Summary

Navigating weaker commodity markets

Commodities are lagging all asset classes this year, on demand fear and resilient dollar. After leading for the past two years. Natural gas prices led energy down, but may stabilise. Industrial metals are focused on China’s reopening, and precious metals on bond yield competition. Ag has been the best performer with consumption resilient and tight supply disrupted. Commodity stocks may be a better hunting ground now with strong cash flows and low valuations.

Stocks hit hard by banking and Fed fears

Stocks hit hard by higher-for-longer Fed rate outlook and SVB and SI bank problems triggering contagion fear. S&P 500’ worst week since Sept. Drove 5% short term bond yields, US$ stronger, and renewed recession fear. Europe’ bank-heavy markets hurt, even as Spain and Italy world’ top performers YTD. China set 5% GDP target. TSLA cut prices. See our 2023 Year Ahead HERE. See video updates, twitter @laidler_ben.

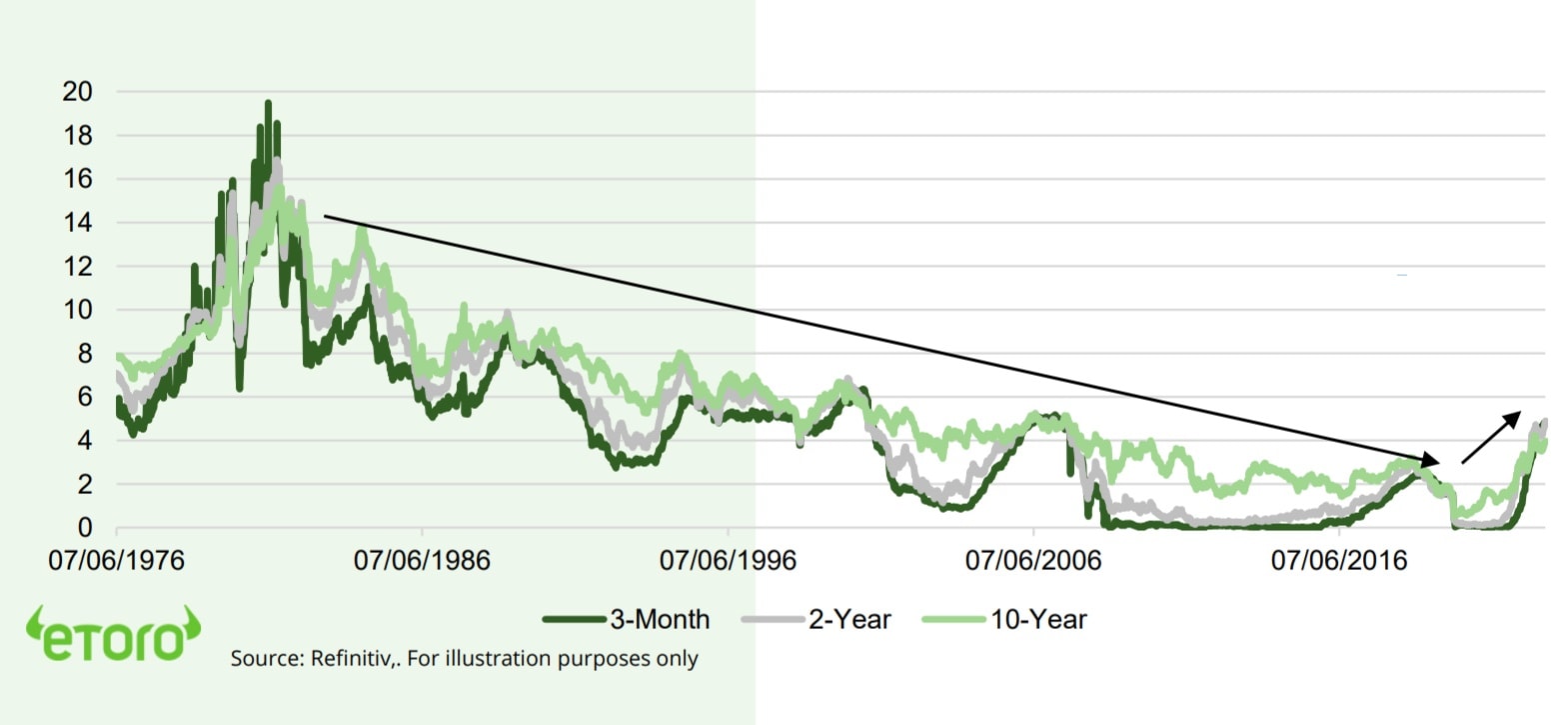

Strong competition from the bond market

Short and long term US bond yields surged. With negative investor consequences. But may seen worst of this repricing. Fed cycle better priced and 10-yr anchored. See BIL to TLT.

