets, from healthcare to derated big tech. More cautious on assets most exposed to recession risk, like cyclicals, small caps, and commodities. Or lower yields, like banks.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -1.20% | -1.13% | -7.53% |

| Brent Oil | -1.82% | 0.41% | -6.66% |

| Gold Spot | 0.26% | 0.61% | 9.24% |

| DXY USD | -0.15% | -0.81% | -1.79% |

| EUR/USD | 0.25% | 1.62% | 2.95% |

| US 10Yr Yld | -15.46 | -4.94 | -45.75 |

| VIX Vol. | -5.90% | -15.61% | -27.18% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point

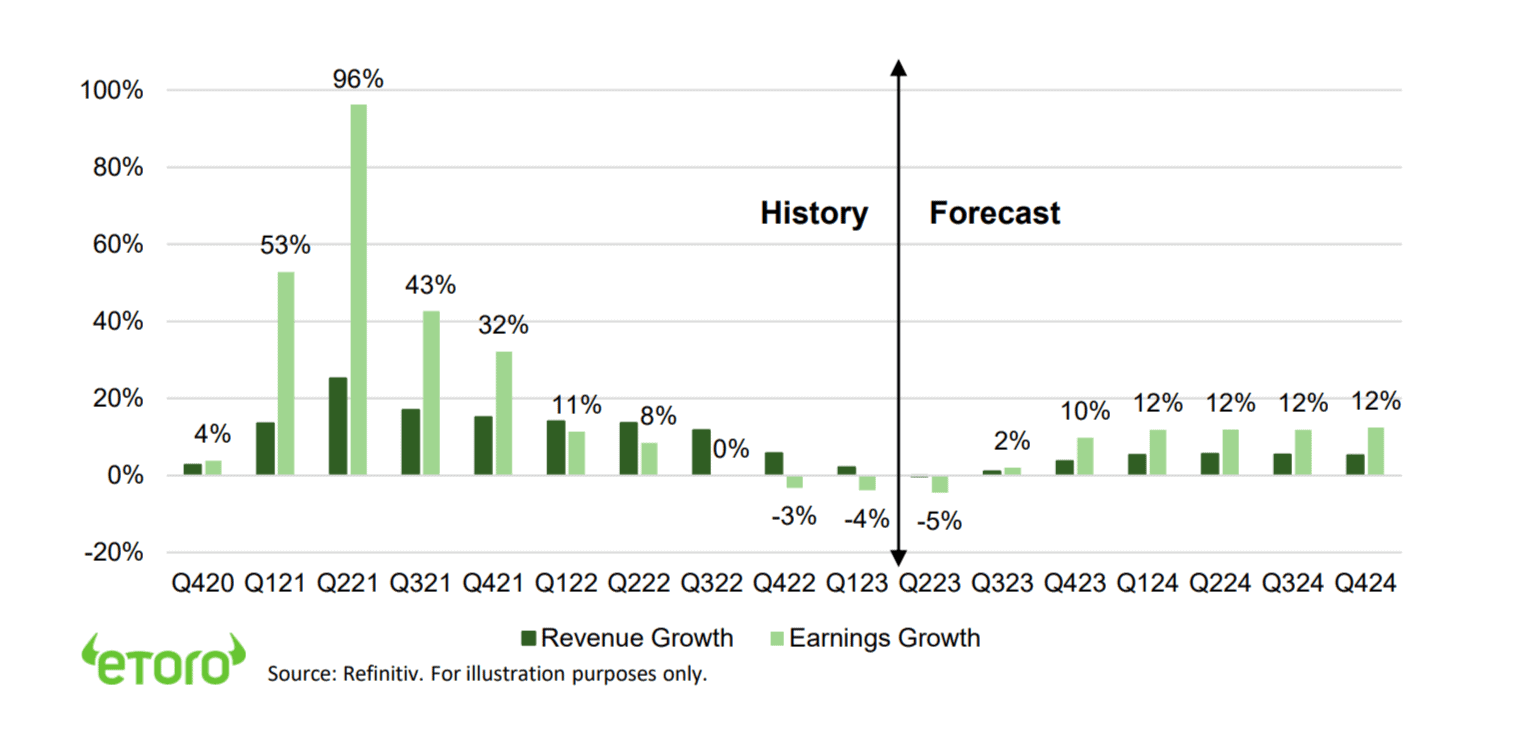

Focus of Week: Anatomy of Q1 earnings relief

Investors dodge the earnings cliff again in Q1, giving more time for the inflation medicine to work

Halfway through US earnings season and investors are breathing a collective sigh of relief. Companies have again dodged the long-feared profits cliff. The quick forecast return to profits growth (see chart) is likely optimistic. But another resilient quarter buys markets time for the peak of interest rates, lower inflation, and rate cuts to come. This will all support high valuations even as earnings ease further.

