Card Factory ($CARD.L) is a popular brand known in the UK for high-quality gifts at affordable prices. Despite its challenges, the company has potential for growth.

Key Highlights

- Card Factory is a resilient business with a strong brand awareness in the UK

- The results of the Christmas period will be the catalyst for its success

- Card Factory currently trades at a significant discount

The Business and the Industry

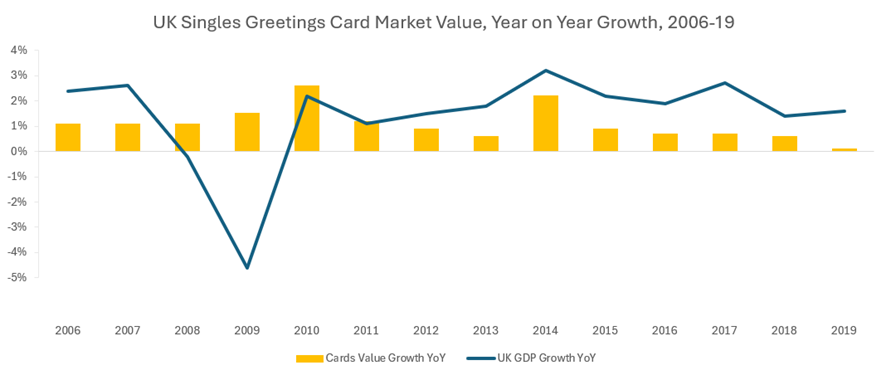

It is difficult to understand the greeting cards industry outside of the UK, as this is a quintessentially British phenomenon. Britons express their love and affection through the exchange of cards, and engage in this tradition at a rate 2-3 times higher per capita compared to the United States. It is then not a surprise that the overall UK greeting cards market has historically proven recession resilient, demonstrating consistent growth even through downturns.

Data from OC&C Strategy Consultants – Visualization by the author

Card Factory was founded in 1997 with the purpose of delivering high quality greeting cards at a low price. To succeed, the company initiated a strategic move towards vertical integration. Card Factory started to design and manufacture its products in-house, allowing superior cost control and adaptability to market trends. By focusing on high-quality products at compelling price points the company gained a niche in the budget sector of the market. Over the years, Card Factory kept growing, reaching over 1000 locations while focusing on non-card items like celebration essentials and gifts, but always maintaining its image as a budget brand.

An increased competitive environment combined with the severe blow of the COVID-19 pandemic meant the need for a new strategy at Card Factory. The company initiated a new investment cycle to improve the online customer experience and expand its product mix. The management also changed the store layouts, decreasing the space for the greeting cards (only 7% of the total) and strategically placing them around the perimeter of the store making room for celebration essentials and gifts.

Now Card Factory offers a one-stop shopping experience to celebrate life moments, well aligned with broader consumer trends. It transitioned from a store-led card retailer into a market-leading, omnichannel retailer of cards, gifts and celebration essentials. Customer traffic and revenues have surpassed pre-pandemic levels, showing strong customer loyalty, and non-card items now account for roughly 51% of revenues.

Data from Card Factory Annual Report (FY 2024) – Visualization by the author

Competition

The main competitors in the greeting card market for the UK include the specialty retailers (Clintons, Moonpig), grocery stores (ASDA, Tesco) and general merchandise stores (Wilko, Home Bargains).

Moonpig is the main competitor in the specialty retailer space. The company is focused on the online greeting cards space, where it quickly gained a significant market share. Anyway, despite its initial disruptive presence that eroded part of the traditional retail market channel, the company has now stopped growing. In particular, its dependence on the postal services turned out to be expensive against in-store purchases, especially for minor transactions.

ASDA emerged as Card Factory’s main competitor in the traditional greeting card business. Leveraging its scale, ASDA was able to negotiate more favorable deals with suppliers, enabling the grocery chain to sell greeting cards at prices even lower than Card Factory. This competitive pressure became the catalyst for Card Factory’s strategic shift, transforming it into a one-stop shop for all life moment celebrations.

Despite the challenges, Card Factory can still rely on its competitive advantage given by its vertically integrated brick-and-mortar greeting cards retailer model. This provides a robust competitive advantage, allowing comprehensive control across all operations and quick adaptation to market trends. Differently from general stores relying on suppliers like Hallmark, Card Factory can command greater product variety with better quality.

Target Market

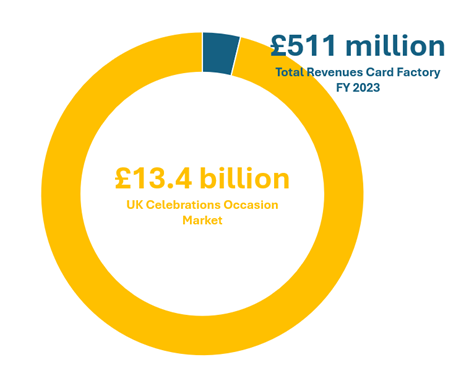

Card Factory controls roughly 30% of the UK greeting card market by volume. The rest is roughly evenly distributed between groceries and general merchandise stores. The unique value proposition of Card Factory poses the company in a perfect position to profit from the broad celebration occasions market.

Data from Card Factory Annual Report (FY 2024)

Visualization by the author

The targeted market opportunity for Card Factory totals to £13.4 billion in the UK. This includes the UK greeting cards market worth £1.4 billion, the UK celebration essentials at £2 billion and the UK market for (selected) gifts at £10 billion. The company also identified several international opportunities with an estimated £8 billion addressable market for greeting cards that can increase up to £80 billion when celebration essentials and gifts are included.

