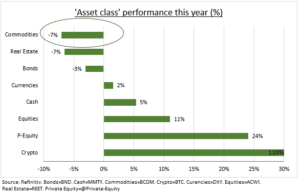

TOUGH: Commodities has been the worst performing asset class of 2023 (see chart). Energy, industrial metals, and agriculture are all lower. Precious metals is the sole exception alongside niche commodities from OJ to uranium. The asset class was held back by China’s sluggish reopening and the strong dollar, plus dramatic price crashes from natural gas to lithium. 2024 is set up to be a better, but not great, year. With a modest triple boost from Chinese demand, tight supply, and lower dollar, balancing a weaker US economy. Commodities provide diversification and an inflation hedge. They have their performance moments, with asset class leading gains in 2021 and 2022. But longer-term its poor, with the broad base Bloomberg commodity index lower today than twenty years ago. Our focus is on ‘breakfast’ and ‘carbon transition’ commodities.

DRIVERS: China is by far the world’s largest commodities buyer and will increase its demand in 2024 as authorities boost fiscal spending and its property crisis eases. Supply will stay tight after 15-years of under-investment, and shareholders prefer dividends to growth. A modestly weaker dollar will make US dollar denominated commodities cheaper for the biggest buyers like China and India. Part offsetting this will be a sharp slowdown in US, the world’s no.1 economy.

FOCUS: With over thirty major traded commodities we expect a wide variation in performance. We focus on ‘breakfast’ and ‘carbon transition’ commodities. Sugar to cocoa and orange juice, have rallied sharply this year, with weather-and disease-related supply disruption. This may continue in 2024 with a strong El Nino and continued climate change. Whilst the carbon transition may get a needed boost from December’s COP 28 climate summit and be an underlying support for demand for ‘transition metals’ from copper to aluminum and nickel. They are the China-centric building blocks for everything from solar panels to electric batteries.

Data as of 07/11/2023