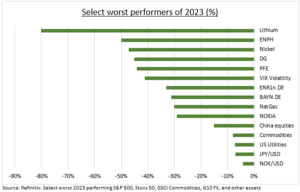

ROTATION: We see a continued performance rotation from the defensive growth outperformers of 2023, like big-tech and the US. Toward the more cyclical assets that have underperformed, and are heavier weighted in the rest of the world. Like financials, real estate, industrials, and small caps. They are most sensitive to our macro-outlook of an economic soft landing and interest rate cuts. And benefit from lower expectations and valuations after often multi-year underperformance. A little reallocation can go a long way given the super-sized nature of US and tech assets. Going a step further, we look at the worst performers of last year, for ‘zero-to-hero’ (see chart) rebound opportunities, like the Yen, VIX, renewables and healthcare.

IDEAS: 1) The Yen is the world’s most undervalued major currency, with support from coming US rate cuts and Japan’s global outlier tightening. 2) VIX is a cheap hedge on our bullish stocks outlook. It’s at near lowest ever levels and far below its long-term average of 20. 3) Renewables from lithium to Enphase have seen painful declines even as long-term demand growth is just getting started. 4) Vaccine stocks from Pfizer (PFE) to Moderna (MRNA) have seen a big post-covid reset, and broader healthcare an overdone reaction to the rise of weight-loss drugs.

ZERO-TO-HERO: This ‘buying the dip’ strategy is favoured by retail investors, with BAYN.DE and ENR1n.DE, for example, among the most popular shares on the eToro platform after recent price plunges. But this comes with high risks. Including that 1) momentum strategies, holding onto performance winners, has historically been one of the best investment styles. 2) Whilst underperformers can keep falling. Commodities were the worst asset class for four straight years last decade. But there are plenty of examples showing market leading rebounds from dire losses. Emerging markets from the 2008 global financial crisis and REITS from 2020 pandemic.

All data, figures & charts are valid as of 04/01/2024.