COCOA: The rally for the main chocolate ingredient has accelerated in time for Easter. Prices soared 230% the past year to $10,000/t and are twice the previous all-time-high. A supply and demand squeeze has turned into a speculative extravaganza. In a usually small and overlooked market, not big enough to be included in the 24-asset benchmark Bloomberg Commodity Index. It is now the 5th most held commodity on the eToro platform with 150% growth in holders in the past month. These price spikes come with the territory in commodities and often lead to a price bust (see chart). But high cocoa prices may last. And consumers barely begun to feel them yet.

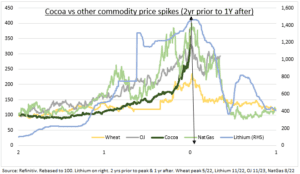

RALLIES: These blistering rallies come with the territory in commodities. A reminder it’s one of the most volatile asset classes, with an 18% annualised volatility in the past decade. Versus 5% for bonds, 7% for currencies, and 15% for US large caps. Recently we’ve seen similar dramatic rallies in OJ, wheat, natgas, and lithium to name just four (see chart). The bigger question is what happens next? Prices usually fall as the ‘solution to high prices is high prices’.With supply incentivized and demand curbed. Or as supply bottlenecks eased. We saw this in wheat, lithium, and natgas. But not in OJ as supply problems remain. And OJ is the closest parallel to cocoa.

CONSUMER: Consumer chocolate prices will now surge as lower-priced cocoa inventory is worked off. Sweets inflation is just 5% in the US and 9% in the UK vs the 230% cocoa surge. Producers like Hershey (HSY) and Nestle (NESN.ZU) may adjust recipes (less cocoa) and packaging (shrinkflation) to cushion the blow. But consumers will eat less chocolate and more substitutes (gummy bears?). The largest eaters are the Swiss and Germans at over 8 kg/yr. Supply will stay tight. Its concentrated (Ghana and Ivory coast), next harvest not till Oct., new trees take 5-yrs to mature, and with underlying constraints (artisanal product, child labour laws).

All data, figures & charts are valid as of 26/03/2024.