Southern Europe on top of the world

Spain (ESP35) and Italy world’ best performers this year. Both benefited from heavy exposure to banks rally, cheap and derated valuations, and surprise 30% Q4 earnings recovery.

Cooling the Semiconductor rally

Semiconductor stocks (SOXX) been on a tear, led by NVDA. Seem room for caution With high valuations, China demand clouds (29% industry), and still lower short term sales.

Big tech and financial sector changes

Coming big GICS reorganisation of global sectors to boost financials and cut tech, with implications for $10 trillion global ETF industry.

Crypto contagion takes a toll

Bitcoin (BTC) and crypto assets again pulled back after their dramatic rally this year. With BTC dipping below $20,000. Crypto-focused bank Silvergate (SI) is winding up after a deposit run. Whilst JP Morgan (JPM) ending banking services to leading exchange Gemini. Solana (SOL) further impacted by recent chain outages.

Energy leads commodity sell off

A stronger dollar and renewed recession fears drove commodities weaker. Energy markets led down with both oil and natgas sharply lower. Ag saw support as Argentina’ drought worsens. EU carbon credits bucked the sell-off, as Europe’s industrial recovery drives credit demand. It is the best performer the past year.

The week ahead: US prices, ECB, and Witching

1) Est. 8th straight US inflation fall to under 6.4% (Tue). 2) ECB 6th hike, by hawkish 0.5% to 3.5%. 3) Plus UK spring budget and China two-month NY data. 4) US triple-witching options expiry volume (Fri) and big GICS sector reorg. 5) Q4 results from ADBE, FDX, GME, XPEV, and VOW3.

Our key views: Cautious but gradual recovery

See gradual recovery with plenty bumps in road. The inflation and interest rate shock is slowly easing, and global recession risks have faded. But shorter term cautious with sentiment less bad and high bond yields causing problems. Focus cheap and defensive assets. High risk tech, small cap as inflation fall picks up.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -4.44% | -5.79% | -3.73% |

| SPX500 | -4.55% | -5.60% | 0.58% |

| NASDAQ | -4.71% | -4.94% | 6.42% |

| UK100 | -2.50% | -1.70% | 3.98% |

| GER30 | -0.97% | 0.78% | 10.80% |

| JPN225 | 0.78% | 1.71% | 7.85% |

| HKG50 | -6.07% | -8.83% | -2.33% |

*Data accurate as of 13/03/2023

Market Views

Stocks hit hard by banking and Fed fears

- Stocks double-whammy of higher-for-longer Fed interest rate outlook and SVB and SI problems triggering bank contagion fear. Drove short term bond yields to 5%, dollar stronger, and renewed recession fear. Europe’ bank-heavy markets hurt, even as Spain and Italy world’ top performers this year. China laid out 5% GDP growth target. TSLA cut prices. See our 2023 Year Ahead View HERE.

Strong competition from the bond market

- Inflation expectations have been rising. And the size and duration of the Fed interest rate cycle is increasing. This has sent short and long term US bond yields surging. With generally negative consequences for investors. 5% short term yields are a boon to savers, but rising hurdle to owning more risk assets. A 4% ten-year bond yield puts a ceiling over expensive stock valuations.

- Better news is that the worst of this bond repricing may be nearing an end. This would help stocks. Short term yields now reflect a newly hawkish 50bps hike outlook. Above average long term real yields and flatlining copper/gold ratio give some comfort on 10-yr.

Southern Europe on top of the world

- Spain (ESP35) and Italy the world’ best performing major markets this year. Both benefited from heavy exposure to the banks fuelled rebound, from SAN to UCG. Off particularly cheap and derated valuations. With Q4 earnings surprisingly rising c30% versus last year. And as broader macro ‘fragmentation’ and GDP growth risks cool.

