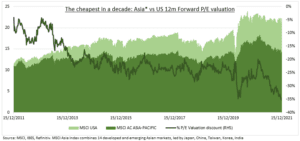

A BETTER 2022: Asian markets were disappointing this year. With a slowing and more interventionist China and Asia’s low-tolerance covid strategies. This sets up for a better 2022. The valuation gap vs the US is a record 35% (see chart), and with much room to re-open economies. It’s a diverse region, with 14 main markets and 4.5 billion people. India was world’s 2nd best performer, up 25% this year and leading China by record 45%.

CHINA: The world’s no.1 manufacturer enters 2022 with reset expectations on its GDP and property slowdown, and tech regulation. Valuations are now cheaper and authorities flexing policy flexibility, just as peers elsewhere start tightening. The world’s 2nd largest equity market is under-owned and a source of significant alpha generation. It’s tech leadership from AI to EV’s is driven by 50% more patent applications than the no.2 (US).

JAPAN & TECH: Korea/Taiwan dominate global tech supply chains. They are cheap and will benefit from a stabilizing China and a robust, but ageing, tech cycle. Japan is the world’s ‘forgotten market’, but still it’s 3rd largest. The economy is struggling but it’s globally competitive corporates benefiting from strong global growth and a weak Yen.

EXPOSURE: Asia’s potential remains huge. Exposure is possible via ETFs (AAXJ) or smart portfolio @AsiaDragons. Thematic exposure via @ChinaTech and @ChinaCar. China is now more focused on local or Hong Kong markets after crackdown on ADRs.

All data, figures & charts are valid as of 20/12/2021