CRE: Commercial real estate (CRE) is being fingered as the next economic shoe to drop, after the recent banking scare. It’s a $20 trillion asset class in the US alone, and small and mid sized banks are its biggest lenders. These banks are now in retreat with twin funding and regulatory headwinds. Concerns focus on offices with work-from-home keeping occupancy levels at 50%. And on multifamily residential with new supply sharply rising. This is a manageable and slow moving earnings problem and not a systemic threat. Lending standards and loan provisioning are conservative, much is already priced in by public markets, and interest rate cuts are coming.

SLOW: The Fed’s historically large and fast 5% interest rate hikes have raised borrowing costs and depressed building values. Less small-and-mid bank lending will only make this worse. But it’s likely a slow-moving and not systemic problem. 1) CRE loans are typically ten-years, making ‘maturity-wall’ risks limited. Whilst loan-to-value (LTV) levels are a conservative 66%. Though still means c$250 billion commercial mortgages come due this year. 2) Worst-hit office problems well-known, building since 2020 covid crash, and heterogenous. Hotel and retail segments already weathered double-digit delinquencies. 3) Lower interest rates are coming by year end.

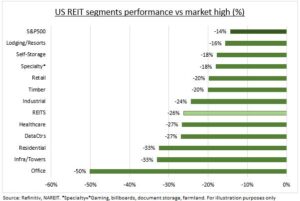

REITS: The public markets have reacted much quicker than private markets, as usual. Real estate investment trusts (REITS) have underperformed the S&P 500 by 10pp since its end 2021 peak (see chart). It’s the most interest rate sensitive sector with highest debt levels. Price falls have been led by office REITS (like ARE and BXP), residential (AVB, EQR), and tech-focused segments (AMT, CCI). Pandemic losers, from retail to lodging, been more resilient. REITS is the smallest US sector, at 3% of total. And smaller in UK and Europe at <1%. @RealEstateTrusts.

All data, figures & charts are valid as of 05/04/2023