RELOOK: High dividend yield stocks (HDV) have been this year’s big investment style losers, underperforming the S&P 500 (SPY) by 20 points. With unprecedented competition from the Fed’s 5.50% risk-free interest rate driving a $1 trillion ‘dash-for-cash’. They are now worth a new look with global central banks at the top of the interest rate cycle, and cuts coming onto the horizon. At the same time as the economic slowdown builds, potentially driving interest in more defensive strategies. Longer term, dividends have been a strong inflation hedge, and reinvested dividends made up an overwhelming 58% of average total market returns in the past 20 years.

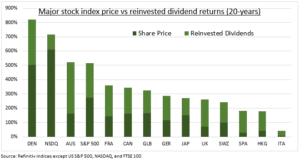

DIVIDENDS: Global listed companies paid a whopping $1.6 trillion in dividends to shareholders last year, up 8% on the prior year. Banks and consumer sectors are the biggest paying sectors globally, at 27% and 17% respectively. With the world’s biggest dividend payers ranging from Nestle (NESN.S) to HSBC (HSBC.L) and Mercedes (MBGn.DE). Reinvested dividends make up a whopping 48% of long term global stock market returns. Global stocks are up 170% the past 20 years (see chart), but a near double 320% if dividends are reinvested. The average of major markets is an even higher 58%. This reflects the relative low levels of dividends in buyback and tech-centric US markets. Dividends are 47% of S&P 500 total return and 15% for the NASDAQ.

INFLATION: Dividends also provided a great long term inflation hedge. Consumer prices are up 63% in the US and UK in the past 20 years. Whilst the average S&P 500 dividend payer has raised its dividend per share an inflation beating 84%. Similarly in the UK FTSE 350 the average increase has been 77%. United Health (UNH) led in the US with a near eight-fold increase, and building group Ashtead (AHT.L) in UK with a 14x surge. Among the small minority to have cut are US and UK banks and household names from Disney (DIS) to Marks & Spencer (MKS.L).