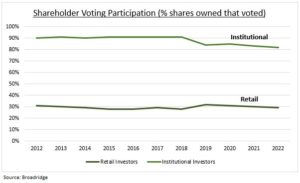

RETAIL: Q4 company earnings season is coming to an end. This shifts investor attention to the upcoming annual general meeting proxy voting season. This will likely be focused on dividend policy, executive pay, and ESG. Newly more significant retail investors are a key actor here. And one that has typically been under-represented by not voting as much as institutional investors (see chart). This comes against a backdrop of increased traditional investor activism, from Salesforce to Disney, and with ‘short-report’ writers taking on bigger stocks, like India’s Adani.

PROXY: Proxy season is fast approaching. The April-June period is when most large public companies host their annual general meetings (AGMs). And shareholders vote on key issues, from dividends to board seats. The 2022 season was characterized by an increasing ESG focus at US stocks and more contested pay resolutions in Europe. Retail investors are a key focus. They are more numerous than ever. But with their voting participation low, at an average 29% of shares owned vs 82% for institutional shareholders. Etoro tries to help by making voting easier.

ACTIVISM: Activist short sellers have been grabbing the headlines, with Hindenburg Research dramatically impacting Adani group stock prices. This has contributed to India being among the world’s worst performing stock markets this year. These activists’ traditional focus on smaller stocks is now evolving to larger targets, from Adani to Sunrun (RUN) and NIO (NIO). Last year saw 113 such ‘short’ reports, driving an average 31% share price decline for targeted stocks. Whilst traditional and larger activists have also had success. Looking for cost cuts and strategy changes. From Elliot and Starboard at Salesforce (CRM) to Nelson Peltz at Disney (DIS).

All data, figures & charts are valid as of 23/02/2023