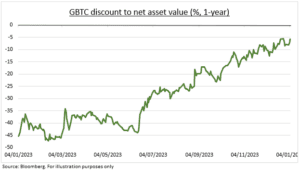

SPOT ETF: The SEC’s long-awaited decision on a spot bitcoin exchange traded fund (ETF) is imminent. Investor expectations are justifiably high, proxied by the dramatic narrowing of the Grayscale Bitcoin Trust (GBTC) discount to net asset value (see chart), and after the SEC’s stepped-up engagement so far. This suggests downside to a disappointing result, and some may be tempted to even ‘sell the news’ on a positive outcome. But this overlooks the long list of coming crypto asset catalysts, from the Bitcoin halving to regulatory changes. Any one of which is significant for such a small ($1.6 trillion), young (16 years), and retail-dominated asset class.

EXPECTATIONS: Crypto was by far the best performing asset class of 2023. Partly on hopes the SEC would approve spot ETF applications, from Blackrock (BLK) to Fidelity. This would see Bitcoin ETF’s join the $7.5 trillion of assets currently in over 3,000 ETFs in the US alone, and boost investor access to the asset class. Bitcoin outperformed Ethereum (ETH) in anticipation, taking its asset-class ‘dominance’ to 50%. Sentiment is high, proxied by the Grayscale Bitcoin Trust (GBTC). It holds 3% of outstanding Bitcoin and plans to convert to an ETF after a positive SEC decision. Its share price discount to its net-asset-value has already narrowed dramatically.

OUTLOOK: Regardless of this SEC decision, we are constructive. Spot ETFs are likely coming sooner rather than later, given the progress made so far. Ethereum spot ETFs are coming behind BTC, supporting some catch up performance. Whilst other catalysts lie ahead. From April’s Bitcoin ‘halving’ to mid-year Fed interest rate cuts, year-end accounting and regulatory changes making it easier for US companies and global banks to hold crypto, and an eventual central bank deciding to hold Bitcoin. Any would be significant in the context of the asset class. This outweighs the up to $10 billion coming liquidations from Mt. Gox and FTX creditors in 2024.

All data, figures & charts are valid as of 08/01/2024.