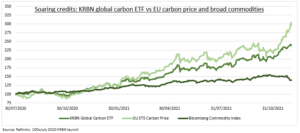

CARBON: Carbon prices are among the new kids on the commodity block. Europe’s ETS carbon price is +170% this year, a multiple of the Bloomberg commodity index, and behind only the continent’s gas prices and lithium. This is a clear direction-of-travel for 1) the growing number of carbon credit schemes, like China, 2) deals at the COP26 meeting to structure international carbon trading, and 3) voluntary company moves to internally price carbon. See KRBN for direct futures exposure and @RenewableEnergy for indirect.

IMPACTS: The latest spike in EU carbon price to a symbolic $100/t CO2 is being driven by soaring natgas prices. This encourages utilities to switch to cheaper coal that needs more carbon permits. But these prices may become the ‘new normal’ as Europe accelerates its carbon transition. Utilities are most impacted. Buying pollution credits to offset their current CO2 pollution would cost around 11% of revenues. Materials (9% of revenues), energy (5%), and consumer staples (2.5%) are all over European 2% average.

‘KRBN’ VEHICLE: A newish way for investors to gain broad exposure is through this $1.6 billion ETF. It tracks the most liquid carbon credit futures globally: EU allowances (see chart), with a 72% weight, and the remainder in California carbon allowances (CCA), and the US Northeast Regional Greenhouse Gas Initiative (RGGI). It has a low 0.40 correlation to US equities and broad commodities, and a relatively high 0.78% cost.

All data, figures & charts are valid as of 08/12/2021