OUTLOOK: The January 10th spot Bitcoin ETF approval by the US SEC, after a decade-long wait, drove a dramatic round-trip in the Bitcoin price. Soaring by over 50% in anticipation of the decision, before selling off below $40,000 after the news. And now regaining some ground as underlying Bitcoin ETF inflows have built, with their holdings already proportionately much larger than for gold ETFs. And attention now switching to three other looming catalysts. With the fourth Bitcoin halving, a first Fed interest rate cut, and potential Ethereum spot ETF approval. All are potentially significant for what is the smallest, youngest, and most retail-dominated asset class.

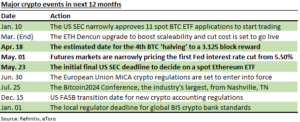

CATALYSTS: The three events to watch in the short term are 1) Bitcoin’s fourth halving, after 2012, 2016, and 2020. That will enhance its scarcity by cutting miners’ block reward to 3.125, halving supply growth. It’s set for mid-April with total supply fixed at 21 million and 93% already circulating. 2) Fed interest rate cuts, with odds of the first cut at the May 1st meeting from 5.50%. With lower rates both boosting global liquidity, at the same time as lowering the competition of risk-free assets with no-yielding Bitcoin. 3) Initial SEC final deadline to approve a spot Ethereum ETF. Though chances are somewhat lower for ETH than for BTC after its narrow 3-2 approval.

HANGOVER: January’s SEC approval of eleven spot BTC ETFs saw investors rebalance away from the huge $20 billion Grayscale Bitcoin Trust (GBTC) to cheaper ETFs. And profit-taking after its big discount to NAV disappeared. The iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin (FBTC) are in a two-horse inflows race and closing on $3 billion of assets each. This pace puts them among the top ten asset-gatherers, behind US stock giants like IVV, VOO, and QQQ. It’s also more than double the start seen by the SPDR Gold Shares (GLD) ETF after its 2004 launch. They already own c.4% of all Bitcoin, making proportionately larger the gold ETFs.

All data, figures & charts are valid as of 06/02/2024.