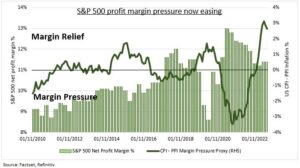

EARNINGS: Stock market returns this year have been nearly all led by higher valuations. This is putting a spotlight on earnings to start providing some needed support. But weaker economic growth and lower inflation are set to drive a rare S&P 500 revenues recession this reporting season. But this is being partly offset by some timely relief to company profit margins (see chart), as input prices have fallen faster than consumer prices. US margins remain over 11%, above average, and the 9% seen in Europe. This reflects the US’s huge and high margin tech sector, alongside the ‘reopening’ cyclical sectors still rebounding from depressed profitability.

RELIEF: Easing company cost pressures are helping to offset the weaker revenue environment, on both sides of the Atlantic. We proxy this by the difference between producer prices (costs to make something) versus consumer price inflation (the prices companies can sell at). In the US, producer price rises are 3 points lower than consumer prices, and in Europe the gap is a much wider 7 points. This will filter into company profit margins in coming months as inventories are used up and products sold. A similar message is seen from the forward looking purchasing manager index data, where input cost falls are outpacing the slower easing consumer inflation.

SECTORS: Part of the higher net profit margins seen in the US is structural. The tech sector has profit margins of 22%, double the S&P 500 index average, and second only to real estate (36%). Tech is by far the largest US sector today and has seen its index weight rise over 50% in the past decade. Secondly, ‘re-opening’ sectors like industrials and consumer discretionary are still seeing recovering margins with demand rebounding and capacity tight. This is offsetting the falling profit margins coming from energy and materials as commodity prices have fallen back.

All data, figures & charts are valid as of 18/07/2023.