CATALYSTS: Bitcoin (BTC) briefly spiked 10% yesterday on report a spot bitcoin ETF had been approved. This was premature but illustrates the sensitivity of the asset class to any good news. And should give investors heart with the long list of potential catalysts coming. From the SEC’s January 2024 spot bitcoin ETF deadline to March’s ‘halving’, new global banking and US corporate accounting regs implementation making it easier to own crypto, to a potential first central bank holding bitcoin in reserves. It’s by far the smallest, youngest, and most retail-owned of all asset classes, and disproportionately sensitive to any sign of market development. It has held onto its asset-class leading gains this year, but volumes, volatility, and correlations have all plunged, even as its global adoption continues and the uneven regulatory backdrop develops.

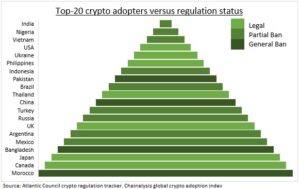

ADOPTION: Crypto remains very popular with retail investors. Our global survey shows it’s the most popular of all assets for the fourth quarter, ahead of cash and stocks, and average holder has a chunky 21% allocation. The latest crypto adoption index shows ownership recovering off the lows of Q4 last year, of the FTX debacle and crypto’s latest performance ‘winter’. The index ranks the top five crypto adopters as India, Nigeria, Vietnam, the USA, and Ukraine. Countries where crypto is banned still rank highly, like Pakistan (#8), China (#11), and Morocco (#20).

REGULATION: A global crypto regulation study of sixty major economies shows crypto legal in over half (see chart), partially banned in 32, and banned in 8 led by China and Saudi Arabia. Two-thirds are in the process of making big changes to their regulations, with the regulatory pace accelerating. With the EU’s MiCA regulations entered into force in June to the clarifying of SEC and CFTC authorities in the US. Many have regulatory ‘sandboxes’ to experiment, even as consumer protection rules seem to be lagging. By contrast near all countries have CBDC tests.

All data, figures & charts are valid as of 16/10/2023.