Introduction

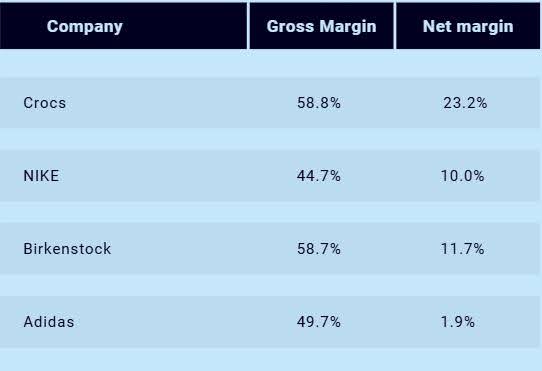

Crocs ($CROX) is a global leader in casual footwear. The company owns the brands Crocs and Heydude, which it recently acquired. Its management has made Crocs the most profitable company in the industry, even ahead of companies like Nike or Adidas. Despite this, the market still doesn’t like the acquisition of Heydude, which, in my opinion, will lead to higher growth and a more diversified offering of products.

Source: Finchat, Author Analysis

Key highlights

- Best-in-class business valued as a bad business

- Good capital allocation and good management

- Heydude, the big issue of the company?

Business Model Overview

Crocs’ business model is simple: They sell sandals and shoes, taking care of the design, development, distribution, and marketing of those shoes. As stated before, the company owns two different brands: Crocs, which accounts for 80% of the company’s revenue, and Heydude, which accounts for the other 20%.

Regarding the Crocs brand, its revenue comes mainly from the US (56%), although the international segment of the company is growing larger. Heydude has most of its revenue coming from the US.

