In the summer of 2024, Crowdstrike made the headlines but not for the reasons investors would expect or hope. While many looked forward to starting their well-earned holidays, a major IT disruption got the planes stuck on land & many businesses froze. The reason? A routine software update which rapidly escalated into a global digital crisis. Which software? You guessed it right! CrowdStrike’s Falcon sensor program.

source: IT outage – photo from Wikipedia

Has the company collapsed after the incident? Not really. Today, its stock listed on NASDAQ trades around an all-time high.

Is there a justification for the performance of the stock?

Let’s dive in & explore! 🔍

What is CrowdStrike?

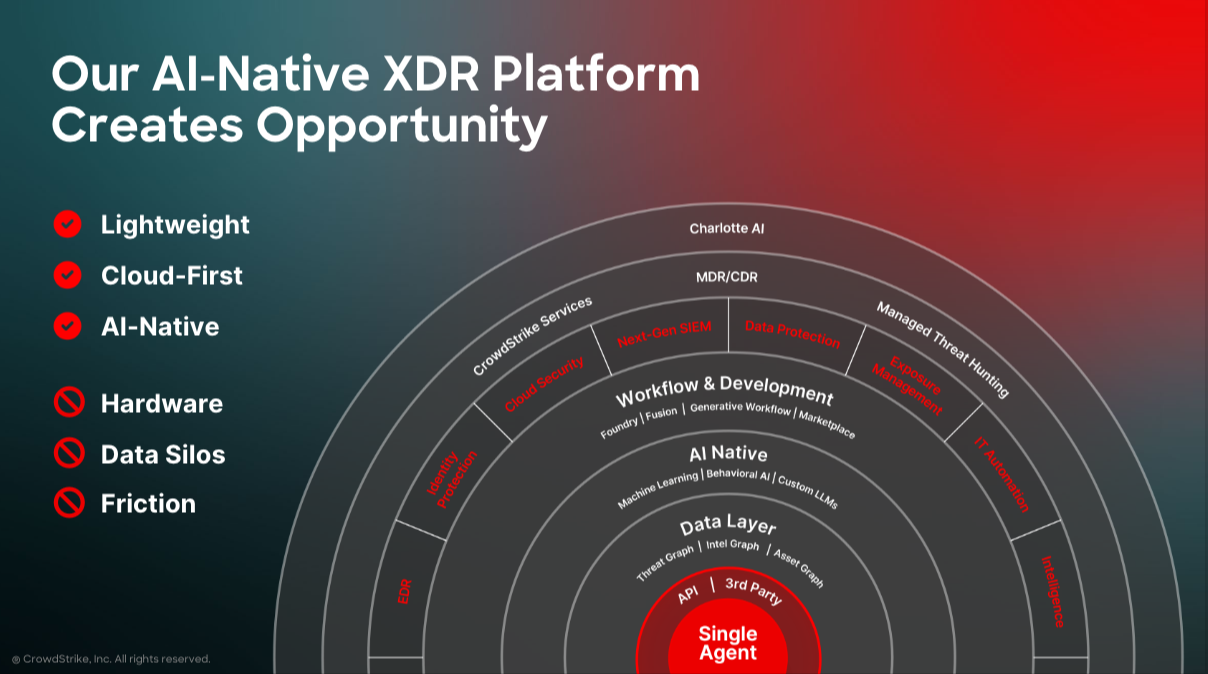

CrowdStrike Holdings, Inc. is an American cybersecurity technology company headquartered in Sunnyvale, California, and was founded in 2011. Renowned for its innovative approach to cybersecurity, CrowdStrike specializes in cloud-native endpoint protection, threat intelligence, and proactive incident response services. The company is best known for its Falcon platform, which leverages artificial intelligence to detect and prevent cyber threats in realtime. As a leading provider of cloud-delivered endpoint protection, CrowdStrike’s recent earnings report and financial metrics highlight its strong market position and future growth potential.

source: CrowdStrike company presentation

Financial Performance

CrowdStrike’s fiscal year runs from February 1 to January 31 of the following year. For example, the fiscal year 2024 ended on January 31, 2024.

According to NASDAQ, CrowdStrike is estimated to report next earnings on 03/04/2025. So we will dive into the last report.

