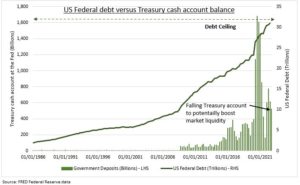

CEILING: The US hit its $31.4 trillion debt ceiling last week. There are ‘extraordinary measures’ that buy time until the summer. But the limit needs to be raised for the US to pay its debts. This has happened 68 times since the 1960’s. But a divided Congress has many worried on political brinkmanship and miscalculation. Republicans control the House by 3 seats and Democrats the Senate by 1. A deal will see spending cuts to reign in the 5% of GDP fiscal deficit. And to slow increases in the US’s 120% debt/GDP. This is double Germany but half of Japan’s. The fear is a repeat of 2011’s showdown that hit the markets and risked the $24 trillion US treasury securities market. But there are also silver linings, of more liquidity now and of lower bond yields ahead.

RISK: August 2011 was the closest the US has ever come to not raising, or suspending, the ceiling. A deal was not reached until the day the government was due to run out of funds, risking an unprecedented default. This extraordinary political brinkmanship saw the S&P 500 fall 15%, economic policy uncertainty soar, and short-term Treasury yields and credit spreads spike. It came against the backdrop of a slowing economy and Eurozone crisis uncertainty. This led S&P to downgrade the US AAA debt rating and to the Budget Control Act sharply cutting fiscal deficit.

BENEFIT: There may be unintended consequences of a showdown. Not all negative. The US Treasury’s ‘extraordinary measures’ will see them slash their de-facto checking account held at the Fed (see chart). This will see over $200 billion of liquidity pushed into the financial system in the next few months, potentially helping markets. Similarly, not all assets suffered in the 2011 stand-off. Long term US bond yields fell 65 bps around the impasse, seeing a strong safe haven bid, and their prices rallied 10% over the summer. Lower yields would help equity valuations.

All data, figures & charts are valid as of 23/01/2023