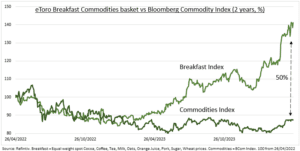

RISES: Our proprietary Breakfast commodity price index has surged by 54% in the past year. As weather-driven supply disruptions have spread, driving cocoa, OJ, and coffee prices higher. This has dramatically outpaced the recent turn up in broader commodity markets (see chart). And will start to flow through into higher consumer supermarket prices in coming months, putting a floor under the recent inflation slowdown. It is a likely benefit for agricultural producers and their suppliers, from Deere (DE) to Mosaic (MOS). But a possible volume and profit margin headwind for food producers, from Kraft (KHC) to Nestle (NESN.ZU). See @AgriWorldwide.

BREAKFAST INDEX: Our equal-weight index of nine popular breakfast ingredients, from sugar to wheat, has dramatically outpaced broader commodities. Our breakfast index is up 54% the past year versus a 2% gain for the Bloomberg Commodities index. Gains this year have been led by cocoa (+150%), pork (35%), coffee (30%), and orange juice (20%). As supply-side and mainly weather-related shocks, from West Africa to Florida and Brazil, have destabilised many ag markets. These big price gains have more than offset the modest declines across other breakfast commodities like wheat (-9%), milk (-6%), oats (-4%), tea (-5%), and sugar (-3%).

INFLATION: Food prices have led the US and UK inflation slowdown. US food inflation has decelerated from 8.5% to 2.2% in the past year. Whilst in the UK, the latest 4% rise is a fraction of the 19% rate a year ago. We can also see this bottom-up. We examine the average UK supermarket price of a basket of 15 typical breakfast foods. From tea bags and coffee to sliced bread and jam and bacon and eggs. It’s currently £42.26, up by 4% the past year. But with shopping aisle prices starting to move up for the most impacted commodities. With supermarket price rises led by hot chocolate (+18%), granulated sugar (14%), fruit juice (11%), coffee (9%).

All data, figures & charts are valid as of 29/04/2024.