CHANGED TIMES: Time was when countries cut interest rates to weaken currencies and steal a growth march on others. This has now flipped. The 20% stronger US dollar DXY index this year is driving global FX weakness and stoking inflation fears. This is forcing many to hike interest rates, or intervene, to defend currencies. From Japan’s direct buys to China’s indirect curbs and UK’s verbal intervention. But the intervention record is poor, and only slows the dollar wrecking ball. More needs lower risk aversion and clarity on end of the Fed hiking cycle. Until then the dollar will keep pressuring many, like the GBP and EUR, with only a few beneficiaries.

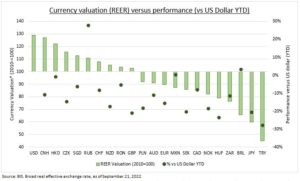

US DOLLAR: The dollar has already surged, is very expensive, and markets pricing a January end to the Fed’s big hiking cycle. But the large rate rises until then and high investor risk aversion is keeping the greenback the asset of choice meantime. Whilst trends on the other side of many currency pairs are poor. With rising recession risks, heavily negative real interest rates, and tensions with rising fiscal spending. Policy makers may verbally tap the brakes on the dollar at the Oct. 12th G20 ministers meeting. But this would only be temporary relief until fundamental drivers ease. Meantime many valuations, like the GBP and EUR, are still not cheap (see chart).

VICIOUS CIRCLE: The negative impacts of dollar strength are well-documented. Driving higher local inflation, especially in those like the UK with a large share of imported goods. By tightening financial conditions, led by those emerging markets with lots of US dollar debt. And by cutting US earnings growth around 5%, focused on its globalized tech sector. But there are winners. With lower commodity prices, a local exporter competitiveness boost, and lower US inflation.

All data, figures & charts are valid as of 27/09/2022