Detailed Investment Thesis

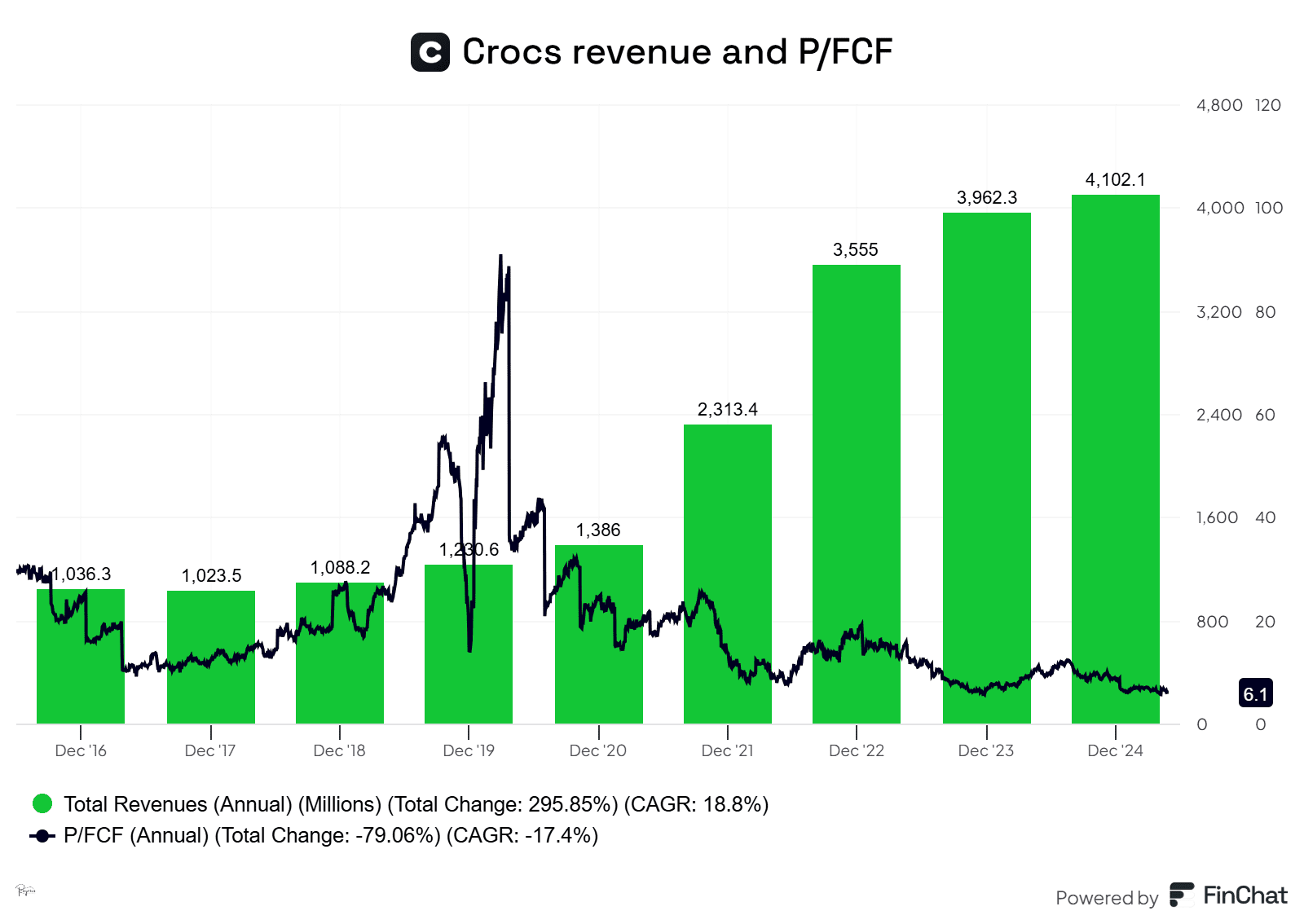

Crocs is currently trading at 6 times earnings. With high Free Cash Flow conversion and a solid return on invested capital (ROIC), the market is discounting the company’s revenue to fall and its margins to decrease. However, even if that’s the case for its US business, the company is pushing its international expansion, making room for more growth. In fact, the company has steadily been growing its revenue by double digits during the past.

Source: Finchat

The company has guided for 2025 that Crocs brand is going to grow about 6%, while Heydude is going to keep shrinking its revenue by 7% to 9%. As an aggregate, that means that the whole company is going to grow its revenue by about 3%. Thus, the current valuation is ridiculous since it is considering that the whole business is going to shrink.

In the meantime, the company has approved $1.3B buybacks, which means that the company can buy 20% of its market cap today under the current authorization while paying down debt.

Approaching the valuation conservatively, we can value Crocs as a slow grower, with revenue growth of about 3%-4% for the future. Regarding Heydude, the company has pushed too much of its sale and is now focusing on a turnaround. The question is, can they do it?

The management of the company has stated that it’s following Crocs’ turnaround manual. They’re applying the same measures they took when Crocs’ revenue fell from 2015 to 2017. In my opinion, this turnaround can generate headwinds in the short term, but from 2026 on, it should be completed and should add some top-line growth to the company.

Thus, I assume that this year’s EPS of 15$ per share is sustainable since Crocs’ growth should offset Heydude’s decline. Applying a conservative PE multiple of 12 times, much lower than its competitors and below the average of the US stock market, the company’s stock should double its price.

