RALLY: Semiconductor stocks have been on a tear. The SOXXX ETF is 40% off its October lows. They lag only TESLA-fuelled autos among the 24 US industry groups this year. Has been led by NVIDIA (NVDA), the S&P 500’s best performer and now 5th largest stock. The industry rally has been driven by a less-bad economic cycle, China’s reopening, and propelled by Chat GPT driven AI enthusiasm. Auto (EV-led) and industrial (automation) semiconductor segments are set to continue their resilient double-digit growth. This is offsetting weaker demand from traditional biggest computing and wireless areas. The positive long term semis outlook remains, but higher valuations, China demand clouds, and still lower sales argue for some caution now.

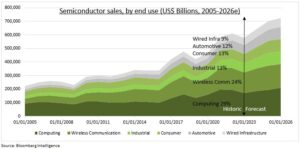

HEADWINDS: The $550 billion revenue global industry faces some challenges. Chip demand is still decelerating, with global sales down 18% vs last year. But anticipating a double-digit 2024 rebound (see chart). The US’s ‘carrot-and-stick’ policy is further tightening export restrictions to China, which is 29% industry sales. Whilst reshoring incentives in the $52 billion CHIPS Act also add to industry over-capacity concern. Valuations have soared and are threatened by higher US bond yields. For example, NVIDIA’s 50x 12-month forward P/E is double its long-term average.

LONG VIEW: Brighter horizons lie ahead. The industry has become less notoriously cyclical. It has consolidated sharply, whilst barriers-to-entry ‘moats’ have deepened. As capex needs and complexity (‘it’s not rocket science, it’s more complicated’) have surged. Meanwhile chips have become ever more central to the modern digital economy (‘the new oil’). See @Chip-Tech, and industry heavyweights from Broadcom (AVGO) to ASML (ASML) and Taiwan Semi (TSM).

All data, figures & charts are valid as of 09/03/2023