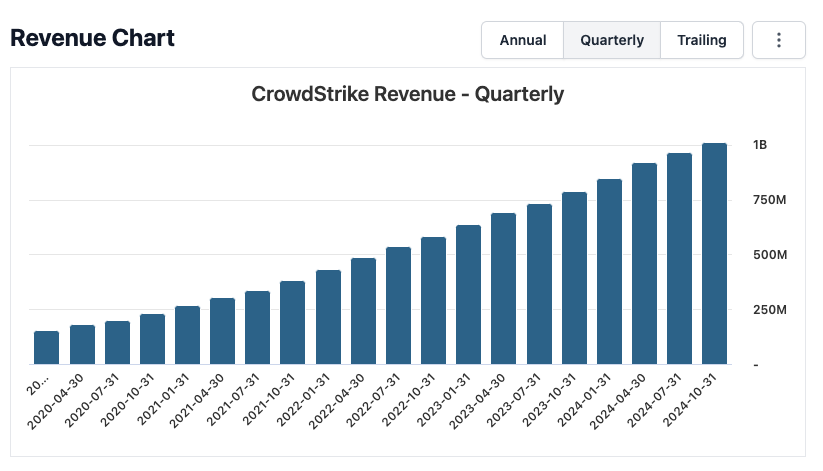

CrowdStrike’s financial performance in the third quarter of fiscal year 2025 caught the eyes of investors, as it showcased significant growth and operational efficiency. Here are some key highlights from the latest earnings call and financial reports:

- Revenue Growth: CrowdStrike achieved a milestone by surpassing $1 billion in quarterly revenue for the first time, marking a 28.5% year-over-year growth. The company’s total revenue for the twelve months ending October 31, 2025, was $3.74 billion, reflecting a 31.4% growth rate.

- Annual Recurring Revenue (ARR): The company reported an ARR exceeding $4 billion, growing 27% year-over-year, making it the fastest pure-play cybersecurity software company to reach this milestone.

- Free Cash Flow: CrowdStrike generated $231 million in free cash flow, representing 23% of its revenue, and achieved a Rule of 51 on a free cash flow basis.

- EPS: The earnings per share (EPS) for the quarter ending October 31, 2025, was reported at -$0.07. However, for the twelve months ending the same date, the EPS was $0.52, indicating a positive trend in profitability.

source: CrowdStrike revenue growth by stockanalysis.com

Valuation Metrics

CrowdStrike’s valuation metrics provide insights into its market perception and growth expectations:

- Forward P/E Ratio: according to GuruFocus, CrowdStrike’s forward P/E ratio was 95.99 (as of Feb. 08, 2025), reflecting high growth expectations from investors.

- Price to Sales Ratio: The company’s price to sales ratio stood at 26.8 for the quarter ending October 31, 2025, indicating a premium valuation in line with its growth prospects.

A forward P/E ratio above 90 is extremely high but not uncommon. According to GuruFocus, the highest $Meta traded in the past 13 years was at 108.4.

Interestingly, based on various metrics including company and industry growth, Simply Wall Street states that CrowdStrike is traded at 16.9% below their estimated fair value. SeekingAlpha also describes the company as a high quality one in a growing industry.

While these figures look staggering for value investors who are hunting undervalued businesses, growth investors are not shying away from the company!

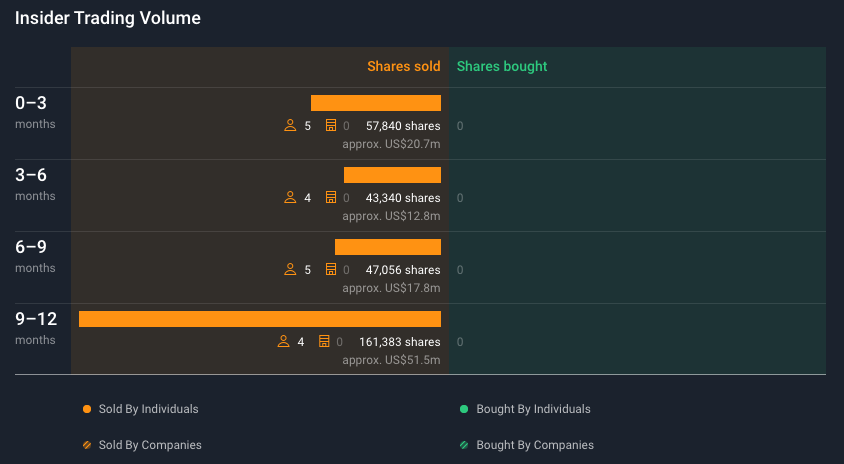

A look at insider trading

In the past six months, insider trading at CrowdStrike Holdings, Inc. has been quite dynamic, reflecting strategic decisions by key stakeholders. Notably, George R. Kurtz, the Founder, CEO, and Director, sold 1.1 million shares, reducing his holdings by 14.5%. According to him, last sales “were made to cover tax withholdings due on vesting of restricted stock unit awards, as required under the Issuer’s administrative policies”.

source: CrowdStrike insider trading volume by Simply Wall St.

While it’s essential to consider the broader context of insider trading activities (there could be many reasons for insiders to sell independent of the company performance), it is worth keeping an eye on such developments. As a general rule, seeing insiders selling at a significantly higher price than market price or significantly buying stocks can be seen as positive signs. On the other hand, when we see multiple insiders selling big chunks of their stocks, especially if under market price, then we should quickly investigate as an investor. This is a potential red flag!

