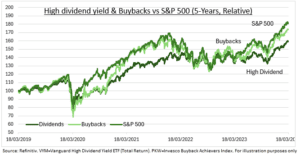

STYLES: Dividends and especially stock buybacks are coming back into style with investors. With their chronic 2023 style underperformance narrowing sharply this year (see chart). This maybe set to continue to build as earnings recovery spreads, supporting increased buybacks and higher dividend payouts. And as competition from high interest rates starts to ease as Fed and ECB cut. Company buybacks remain the biggest buyers of US stocks, at $800 billion last year. With the largest buy-backers in the tech sectors and the US. Whilst stickier dividends drive cash returns in the rest of the world, with banks, utilities, real estate among the biggest payers.

BUYBACKS: S&P 500 companies spent 18% more on share repurchases last quarter, taking the Q4 total to $220 billion. The new 1% buyback tax seemed to have little impact on company decisions. Though chances are it gets significantly raised in the future. Buybacks are top-heavy with 20 stocks accounting for half of activity. Led by Apple (AAPL), Alphabet (GOOGL), and newcomers RTX (RTX), General Motors (GM), and Broadcom (AVGO). The total Q4 buyback + dividend yield was 3.30%. Companies prefer buybacks for 55% of their shareholders cash returns, led by tech. Utilities and real estate led those preferring dividends. See @Buybacks

DIVIDENDS: Global dividends rose 7% in Q4, led by Emerging markets and Europe, with half the growth coming from the banking sector. Though much of this growth was offset by sharp cuts across the mining sector, as profits plunged. And rising Japanese payouts eroded by the sharply weaker Yen. Dividends dominate cash returns to shareholders in non-US markets. Forecasts are for a 5% growth this year, with underlying dividends supported by rising payouts and improving profits. Whilst lower special divs flatten overall growth. Microsoft (MSFT), Apple (AAPL), and Exxon (XOM) were world’s three largest payers last year. See @DividendGrowth.

All data, figures & charts are valid as of 19/03/2024.