CONSUMER: The consumer has been the biggest single driver of the US economic surprise this year. Personal consumption is 68% of the economy and the latest pick up in retail sales helped boost the Atlanta Fed GDP NOWCast to 5.8%, a 40-year high if realised. Near record low unemployment, wage growth ahead of inflation, and a housing and stock market ‘wealth effect’ has offset higher interest rates, declining pandemic savings, rising gas prices, and the looming student loan restart. But these headwinds are building, and the consumer has changed. Now more focused on smaller luxuries, restaurants, online, groceries, and trading down. More cautious on bigger ticket items or those over-consumed in the pandemic. Back-to school and college spending, that rivals Christmas in size, may give a big last hurrah. See @ShoppingCart.

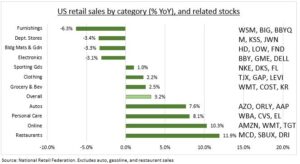

WINNERS/LOSERS: July retail sales by category painted a clear picture of how consumer spending has been changing, with signposts to the stocks most focused on those sectors (see chart). Categories growing above average included autos, health and personal care, online, and restaurants. Online is now 16.9% of retail sales, doubling in a decade. Whilst restaurant spend (‘eating out’) just overhauled grocery (‘eating in) as a proportion of sales for the first time. Categories growing less include furnishings, department stores, home improvement, and sporting goods. All bigger ticket, credit dependent items or those over-consumed in pandemic.

BACK TO: Back-to-School and to-College rivals Christmas as the biggest spending event of the year. Its est. at a combined $135 billion, up by a huge 22% vs last year. School spending is seen at $890/household and College at $1,370. This usually focuses on bigger ticket consumer electronics and furnishing items that have been struggling since the pandemic boom. This could be a welcome boost from HP (HP) to Dell (DELL). See our related back-to-school BIC interview.

All data, figures & charts are valid as of 21/08/2023.