- But also have differences. From Spain’s LatAm exposure to Italy’s luxury stocks and M&A activity. Still cheap valuations and the earnings rebound should provide some support to inevitable market volatility. With inflation high, interest rates rising fast, and the Ukraine war ongoing.

Cooling the Semiconductor rally

- Semiconductor stocks been on a tear. SOXXX ETF is 40% off October lows. They lag only TESLA-fuelled autos among 24 US industry groups this year. Has been led by NVIDIA (NVDA), S&P 500’s best performer and now 5th largest stock. Rally driven by less-bad economic cycle, China reopening, and propelled by Chat GPT driven AI enthusiasm.

- Auto (EV-led) and industrial (automation) segments are set to continue double-digit growth. Offsetting weaker demand from biggest computing and wireless areas. But much higher valuations, China demand clouds (29% industry), and still lower short term sales argue for some caution now.

Big tech and financial sector changes

- Some of largest tech and consumer stocks change sectors in a big GICS reorganisation . This happens Friday, March 17. It will impact much of the $10 trillion global ETF industry. Is meant to better align what companies actually do, with sectors they sit in.

- 38 stocks in S&P 500 will be moving, for example. The biggest sector, tech (XLK), will shrink and get even more concentrated, as Visa (V) and Mastercard (MA) leave. Whilst 3rd largest financial (XLF) sector will get 20% bigger.

US government bond 3-Mth, 2-Yr, and 10-Yr yields (%)

Crypto contagion takes a toll

- Bitcoin (BTC) and asset class pressured again, sharply cutting its asset-class leading gains this year. Bitcoin dipped below $20,000. Came on outlook for higher-for-longer US interest rates.

- But also as Silvergate Capital (SI), a key on-ramp to the US financial system, went into voluntary liquidation after a deposit run. Additionally, JP Morgan (JPM) also ended providing banking services to Gemini, a leading crypto exchange.

- The 11th largest market cap coin Solana (SOL) lead asset class weakness, additionally worsened by concerns on its recent chain outages.

Commodity market losses return

- A renewed down week that took asset class losses this year to 7%, the most of any. The driver was a stronger US dollar, as the Fed signalled higher-for-longer interest rates. This also boosted recession fears, that would impact demand.

- US and European natgas prices extended their dramatic 70-80% losses from highs. With warmer weather impacting demand and supply or storage levels still high. Whilst brent crude prices were more stable, holding above $80/bbl.

- EU carbon credits rose again, back over EUR100/t, and been best performer of all the past year. Recovering EU industrial activity is boosting permit demand. Ag also supported by worsening drought in major exporter Argentina.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -3.68% | -3.82% | 8.50% |

| Healthcare | -4.51% | -6.60% | -8.52% |

| C Cyclicals | -5.71% | -6.87% | 6.59% |

| Small Caps | -8.07% | -7.61% | 0.65% |

| Value | -5.42% | -6.72% | -4.51% |

| Bitcoin | -10.44% | -8.03% | 21.00% |

| Ethereum | -9.07% | -7.27% | 18.85% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: US prices, ECB hike, Triple Witch

- Hopes for an 8th straight fall in US headline inflation (Tue) from 6.4%. Comes ahead of the FOMC March 22 meeting where interest rate hike expectations have risen to a large 0.50%.

- ECB to stay on front foot with 6th hike, by 0.50%, to 3.5%. Focus press conference guidance for the hiking pace. UK government (Wed) set for spring budget. China two-month NY economic releases.

- Friday is US triple-witching futures and options expiry, one of four highest volume days of year. Will also see the GICS sector rebalancing, that is adding to financials and trimming back on tech.

- Remaining Q4 earnings include ADBE, FDX, LEN, DG and meme stock GME in US. Also VOW3, PRU, BOL, ITX, and MANU in Europe. And XPEV, Ping An and CK Infrastructure among Asian stocks.

Our key views: Cautious but gradual recovery

- See gradual recovery with plenty of bumps in road. The US inflation and interest rate shock is slowly easing, and global recession risks faded with China reopening and plunged natgas. But are cautious short term with investor sentiment now less bad and higher bond yields causing problems for many.

