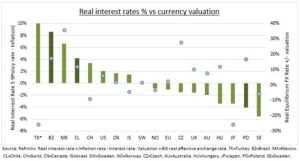

CUTS: The global interest rate cycle has begun to turn and the rate cut countdown clock started. This has big implications for currency markets, with some more vulnerable than others to falling interest rate support, and as the strong US dollar piles pressure on all. The LatAm rate cuts have come alongside continued and reassuring currency resilience, offsetting their high valuations, as their real interest rates remain high (see chart). The US (DXY) and Canada (CAD) are likely the first bigger banks to cut next year and will take comfort from this. Whilst Poland’s overly ambitious rate cut, the first in Europe, shows the risks, with the Zloty overvalued and real rates very negative. This will be a concern for other low-yielding European currencies.

REACTIONS: LatAm has been the vanguard of rate cuts, having hiked earliest and hardest. The Real (BRL) has held onto most of its world-beating gains. Whilst Chile’s Peso (CLP) weakened, likely more driven by the weak outlook for its no.1 trading partner, China. Whilst the Zloty (PLN) plunged after the central banks big rate cut surprise ahead of the October 15th general election. This seemingly political cut has forced the government to verbally intervene. China’s RMB suffered from the drip-feed of policy stimulus interest rate cuts but has support from capital controls and world’s largest FX reserves. Japan (JPY) and Turkey (TRY) remain the FX world’s valuation outliers and the most sensitive to inflation and interest rate outlooks.

DATA: Interest rates above inflation should put these economies in a good position to attract capital, supporting their economies and currencies. Turkey, Brazil, and Mexico have among the world’s highest real rates. Sweden, Poland, and Japan are among most negative. We compare vs Bank for International Settlements (BIS) estimates of inflation adjusted valuations. Mexico’s Peso (MXN) and Czech Koruna (CZK) are over-valuation outliers. Japan and Turkey cheapest.

All data, figures & charts are valid as of 14/09/2023.