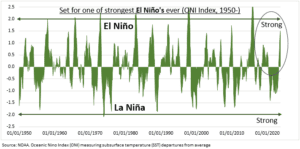

DOUBLE-WHAMMY: We are in the peak El Niño weather disruption period until January, with impacts across agricultural, energy, and shipping markets, and estimates its impact lasts until mid-year. This weather warming phenomena is set to be one of the largest ever (see chart) and adds to climate change trends that have already made this year the world’s hottest at 1.3C over pre-industrial levels. El Niño’s effects are broad, global, differ by region, and the phenomena’s intensity. We are already seeing Panama Canal shipping disruption and soaring cocoa prices, to name just two impacts. Whilst a warmer winter could ease heating oil and natural gas prices.

CANAL & CHOCOLATE: 1) Panama is already seeing its worst drought in 80-years. Forcing the Canal to continue cutting daily capacity from the 36 ship norm to 18 by February, particularly impacting the largest container and LNG ships, and carriers from Maersk (MAERSKB.CO) to Cheniere (LNG). Global container freight rates have bottomed but not yet shown a boost. 2) Cocoa prices have surged 75% this year to 45-year highs driven by El Nino’s weather supply disruption in the dominant west African producers. This combined with very low inventories to cause headaches for chocolate producers from Barry Callebaut (BARN.ZU) to Hershey (HSY).

HEATING OIL & NATGAS: 3) The northeast accounts for 80% of US heating oil demand. Its forecast to see above-average winter temperatures that could cut demand. The last big El Niño event in 2015-16 saw a 18% fall in demand. Prices have been falling recently but remain above long-term averages, with inventories low. 4) European natgas prices have plunged 80% from their 2022 highs but have doubled off May lows. This is set to push up UK household energy prices in today’s quarterly reset. Forecasts are for a warmer than average winter, like 2015-16.

All data, figures & charts are valid as of 22/11/2023.