STRIKE: It’s day 21 of the slowly escalating UAW US auto strike. With sides seemingly inching toward a 20-30% pay raise deal. Affordable with wages 6% of a car’s value, profit margins near multi-year highs, and both volumes and prices surprisingly strong. It would still be a relief. With the US auto industry 3% of GDP or a quarter of all manufacturing. The fear is what lies ahead. After GDP growth relief has driven global auto stocks outperformance this year. Profit margins are still single digit, and industry faces double headwinds of a slower economy and building EV transition. Investors are cautious, with the ‘big 3’ General Motors (GM), Ford (F), Chrysler-owner Stellantis (STLAM.MI) on a low average 4.6x P/E ratio and proxies, like palladium, plunged.

VOLUMES: US sales volumes are set to grow 12% this year, despite the pressures on big ticket, credit dependent spending. Retail auto sales are helped by record 12-year average ages, and fleet demand seeing a post-pandemic pent up demand rebound. But high dealer inventories (at 57 days) and rising incentives (5% of total price) are a sign of a weakening outlook. Though also give flexibility in facing strike disruption. EV penetration lags China and Europe, but is now 8% of US sales nationally, and 23% in California. It’s a flash point in the current strike. But may not be as bad as feared. Deloitte’s latest auto supply chain study sees only 3 of 19 segments suffering (ICE, exhaust and fuel systems) and 10 gaining (from electric drive trains to steering).

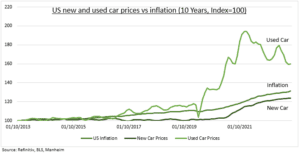

PRICES: US car prices have seen above-inflation increases since the pandemic, as supply chains were disrupted and used car prices surged (see chart). This boosted profit margins. The average new car price hit $50,000, and 57% now think a new car is unaffordable. But prices have since eased, with the Tesla (TSLA) led fall in EV prices that slashed their price premium from 40% to 10% vs the average. The longer-term pricing story is also sobering. Lagging well below inflation, and competition intense, with Toyota (TM) #2 and Hyundai #4 in total US sales.

All data, figures & charts are valid as of 04/10/2023.