- Focus cheap and defensive assets, from high dividend yield, to healthcare, and UK. With higher risk crypto, tech, and small cap assets as the inflation fall accelerates and would de-risk markets. Overseas markets to lead the US. Commodities and the US dollar to take a performance back seat.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -3.47% | -3.79% | -7.32% |

| Brent Oil | -3.91% | -4.48% | -3.90% |

| Gold Spot | 0.54% | -0.20% | 2.33% |

| DXY USD | 0.11% | 0.97% | 1.08% |

| EUR/USD | 0.07% | -0.35% | -0.57% |

| US 10Yr Yld | -25.42 | -3.23% | -17.41% |

| VIX Vol. | 34.13% | 20.80% | 14.44% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point change

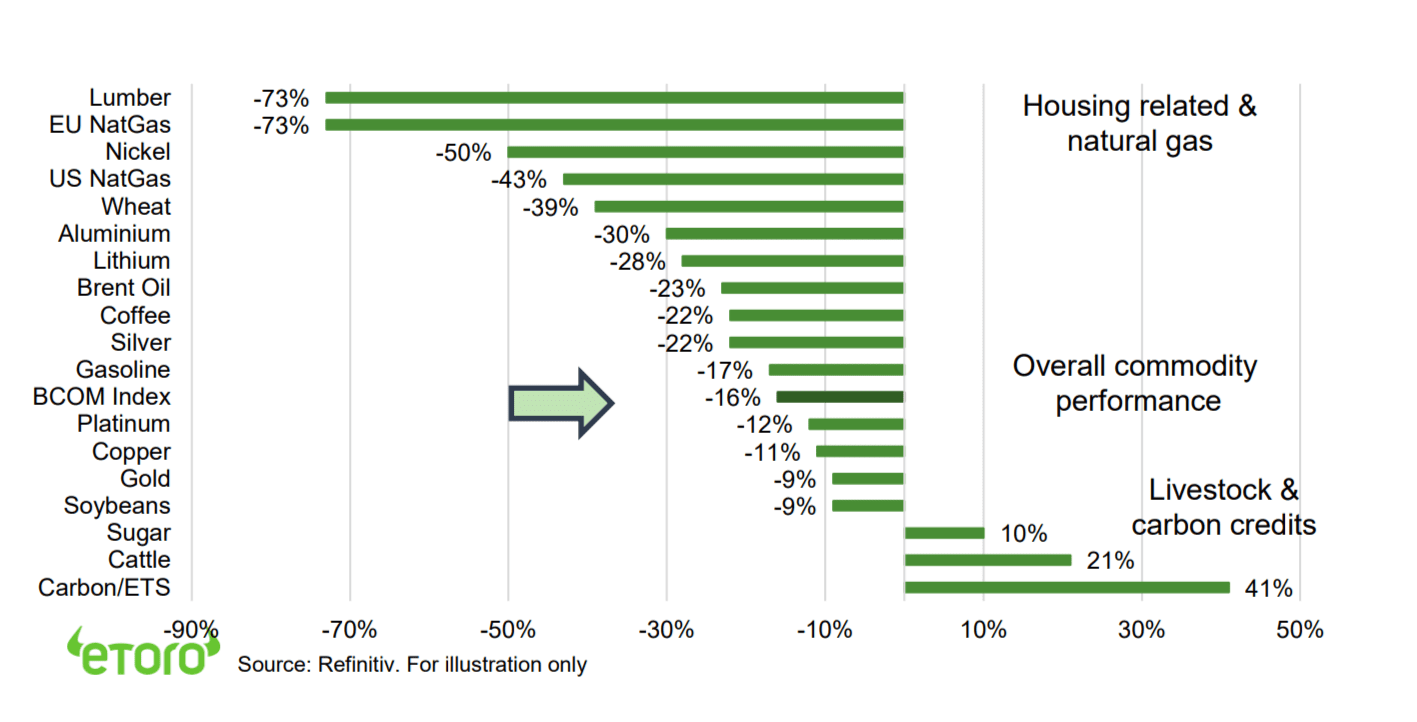

Focus of Week: Commodities down not out

Commodities are lagging all asset classes this year, after leading for the past two years

Physical commodities is the worst performing asset this year. It is 20% of its June 2022 high, after a 130% rally. After leading all assets in 2021 and 2022. We don’t see a ‘three-peat’ but there are of course select opportunities. It’s a reminder that commodities has the worst average performance (-3%) of any asset class the past 15 years, with an above average annualized volatility (20%) and near decade long 2010-19 bear market. Weakness has been driven by a combination of Ukraine war performance payback, weaker global growth and a stronger dollar. This has been balanced by the reopening of China and tight supply trends.

