POLICY: Next week’s annual legislative sessions are make-or-break for China’s nascent stock rebound and investor hopes for broader policy stimulus. As authorities shift from combating the weak stock market symptoms, with short sale bans and like. To the property, confidence, and manufacturing slump causes, combated with reserve requirement and interest rates cuts, and fiscal spending. But stopping well short of 2008 bazooka-style stimulus that could worsen its debt, overcapacity, and deflation issues. We see an ambitious 5% GDP growth goal and more fiscal support. Enough to boost low expectations and valuations but not a big turnaround. With the world watching, from Australia and Germany to luxury and autos. @ChinaTech, @ChinaCar.

TWO SESSIONS: China’s top political advisory body, the National People’ Political Consultative Conference (NPPCC), starts its annual session March 4th in Beijing. Whilst the legislature, the People’s Congress (NPC), starts March 5th. This ‘two sessions’ will set the GDP growth target, and fiscal goals. The GDP target is likely to be ‘around 5%’. Similar to the 5.2% achieved last year. But above the 4.6% consensus for China GDP this year. Authorities are looking to achieve 3 things. 1) Safeguard growth as PMI’s flirt with contraction. 2) Stabilise the oversized property market after its 3-year enforced deleveraging. 3) Restore confidence for the consumer that is now the main economic driver but has 60% of its wealth in property. A proportion double the US.

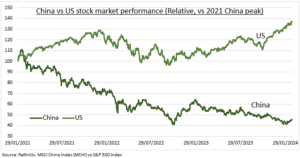

OUTLOOK: Chinese stocks (MCHI) have dramatically lagged the S&P 500 by over 90 points since their January 2021 peak (see chart). And are flat vs the 14-fold GDP surge longer term. The contrarian bull case rests on an attractive confluence of 1) cheap and derated <10x P/E valuations. 2) Terrible investor sentiment, by foreigners and dominant local retail investors. 3) Authorities re-commitment to stabilising the property market and boosting consumer confidence. With its unique policy supports of a 35% savings rate, state-controlled banks, and capital controls.

All data, figures & charts are valid as of 29/02/2024.