Profits helped by low expectations, a US consumer rebound, and better overseas markets

Q1 is helped by low expectations, a 3.7% US consumer spend surge, and better overseas macro. Revenue growth is positive and profit margins over 11%. Over 75% S&P 500 stocks and all sectors beaten forecasts. S&P 500 earnings estimates are now rising. Europe is off to a slower start but leads US profits growth.

Banks set the results tone, but underlying worries remain with deposit outflows to slow lending

Big banks market leading revenue growth was driven by higher net interest margins. But the impact of March’s ‘scare’ remains with deposit outflows and tighter lending for all. Even titan JP Morgan (JPM) saw flat QoQ loans and 3% lower deposits. Whilst problems remained at First Republic (FRC). Deposit competition will be heightened as Apple (AAPL) launches a 4.1% savings account with partner Goldman Sachs (GS).

Big Tech sees a return to growth, talks AI growth, and leverages its huge financial flexibility

Big tech beat low expectations, talked up AI, and leaned on financial strength. Share price rebounds show investors bearish. Microsoft (MSFT) led focus on AI’s growth potential. Meta (META) latest to see advertising recovery. Alphabet (GOOG) announced huge $70 bn share buyback. Tesla (TSLA) a rare profits miss, cutting prices and margins to boost volume. Apple (AAPL) the next focus, facing post-pandemic demand hangover.

Consumer Staples stoke the broader ‘greedflation’ narrative with double digit price increases

Staples benefited from higher prices and resilient volumes, which is feeding a broader ‘greedflation’ backlash. Coke (KO) saw a 11% rise in prices and 3% in volumes in a trend seen from Unilever (ULVR) to P&G (PG). Also in airlines, with American (AAL) latest to report strong demand despite soaring ticket prices.

Cyclicals lead profits growth higher but are set to bear the brunt of a faster GDP slowdown

Discretionary, industrials, small cap led Q1 profits growth. Boeing (BA) and Caterpillar (CAT) profits resilient. Homebuilders rallied with some sector relief. Small cap (S&P 600) profits are +20%. But Bed Bath & Beyond’ (BBBY) bankruptcy revived retail apocalypse fears. Renewables hurt by Republican debt ceiling subsidy cut.

S&P 500 YoY revenue and earnings growth rates (%)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle, stubborn inflation, and now financial sector concerns, is accelerating our 2023 view. Of a quicker GDP slowdown, lower inflation, and a peaking Fed interest rate cycle. Will pressure earnings further but also lower bond yields and take pressure off de-rated valuations. We are invested, believing Oct 2022 was the low, and focus on cheap and defensive assets for a faster ‘V-shaped’ market recovery. See our Q2 Outlook HERE |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the market rout, and now at average levels, and are supported high company profitability and near peak bond yields. Focus on cash-flows defensives, like healthcare and high dividend. Big-tech supported by defensive growth. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and tech/small cap/crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices amd reopening China with high ‘buffers’ of rising fiscal spending (defence and refugees) and weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by lack of big tech sector and 30% cheaper valuations vs US. Banks better capitalised and regulated but loans/GDP much higher. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. Broader EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, if global growth resilient and bond yields risen. Japanese equities among worlds cheapest but threatened by tightening monetary policy and stronger Yen with rising inflation and new BoJ governor. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Hurt by higher bond yields and above average valuations. But structural stories with good growth, high margins, fortress balance sheets support some. ‘Big-tech’ attractive new recession defensives. ‘Disruptive’ tech is much more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors – like discretionary (autos, apparel, restaurants), industrials, energy, materials, and small caps – have cheap valuations, many with depressed earnings, and have been out-of-favour for many years. But they are significantly exposed to rising recession risks. Some especially cheap (energy) or see growth recovery (airlines). |

| Financials | Current stresses likely individual not systemic. Post GFC reforms boosted capital and size/speed of authorities response. But outlook for 1) less GDP growth, 2) lower bond yields and interest rates, and 3) valuation sensitivity after recent surprises, worsens outlook. Insurance and Diversifieds (like Berkshire Hatheway) more defensive. |

| Themes | Dividends and buyback themes attractive with resilient cash flows, rising pay-outs, and investor search for defensives. Power of compounding dividends under-estimated, at up to 1/2 of total long term return. Small caps pressured by rising recession risk. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has wide spread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attrative cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+ supply and Russia 10% world oil supply problems. But commodities not to repeat their 2022 performance leadership. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.