Future Prospects

CrowdStrike’s future looks promising, driven by its innovative platform and strategic initiatives:

- Falcon Flex Model: The Falcon Flex subscription model is enhancing platform adoption, increasing both the share of wallet and enterprise real estate. This model is expected to drive faster and larger ARR uplift over time.

- Product Innovation: CrowdStrike continues to lead in innovation across cloud security, identity protection, and next-gen SIEM, disrupting legacy markets and creating new categories.

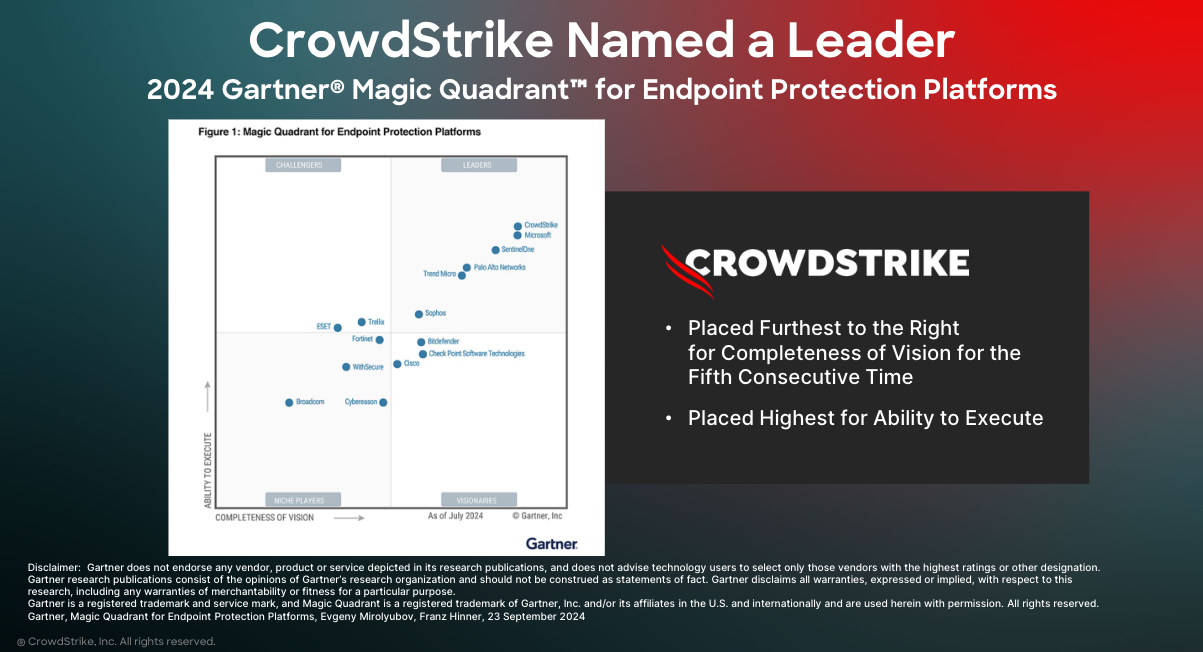

- CrowdStrike was named leader for 5 times in a row in the Endpoint Protection Platforms by Gartner, ahead of Microsoft.

- Strategic Acquisitions: The acquisition of Adaptive Shield adds SaaS posture management to CrowdStrike’s portfolio, further strengthening its market position.

- Long-term Goals: CrowdStrike remains committed to achieving $10 billion in ending ARR by the end of fiscal year 2031 and its target non-GAAP operating model by fiscal year 2029.

source: CrowdStrike company presentation

Conclusion

CrowdStrike Holdings, Inc. stands out as a leading player in the cybersecurity landscape, with its strong financial performance, innovative solutions, and strategic growth initiatives. While the company’s premium valuation reflects high investor expectations, its robust growth trajectory and market leadership position it well for continued success in the evolving cybersecurity market.

The stock is a reasonable one to hold in a portfolio for investors interested in investing in growth, innovation and technology. With such a high forward P/E you may however brace yourself for potential high volatility and possible dips along the way.

Whether you decide to invest in the stock or not, cyber security should be a top priority for everyone. And us, users, shall be the first line of defense against attackers. So if you read this and think of your ‘qwerty’ or birthday date password, you may want to change it now and add a two-factor authentication. 😉

Sources:

- CrowdStrike earning call: https://ir.crowdstrike.com/events/event-details/crowdstrike-fiscal-third-quarter-2025-results-conference-call

- Simply Wall Street:https://simplywall.st/stocks/us/software/nasdaq-crwd/crowdstrike-holdings

- SeekingAlpha: https://seekingalpha.com/article/4755936-crowdstrike-high-quality-company-in-a-growing-industry?

- GuruFocus CROWD P/E: https://www.gurufocus.com/term/forward-pe-ratio/CRWD

- GuruFocus Meta P/E: https://www.gurufocus.com/term/pe-ratio/META#

- Stockanalysis: https://stockanalysis.com/stocks/crwd/revenue/

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.