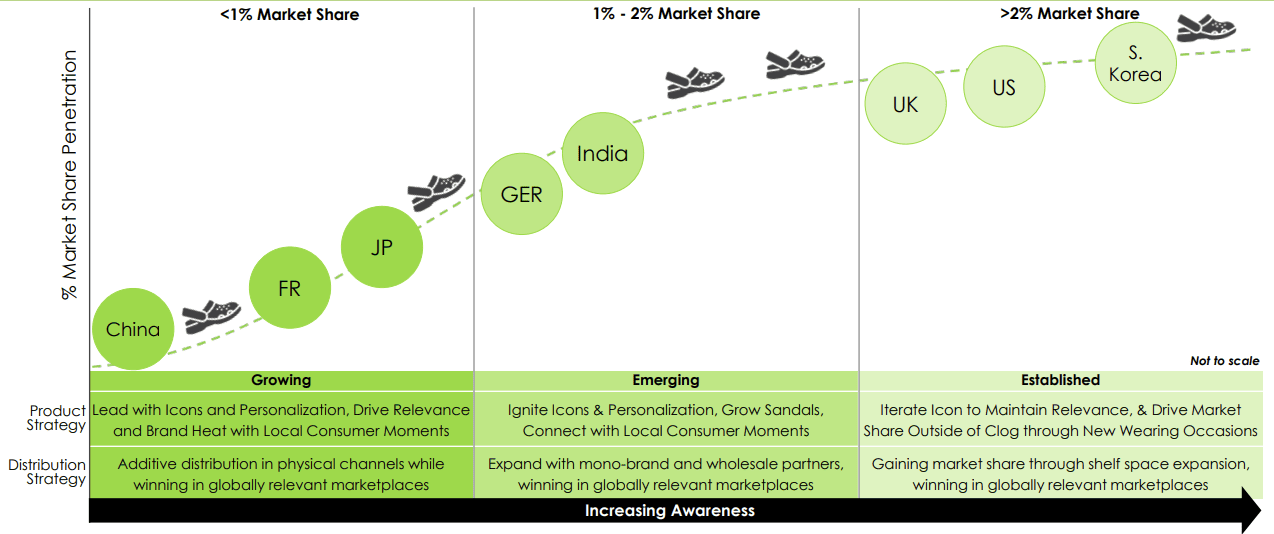

Still, with this valuation, we leave aside any growth that Heydude can potentially generate in the future, as well as any growth of Crocs brand beyond 3%. However, I consider this scenario very pessimistic since Crocs’ international expansion is targeting big economies, like China and Japan, in which the company has low penetration of its products.

Source: Company’s Q4 Earnings Presentation

Catalyst

- The company has a current buyback program of $1.3B, ready to deploy in 2025. It could potentially buy over 20% of the company with the free cash flow generated in 2025

- The improvement of Heydude’s situation, resuming growth, would completely change the perspective of the market. I expect this to happen in 2026.

- Acceleration of international growth, with a special focus on China, which is an underpenetrated market with a great addressable market.

Conclusion

Crocs is a quality company with rational control over costs and a high return on invested capital. Currently, the market is not appreciating the value of the business due to the fear of Heydude’s revenue decrease. However, once its revenue stabilizes, the company as a whole will be growing consistently.

In the meantime, the depressed price of the company offers the management an excellent opportunity to buy back shares at about 6 times price to free cash flow. I wouldn’t be surprised if all catalysts arrive at the same time: buybacks and an improvement of Heydude’s revenue. This would be a major catalyst in a very short time.

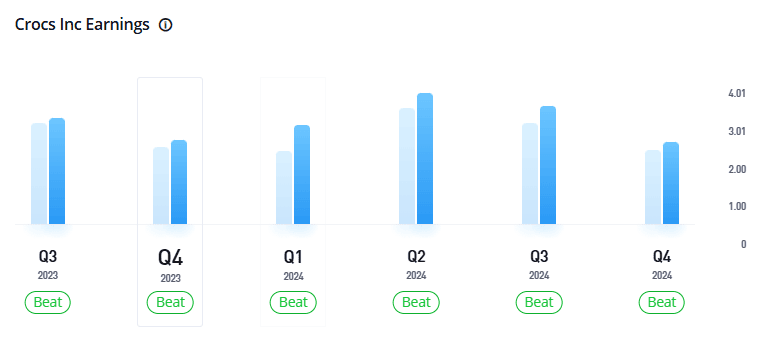

Also, the management is prone to draw a worst-case scenario to investors. As investors weight these projections to create their estimates, Crocs usually beats estimates consistently. However, this is not taken into account in today’s price.

Source: Etoro

At about 6 times earnings and free cash flow, with a huge buyback program ongoing and while quickly deleveraging, Crocs is one of the best options available to invest our money in the US. The worst scenario is priced in, leaving room to have a positive return in almost every scenario left for the future.

Risk Factors

- Inability of the management to turn around Heydude.

- Inability of the management to grow internationally.

- Slowdown in US sales due to macroeconomic challenges or greater competition.

- Changes in the fashion taste of consumers, which can be sudden and unexpected.

I hold a position in CROX at the time of writing.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of or solicitation to buy or sell any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.