Natural gas prices have led the energy complex down, but are set to stabilise

Natural gas prices on both sides of the Atlantic have led the broader energy weakness. Warmer weather and higher prices cut demand and raised supply. Markets are now rebalancing with China reopening and Europe needing to rebuild storage levels. Crude prices have been range-bound with OPEC cutting supply, China reopening, and the drill-rig capacity rebound lukewarm. But economic growth is still downshifting and the carbon transition accelerating. EU carbon credits have been out-performance outlier (see chart).

Industrial metals focused on China’s reopening, and precious metals on US bond yield competition

Industrial metals were the worst performers the past year on rising recession fears. This is now cushioned by the reopening of China, the world’s biggest buyer. It’s 50%+ demand for many metals, from copper to lithium. But its reopening will be gradual, and consumer focused. Non-yielding precious metals have been hit by competition from soaring US bond yields. This will stop soon, providing relief, but unlikely to reverse.

Agriculture has been the best performer with consumption resilient and supply disrupted

Ag been the outperformer, with livestock up the past year. Weather driven supply disruption has been big, from La Nina to record droughts. Consumers resilient, with pent up savings and tight jobs markets. The Ukraine war hit, with both combatants’ major ag exporters. Black Sea Grain Initiative deal up for renewal on March 18. Lumber been an outlier, on US housing weakness, where vast majority houses timber built.

Commodity stocks may be a better hunting ground with strong cash flows and low valuations

Opportunities are in China-focused metals and stabilising natgas. Also, in commodity stocks with current prices well-in excess of production costs and high by historic standards. This allows strong cash flows and dividends for shareholders. They also remain among the cheapest industries in the market. They are also especially relevant in broader stock markets, from Australia to Canada and Brazil. @AussieEconomy.

Commodity price performance (1-year, %)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle and stubborn inflation boost uncertainty, recession risk, and hurt markets. We see this gradually fading in 2023, with global growth stressed but resilient, inflation pressure slowly easing, and valuations now more attractive. Focus on cheap and defensive assets for a gradual ‘U-shaped’ market recovery. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the market rout, and now at average levels, and are supported high company profitability and near peak bond yields. Focus on cash-flows defensives, like healthcare and high dividend. Big-tech supported by defensive growth. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and tech/small cap/crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies are not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices amd reopening China with still high ‘buffers’ of rising fiscal spending (defence and refugees) and still weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by the lack of a big tech sector, and 30% cheaper valuations vs US. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. Broader EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, if global growth resilient and bond yields risen. Japanese equities among worlds cheapest but threatened by tightening monetary policy and stronger Yen with rising inflation and new BoJ governor. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Hurt by higher bond yields and above average valuations. But structural stories with good growth, high margins, fortress balance sheets support some. ‘Big-tech’ attractive new recession defensives. ‘Disruptive’ tech is much more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors -discretionary (autos, apparel, restaurants), industrials, energy, materials- are cheap and attractive if see ‘slowdown not recession’ and lower inflation helps consumers. Select but high risk opportunities from energy to financials. With depressed earnings, cheaper valuations, and been out-of-favour for many years. |

| Financials | Benefits from higher bond yields, charging more for loans than pay for deposits. Also one of cheapest P/E valuations, and room for large dividend and buyback yields. But could be outweighed by rising recession risks, with lower loan demand and higher defaults. Banks most exposed. Insurance and Diversified (like Berkshire Hathaway) least. |

| Themes | We favour Value over Growth on GDP resilience, lower valuations, rising bond yields, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has wide spread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attrative cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+ supply and Russia 10% world oil supply problems. But commodities not to repeat their 2022 performance leadership. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.