The celebration essentials and gifts segments, far more attractive than the standalone greeting cards market, highlight how Card Factory’s strategic shift toward a more diverse product mix could serve as a strong catalyst for future growth opportunities.

Opportunities

The market looks at Card Factory as a stagnant and obsolete business. This is a misconception considering the strategic move that the business has undergone in the afterwards of the pandemic. Indeed, despite the recent decline in the greeting cards segment, the company has leveraged its dominant position in the market to offer additional complementary products.

In fact, the non-card segments offer the strongest growth potential for Card Factory. Currently, only 17% of its customers purchase gifts alongside greeting cards, compared to the industry average of around 70%. This gap presents a significant opportunity for Card Factory to increase gift sales, which in turn could drive higher card sales, still the most profitable part of its product mix.

Risks

There are a number of risks that jeopardize the possibility for Card Factory to deliver these results. As a budget brand, Card Factory is vulnerable to inflationary pressures, as it has limited flexibility to raise prices without affecting its value proposition. That is what happened during the last half year, where the increase in the National Living wage squeezed the company’s gross margin. Anyway, the main competitive advantage of Card Factory lies in its vertically integrated operations, that allow an extensive and more dynamic cost control.

Another risk is posed by possible economic downturns. Despite being able to grow same store sales through 2008 and 2009, the significant exposure to non-card items now introduces a greater vulnerability for Card Factory. Similarly, if consumer preferences were to shift significantly away from traditional greeting cards, Card Factory might struggle to adapt quickly. However, the tradition of sending and receiving greeting cards remains deeply ingrained in British culture, and it continues to be popular even among younger generations.

Card Factory Valuation

But what is the value of Card Factory?

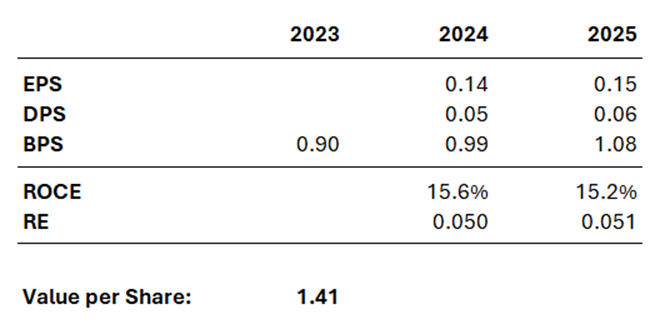

I will use the Residual Earnings Model to value the business, detailed in Accounting for Value by Stephen Penman (Columbia Business School Publishing, 2010). Some major benefits from using this model are the low number of inputs, low amount of speculation added and strict connection to the fundamentals.

I will assume EPS of £0.14 and £0.15 for FY 2024 and FY 2025. These are the most updated estimates of the financial analysts following the company. Plus, I will assume DPS (Dividend per Share) of £0.05 and £0.06, in line with the company’s commitment. I will assume a 10% Cost of Capital, that is reasonable considering the current risk-free interest rates. I will also assume a 0% growth rate for the RE (Residual Earnings). This approach has two key benefits: it significantly reduces the risk of overpaying for growth and aligns with market theory, which suggests that residual earnings tend to diminish over time. Given a BPS (Book Value per Share) in FY 2023 of £0.90, we are now ready to compute the value per share of the company:

The BPS for FY 2024 and FY 2025 is computed adding the EPS and subtracting DPS from previous year BPS. We compute ROCE (Return on Common Equity) as the ratio of EPS and previous year BPS. The Residual Earnings are computed subtracting the Cost of Capital from the ROCE, allowing us to focus on the Economic Profits of the company. The result is then multiplied by the previous year BPS. Finally, we discount future Residual Earnings with a 10% Cost of Capital, assuming no growth for the future periods, and we add it to the base BPS.

As we can see the resulting value per share is £1.41, showing roughly a 50% premium from the current price of Card Factory. This valuation is highly conservatory, meaning that it would be sufficient for the company to deliver their commitments to see this appreciation reflected in the stock price.

Conclusion

The market has recently punished Card Factory too harshly for its disappointing HY 2024 results. The company is significantly undervalued, as the market is underestimating its ability to navigate inflationary challenges in the UK and is showing little interest in an industry perceived as stagnant and obsolete. However, Card Factory is evolving into a one-stop shop for celebrating life’s moments. This transformation opens exciting new growth opportunities, leveraging its strong brand recognition and dominant market position.

The upcoming Christmas period, which accounts for roughly 70% of the company’s yearly results, could serve as a key catalyst to assess its performance.

Additionally, the acquisition of Garven Holdings, LLC, announced on December 5, 2024, underscores Card Factory’s strong financial position and highlights management’s commitment to achieving its ambitious growth targets. At the same time, the January trading update for the second half of 2024 revealed strong revenue growth (+6.2% year-on-year) and demonstrated management’s ability to deliver on its targets.

Finally, there has been notable insider activity in the stock. The Senior Independent Director, Pam Powell, purchased 5,109 shares on December 30, 2024. The CEO, Darcy Willson-Rymer, acquired 49,529 shares on December 11, 2024, and the CFO, Matthias Seeger, bought 21,244 shares on December 5, 2024.

As Peter Lynch famously said, “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

Maybe you should do the same!

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.